NDX Futures: A New Retracement High

7:15 am

Good Morning!

NDX futures rose to 12478.90, a new retracement high and confirmation of the probable extension of the rally. The Cycles Model offered a potential reversal yesterday, but the markets ignored it, having not yet even retraced at 38.2% retracement at 12613.00. There is more to go. The current Master Cycle, which began on August 16, only reaches its halfway point at mid-day on Tuesday. The 50% retracement value is at 12825.00, just under Intermediate-term resistance at 12856.63. Both targets are viable.

In today’s op-ex, Max Pain is at 12325.00-12340.00. Calls gain dominance at 12350.00 and long gamma kicks in at 12400.00. Calls remain strong until 12600.00.

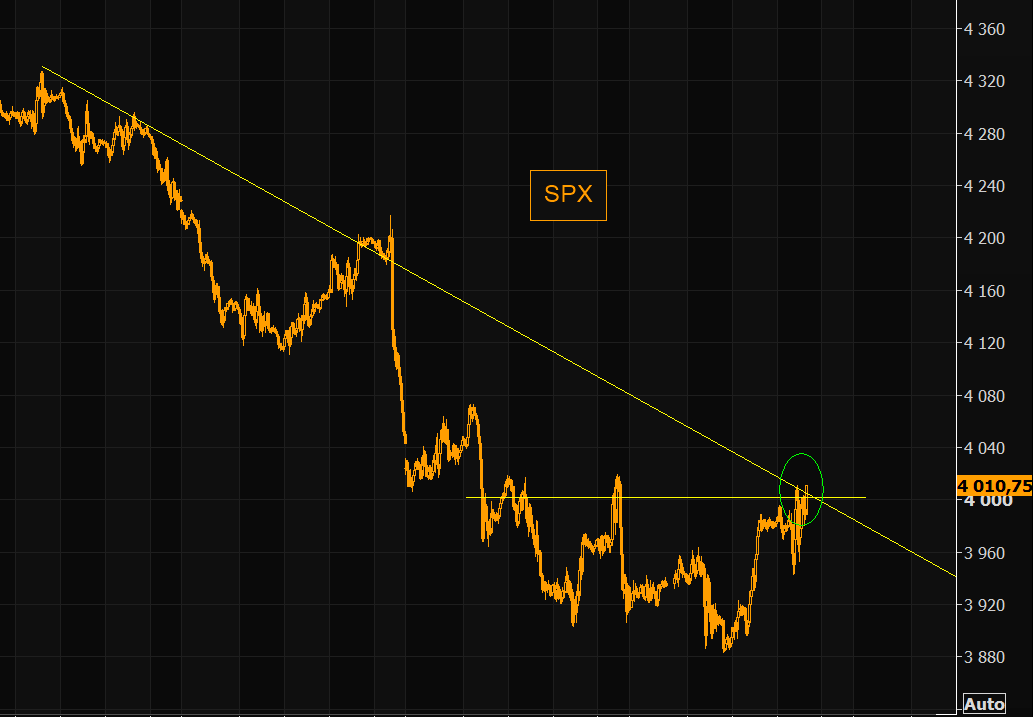

ZeroHedge remarks, “SPX is up 3.2% from recent lows

Back above 4k and people are still waiting for new lows…

Source: Refinitiv

Evaporating puts

As we outlined yesterday in our thematic email (We will probably bounce here), the institutional players loaded up on puts just in time for the bounce. Note they loaded up on single stock puts, and not index puts. The second chart shows that this put buying has led to “…MONSTER richening in Put Skews (wingy downside) to some “extreme” levels amongst key S&P Mega Cap Tech / Growth type names”. Index skew on the other hand remains depressed (chart 3).”

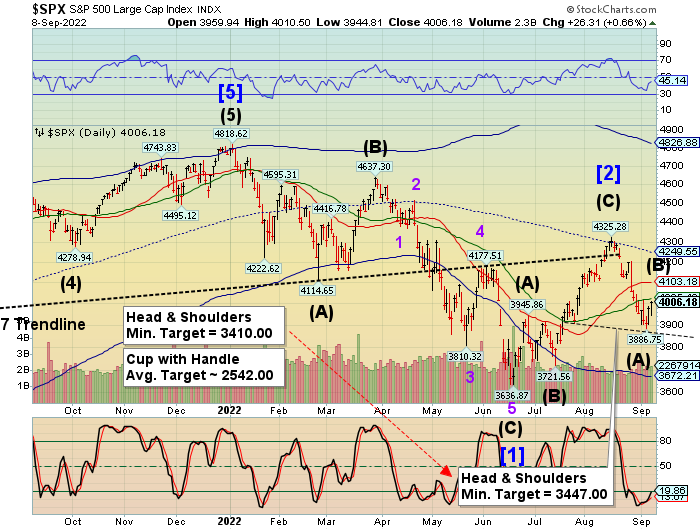

SPX futures rose to a new retracement high of 4044.70, above the 50-day Moving Average at 4025.42. The next resistance is the Intermediate-term value at 4103.18, very near the 50% retracement value at 4106.01. The current Master Cycle reached its halfway point at midday on Tuesday. The second half of the Cycle may be intensely destructive with a high probability that the Head & Shoulders targets may be fulfilled in the next month.

More By This Author:

SPX Futures: Starting A New Master CycleUSD Futures Rose To A New High

Nasdaq Futures Crashed To A New Bear Market Low

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more