Nasdaq Up Over 500 Points Amid Renewed AI Optimism

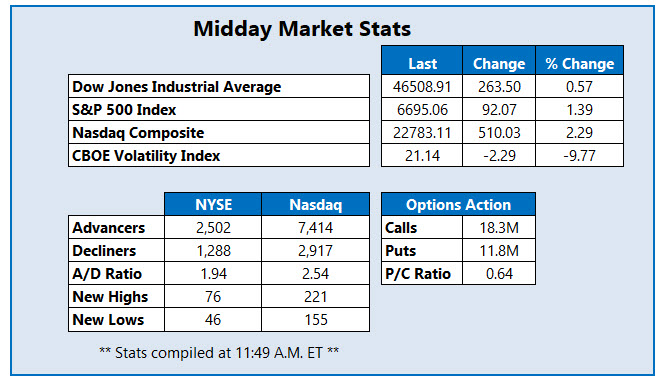

The Nasdaq Composite (IXIC) boasts a 510-point lead this afternoon, as enthusiasm over AI trade resumes and investors become optimistic of tech behemoth Alphabet's (GOOGL) prospects. The Dow Jones Industrial Average (DJI) is also sporting a triple-digit lead, while the S&P 500 Index (SPX) sits firmly higher as renewed hopes of an interest rate cut in December circulate. Elsewhere, the Cboe Volatility Index (VIX) could mark its third loss in four sessions

Shares of Abercrombie & Fitch Co (NYSE: ANF) are down 5.5% to trade at $66.27 at last glance, ahead of the retailer's third-quarter earnings report, which is due out before the open tomorrow. Options traders are already chiming in, with 6,183 calls and 23,000 puts traded so far today, which is nine times the volume that is typically seen at this point. The most active contract by far is the December 65 put. ANF carries a 55.4% year-to-date deficit, and earlier hit its lowest level since April.

Broadcom Inc (Nasdaq: AVGO) stock is among the SPX's outperformers today, up 9.6% to trade at $372.80 at last check. The security is enjoying today's broader market tailwinds, on track for its biggest single-day percentage gain since Oct. 13 while sporting a healthy 59.7% year-to-date lead. Shares are also not too far removed from an Oct. 29, record high of $386.48, with long-term support at the 80-day moving average containing their most recent pullback.

(Click on image to enlarge)

Meanwhile, Copart Inc (Nasdaq: CPRT) is among the worst stocks on the SPX, last seen down 4.5% to trade at $38.92. The security earlier attracted price-target cuts from Jefferies and J.P. Morgan Securities to $50 and $45 from $60 and $50, respectively. On track for a third-straight daily loss, Copart stock has shed more than 32% so far this year.

More By This Author:

Stocks Right The Ship But Still Suffer Steep Weekly LossesNasdaq Eyes 3rd-Straight Weekly Drop Despite Today's Gains

Dow Suffers 1,000-Point Reversal Amid Dramatic Tech Pivot