Nasdaq Price Forecast: Inflation Still Spiking But Rebound Likely

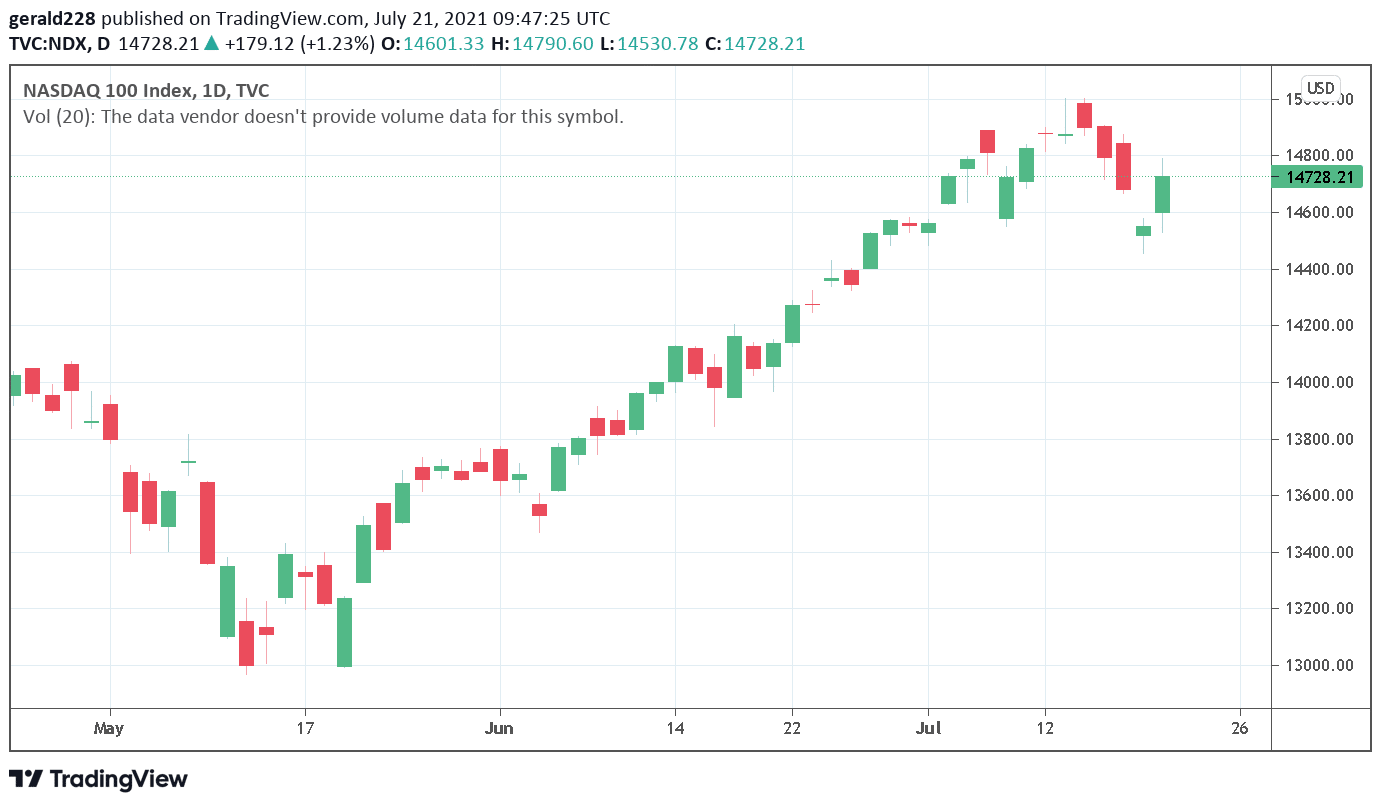

After a slow start to the week in which the Nasdaq price shed around 200 points, the last session has been a positive one. After reaching a high of 14980 on 14 July, the Nasdaq price descended steeply over three sessions even down to a low of 14522 on 19 July.

However, the last session was extremely positive for the Nasdaq index which rose by around 1% to the $14728 level. Although inflation still remains a substantial issue over the short to medium term, it seems that investors have shrugged off these worries and are bullish.

Short Term Forecast For Nasdaq: Mildly Bullish But Tread With Caution

(Click on image to enlarge)

It is extremely difficult to plot a short-term course for the Nasdaq at present. A number of factors include the substantial rise in Covid19 cases in the US. Several states still have rather low rates of vaccination, and the Delta variant is rampant in these areas. All this will undoubtedly have a substantial effect on the economy’s reopening.

The situation regarding inflation is also having an effect on a short-term level. Rising prices of real estate, cars and other durable goods are having a significant impact on consumption levels. Investors’ risk appetite has also dwindled substantially of late with several warnings across the horizon.

Fed Chair Jerome Powell has remained upbeat about inflation control short but as always, the proof of the pudding is in the eating. It remains to be seen what will happen when job support programmes expire and the economy continues to reopen.

If the Nasdaq price retains its bullish streak over the past 24 hours, a 1% rise over the next few days could see the index once again tackle the $14,900 mark. The psychologically significant mark of $15000 would then seem a stone’s throw away and would be an extremely realistic target level for end July.

Long Term Forecast For NDX: Tackling Vaccination And Controlling Variants Remains The Key

Some financial analysts are predicting that the Nasdaq price will continue shooting forward and even flirt with the 18000 mark by end of the year. Although that is quite an optimistic estimate, it remains to be seen if all this will be derailed as Covid19 cases continue to rise worldwide and the economic recovery remains muted.

Large tech companies have continued to prosper with turnover reaching record levels and profits rising fast too. A conservative forecast would be the $16000 level by end of the year but this could also be quite optimistic especially if inflation continues to rear its head and the job market remains restrained.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more