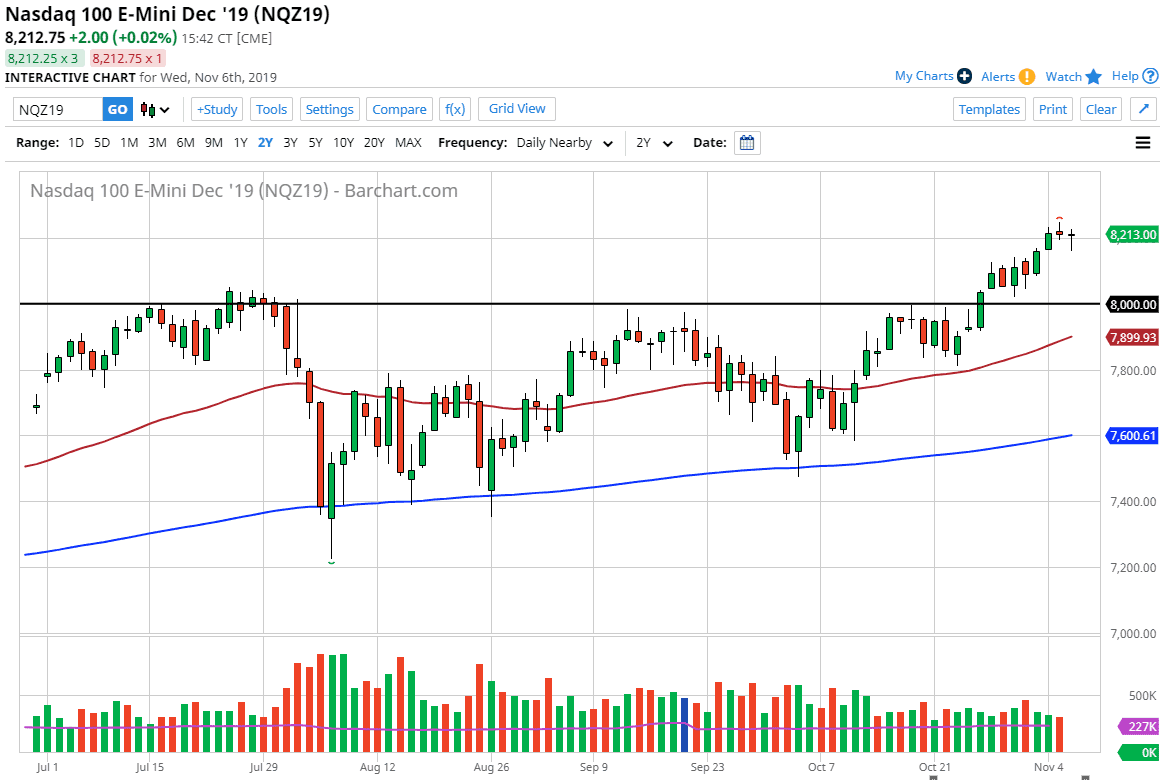

Nasdaq 100 Forecast: To Continue Climbing

The Nasdaq 100 has initially fallen during the trading session on Wednesday but has found enough support underneath near the 8150 level to turn around and form a bit of a hammer. That hammer, of course, is a bullish sign and should continue to drive money towards the upside. Granted, the session on Tuesday was a shooting star, but it certainly looks as if Wednesday saw a nice turnaround. With this, it’s likely that the buyers are looking to pick up any short term dips that they can. That makes sense because we have broken a major resistance barrier and now the Federal Reserve is standing on the sidelines. As long as that’s going to be the case it’s likely that we will see value hunting every time there is cheaper pricing.

To the downside, I see the 8000 level as a massive floor in this market as it was once a major ceiling. The 50 day EMA is starting to climb towards that area as well, so that will also come into factor if we do pullback. Longer-term, based upon the ascending triangle the market has a projected move towards the 8800 level over the longer term. That being said, we won’t get there overnight we certainly won’t get there in a straight line. Look at pullbacks as an opportunity to pick up a bit of value in a market that is extraordinarily strong.

What proves the strength in this market more than anything else was the announcement that the US and China weren’t going to sign the so-called “phase 1” of the deal in Chile, but probably in December. This hesitation has a certain amount of negativity attached to it, but at the end of the day the fact that the market recovered after that shows just how resilient it is. After all, a lot of the big companies that make up the NASDAQ 100 are heavily reliant on US/China trade. So far, the tariffs that have been levied on both countries have been relatively minor, so we continue to see US companies perform quite well. Beyond that, we have recently seen rather strong economic figures coming out the United States, so that, of course, helps the idea of US companies be in a place where money flows to as the rest of the world continues to struggle a bit. Obviously, it can’t go on forever but if the situation remains the same for a while, that means that we will certainly continue to go higher.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more