Navigating The One Big Beautiful Bill Act

Image Source: Unsplash

Over the last three years, the total return on the S&P 500 Index is up an annualized 21.7%. This means investors earned roughly 21% in each year of the last three years in large company stocks that are a part of the index.

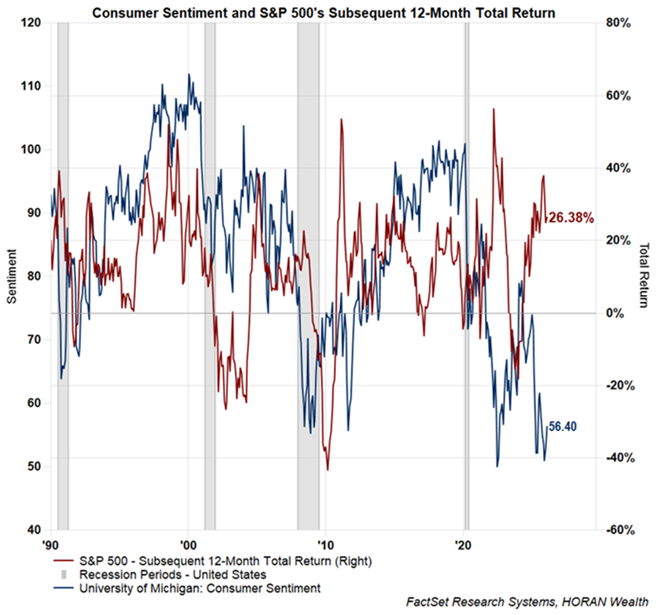

In spite of the strong market return, consumer sentiment remains at a low level, maybe partly due to the fact not all consumers enjoy the direct benefit of a rising stock market. However, when sentiment is lower, future stock market returns tend to be reasonably strong, as is currently being experienced and demonstrated in the below chart.

Some of the favorable market return carrying over into 2026 might just be due to the July passage of the One Big Beautiful Bill Act (or OBBBA). This bill provides tax relief to a broad range of consumers and taxpayers and is applicable to income in 2025. As noted in an article by the Tax Foundation, Tax Refunds and the One Big Beautiful Bill Act:

"Tax Foundation estimates the OBBBA reduced individual taxes by $129 billion for 2025, and outside estimates suggest up to $100 billion of that could be received as higher refunds this filing season, pushing average refunds up by up to $1,000. This is because the IRS did not adjust withholding tables after the law passed, workers generally continued to withhold more taxes from their paychecks than the new law required."

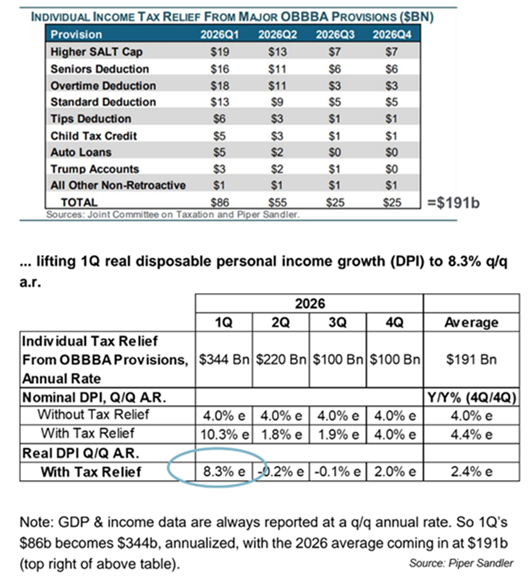

As noted in the article, many of the tax benefits do not benefit the highest income taxpayers due to the income phase outs. More detail is included in the article provided. As noted in a blog post in early December, I highlighted a table from Piper Sandler showing the tax relief benefiting consumers is equivalent to an annualized $344 billion and equates to an increase in real disposable personal income growth of 8.3% in the first quarter.

This consumer savings does not include savings benefiting businesses. The Tax Foundation also wrote an article on the OBBBA's overall potential impact to the economy, Will the OBBBA Tax Cuts Grow the US Economy?, which highlights the boost the Act may provide to economic growth.

In that regard, the Atlanta Fed publishes a dynamic GDP forecast, GDPNow, that estimates quarterly economic growth. The most recent GDPNow reading projects fourth quarter GDP to be reported at 4.2%. Although this is down from the Jan. 26 reading of 5.4%, it remains higher than the below 3% reading seen at the beginning of the year.

In conclusion, with an equity market that seems to only want to go higher, some of the recent favorable return is anticipation of a stronger economy in 2026. If that is the case, certainly some of the positive economic results may get priced into equities in advance of reported company and economic data. Investors, though, will want to keep in mind the positive influence the OBBBA will have on corporate profits and potential economic growth that may serve as a tailwind for the equity market.

More By This Author:

Navigating The Fog: 2026 And Timing The Market

Investor Sentiment Measures Nearing Elevated Level

Small Caps Are Leading The Way

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more