Nasdaq Futures Crashed To A New Bear Market Low

8:05 am, Good Morning

NDX futures crashed to a new bear market low , at 11435.20 and is hovering near the low. I don’t have to explain much about the impact that op-ex has, especially when it is in short gamma. NDX is due for a bounce, but considering the weak bounces thus far, there may not be any incentive to “take profits” on short positions when the outlook is so bleak for the bulls. Thus, not much chance of a short squeeze.

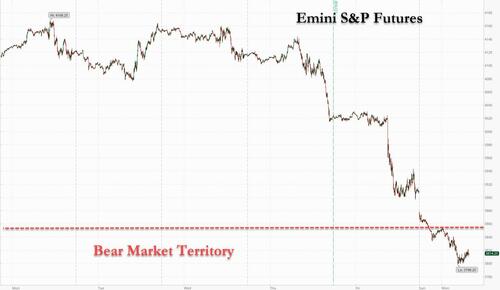

SPX futures also made a new bear market low at 3798.50, followed by a shallow bounce. That bounce may last into the cash market, but most investors will only see the losses and not the attempt to make a bottom. It may fail quickly as the bounce may be sold before it has a chance to materialize. As for op-ex, dealers are frantically trying to avoid paying on the 4800.00 strike with 14840 outstanding put contracts.

ZeroHedge reports, “For all those claiming that stocks had priced in 3 (or more) 50bps (or more) rate hikes, we have some bad news.

All hell is breaking loose on Monday, with futures tumbling (again) into bear market territory, sliding below the 20% technical cutoff from January’s all time high of 3,856 and tumbling as low as 3,798.25 – taking out the May 10 intraday low of 3,810 – before reversing some modest gains. S&P 500 futures sank 2.5% and Nasdaq 100 contracts slid 3.1%, in a session that has seen virtually everything crash. Dow futures were down 567 points at of 730am ET.”

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more