Nasdaq Pulls Back After Breaking Above 23,000

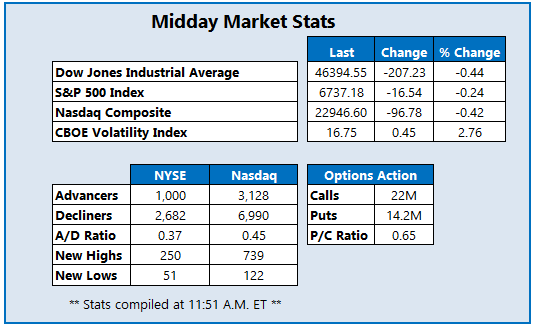

The Dow Jones Industrial Average (DJI) is down triple digits midday, despite Nvidia's (NVDA) 2.4% climb, after the U.S. approved billions in AI chip exports to the United Arab Emirates. The Nasdaq Composite (IXIC) and S&P 500 Index (SPX) sit lower as well, both pulling back from their earlier record highs, with the former breaking above 23,000 for the first time ever. There is no economic data as the government shutdown enters its ninth day, though silver hit a record high and gold remains above $4,000/oz.

Tilray Brands Inc (Nasdaq: TLRY) is the most popular stock in the options pits today, with 436,000 calls and 51,000 puts exchanged so far -- 7 times the average daily options volume. The weekly 10/10 2-strike call is the most popular, with new positions opening there. At last glance, TLRAY was up 28% to $2.20 to trade at 52-week highs, boosting the cannabis sector after strong fiscal first-quarter revenue and a positive outlook.

Serve Robotics Inc (Nasdaq: SERV) stock was last seen up 24.3% at $17.09, after the company partnered with DoorDash (DASH), bringing delivery robots to the service. Though SERV still hasn't recovered from its February bear gap, it's trading at its highest levels since then. Year-to-date, the equity is up roughly 19%.

Shares of Hydro Flask parent Helen of Troy Ltd (Nasdaq: HELE) are down 21.9% at $21.59 today, despite better-than-expected fiscal second-quarter earnings and revenue results, after the company's disappointing full-year profit forecast. Dropping below a swath of daily moving averages, including the 60-day trendline, HELE is heading back toward its July 15, 16-year low of $20.02.

More By This Author:

S&P 500, Nasdaq Snag More Records As Tech Resumes ClimbAI Sector Rebound Gives Major Benchmarks A Boost

S&P 500 Snaps Win Streak As Oracle Stock Plummets