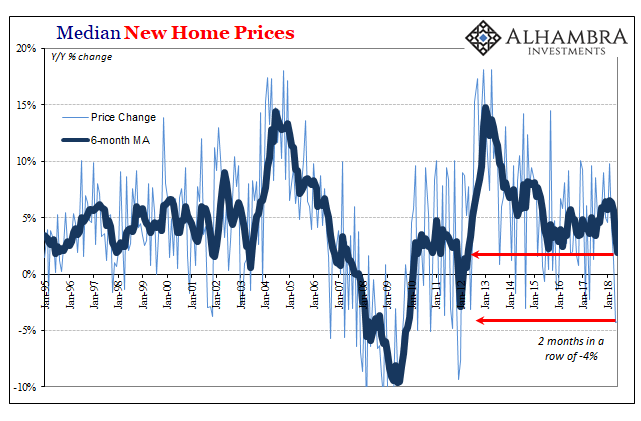

New Home Prices Drop Sharply For 2nd Month

It’s not any stretch to write that the real estate market has hit a soft patch. Resales are down if only a little as are construction indications (permits and starts). These do not indicate that the housing market is in trouble, just that it isn’t so great underneath the unattached boom commentary.

To begin suggesting something more concerning than all that we would expect to find evidence in terms of house prices.

The Census Bureau’s estimates in the New Home Sales series are as noisy if not more so than the other housing related data. On a month-to-month basis not only should we expect to find big differences, those differences are just as likely to be completely revised the following month.

When last month prices were reported to have dropped by about 4% year-over-year in May 2018, that was one thing. Even though it was by far the largest decline since 2012, a single monthly estimate isn’t enough to even write something about it.

For that -4% to then stick around for a second month, unrevised and then matched by the same number in June 2018, that can get your attention. It still might end up as nothing more than noise, and we aren’t in any position to draw solid conclusions, but two months of a clear break reduces the chances of it being strictly a statistical issue.

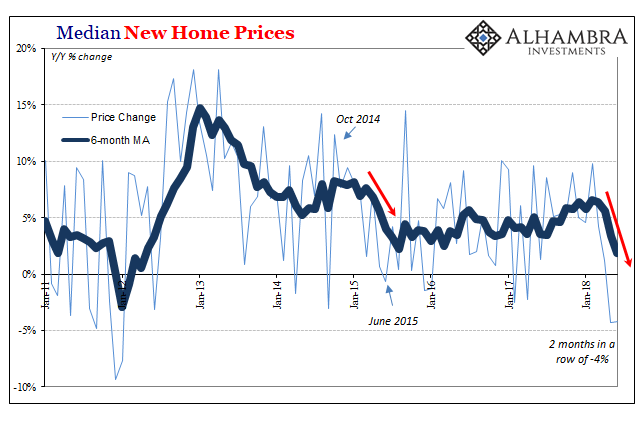

The shift in median home prices is immediately clear on the chart above. That’s not a good start. The last time new home sale price momentum broke so sharply? Between October 2014 and June 2015, the first stages of the “rising dollar” economy and downturn.

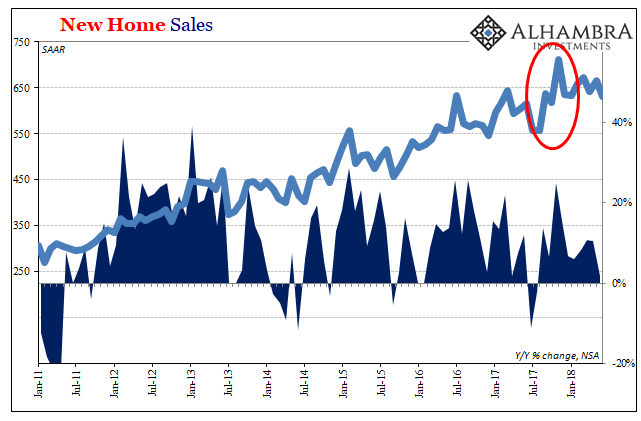

This is not a conclusive indication nor on its own all that compelling. So far, the number of new home sales appears unaffected, though they are already soft like the other real estate data. Excluding the effects in the aftermath of Harvey and Irma, sales have been flat or flatish (depending upon your perspective) for almost a year.

It becomes noteworthy, however, when combined with other indications pointing toward softer softness (autos) overall. A significant change in price behavior proposes the same for consumer behavior, at least in part.

Maybe that’s just slightly higher mortgage rates catching up with prospective home buyers. Or, perhaps home prices though growing at a historical pace still rose too quickly for limited wage growth (despite so many anecdotal labor shortages). Neither possibility actually speaks too highly of the economy, particularly when the NAR continues complaining about a lack of supply to meet supposedly sky-high demand.

Again, by itself it isn’t anything. But we have to take note of this clear shift in home prices as a possible negative outlier maybe indicating a rolling over out of the last Reflation #3 upturn toward Eurodollar Event #4 downturn.

Disclosure: None.