Nasdaq Scores Record High Amid Unusual Chip Deal

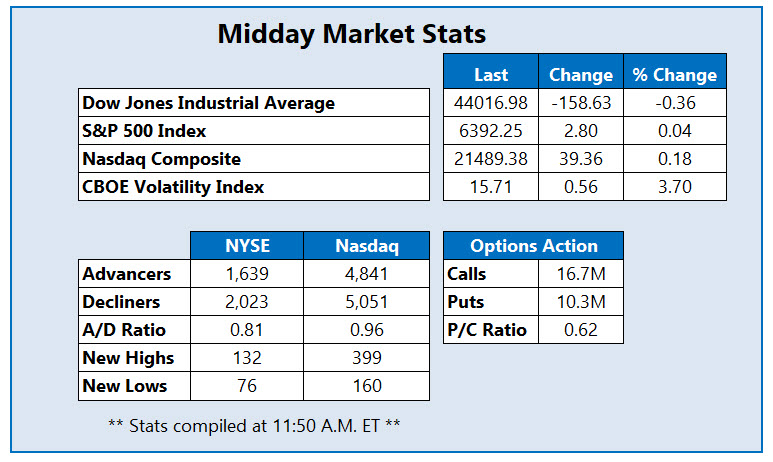

Stocks are on shaky ground today, as Wall Street wrestles with tech headlines ahead of a big week of inflation data. The Dow Jones Industrial Average (DJI) is down triple digits this afternoon, despite a sharp move higher at the open. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are modestly higher, but the latter scored a fresh record high earlier as semiconductor stocks Nvidia (NVDA) and Advanced Micro Devices (AMD) churn amid their unusual deal with the Trump administration.

(Click on image to enlarge)

Exchange-traded fund (ETF) Bitmine Immersion Technologies Inc (NYSE: BMNR), the world's largest Ethereum (ETH) treasury holder, is getting blitzed by call traders today. At last check, 214,000 calls have been changed, volume that is six times the average intraday amount and double the number of puts traded. The weekly 8/22 70-strike call is the most popular, with new positions being bought to open there. BMNR is 778.3% higher in 2025, and up 34% at $68.93 at last check, as cryptocurrencies scale the charts.

Intel Corp (Nasdaq: INTC) stock is one of the better tech stocks on the Nasdaq today, last seen up 5.2% to trade at $20.99. The pop comes amid a Wall Street Journal report that CEO Lip-Bu Tan will visit the White House today. Intel has come under fire from President Donald Trump for its supposed ties to China businesses. Intel stock has reclaimed its year-to-date breakeven level, but a slew of trendlines overhead still loom as resistance.

Upstart Holdings Inc (Nasdaq: UPST) is near the bottom of the Nasdaq, last seen down 4.8% to trade at $65.47, after the fintech company announced a $500 million convertible senior note offering. Upstart stock earlier traded as low as $63.33, breached its 50-day moving average, and is now only 6.2% this year.

(Click on image to enlarge)

More By This Author:

Stocks Secure Best Week In A Month; Nasdaq Hits Record CloseStocks Steady, Eye More Peaks To End Winning Week

Dow Tumbles On Tariff Fatigue; Nasdaq Marks Record Close