Nasdaq 100, S&P 500, Peloton Forecast: Higher Rates & Geopolitics

Equities Forecast: Mixed

Risk Aversion Halts SPX Winning Streak

The SPX index felt the pinch with the threat of a Russian invasion on Ukraine escalating. The oil markets rallied as a disruption in global supply could be severely impacted should a war unfold.

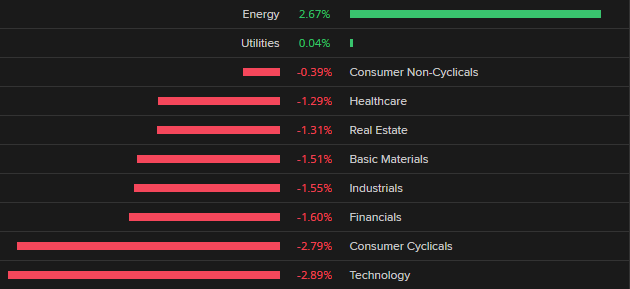

Energy stocks followed suit (see sector summary below) allowing for a ray of sunshine in what was otherwise a red close to the week for the rest of the index.

Sector Summary

Source: Refinitiv

Value over growth during periods of higher interest rates has been reflective in stock prices of recent as the tech stocks have been declining however, with the threat of war looming, safe haven stocks may see some action.

S&P 500 Index Technical Analysis

SPX Daily Chart

Chart prepared by Warren Venketas, IG

Resistance levels:

- 4600

Support levels:

- 4221.45

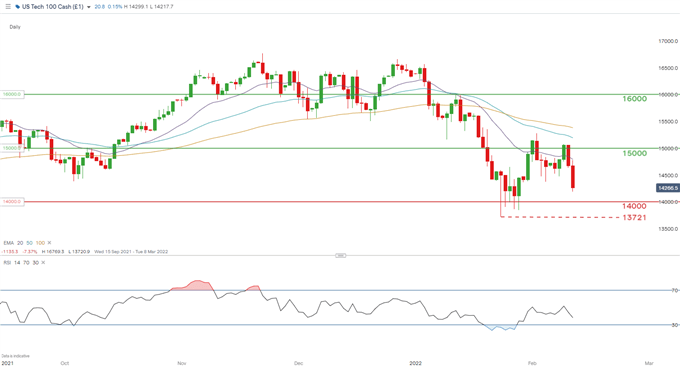

Nasdaq 100 Index Hurt By Rising Treasury Yields

Soaring US Treasury yields after strong US CPI data last week saw markets increase hawkish bets with talks around the potential for 50bps and even 100bps Fed rate hikes to combat inflationary pressure. Traditionally, higher yields have an inverse relationship on tech stocks as rising interest rates (or the threat of) diminishes the future value of earnings. The US is and most of the developed world is starting to dry up liquidity in the market by slowing or stopping asset purchases and raising rates. This accommodative environment has supported growth stocks principally in the tech sector but with a pivot to a less favorable environment, tech stocks are fading. This being said, easy access to cheap capital may help some tech stocks fight the fundamental headwinds via earnings data which has been impressive up until now.

Nasdaq Composite Index Technical Analysis

NDX Daily Chart

Chart prepared by Warren Venketas, IG

Resistance levels:

- 15000

- 20-day EMA (purple)

Support levels:

- 14000

- 13721

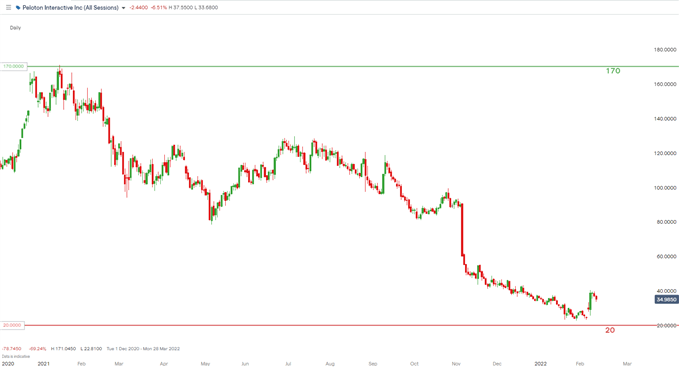

Can Peloton Be Salvaged After Going From Hero To Zero?

Peloton’s (PTON) share price has been steadily declining dropping from $170 to almost $20 per share since January 2021 as the global economy emerges out of the COVID-19 pandemic. With lockdowns and other restrictions being eased, the fitness industry has recovered leaving Peloton’s offering less attractive. A slew of logistical and product defects have added to the falling share price with CEO and co-founder John Foley admitting to poor decision making. Peloton expanded at a rapid pace with large investments into production and logistics without taking into account a decline in demand post-COVID. As a result, Foley is set to step down along with the layoff of 2800 employees in attempts to cut costs. Despite the negative connation around the large scale layoff, the news brought about some positivity around the stock particularly after potential acquirers circle the ailing Peloton including Nike, Amazon and Apple.

With such reputable companies interested along with structural changes in key areas, investors may look to pounce while prices remain comparatively low.

Peloton Interactive Daily Chart

Disclosure: See the full disclosure for DailyFX here.