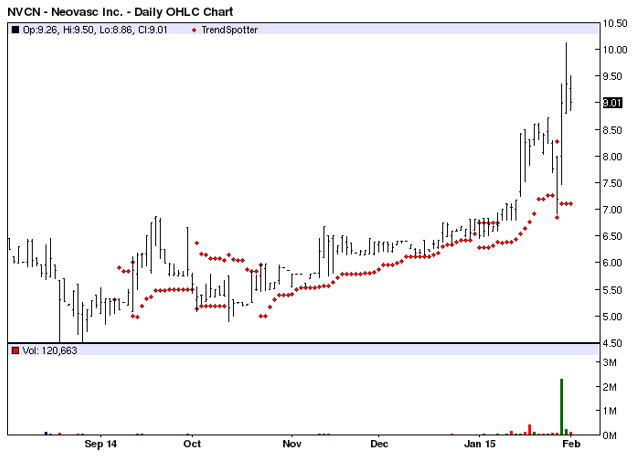

Neovasc - Chart Of The Day

The Chart of the Day belongs to Neovasc (OTC:NVCN). I found the stock by sorting today's All Time High list for the stocks having the most frequent new highs in the last month, then used the Flipchart feature to review the charts. Since the Trend Spotter signaled another buy on 1/29 the stock gained 1%.

Neovasc Inc. is a specialty medical device company. It develops, manufactures and markets products for the cardiovascular marketplace. The Company's products include the Tiara (NYSE:TM) mitral valve prosthesis in development for the transcatheter treatment of mitral valve disease, the Neovasc Reducer (TM) for the treatment of refractory angina and a line of advanced biological tissue products that are used as key components in third-party medical products, including transcatheter heart valves.

Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 37.69% in the last month

- Relative Strength Index 62.39%

- Barchart computes a technical support level at 8.10

- Recently traded at 9.01 with a 50 day moving average of 6.97

Fundamental factors:

- Market Cap $484.38 million

- The 2 Wall Street analysts following the stock have not release their revenue and earnings projections

- They do give 1 strong buy and 1 buy recommendation on the stock

Until recently this has been a very thinly traded stock. The recent interest may be temporary so make sure you sell on weakness of price and volume.

Disclosure: None.

NVCN dropped 3.64% yesterday. Long term, perhaps its the type of company that when it turns profitable is a potential IPO. Last year profit margin was -86%. Overall an interesting stock to watch, but if you're risk averse, perhaps JNJ is a safer bet? JNJ is up 36% in past 2 yrs, an annual yield of 2.8%, and a market cap of $282.23 bn.