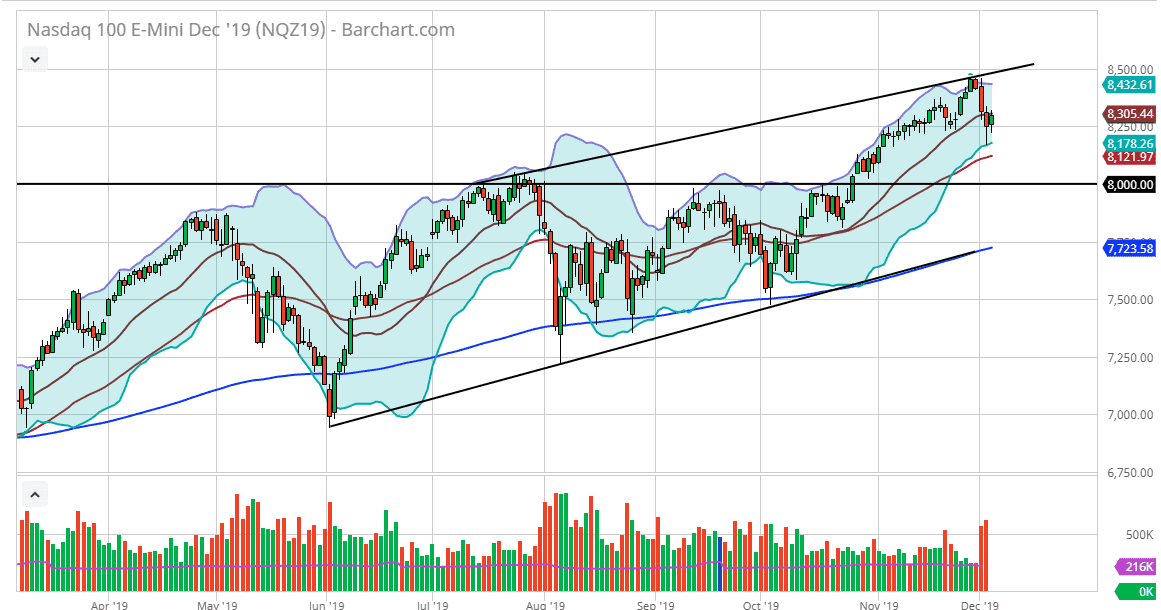

Nasdaq 100 Forecast: Continuing Longer-Term Uptrend

The Nasdaq 100 has fallen initially during the trading session on Wednesday but turned around to recapture the losses from the previous session. Remember, this is a market that continues to be in a bull trend, but over a previous couple of sessions had dealt with a lot of negativity involving the US/China trade situation. Ultimately, the comments of Donald Trump during the trading session on Tuesday sent the market tumbling as he suggested that a trade deal was probably better off after the presidential election. That being said though, the market is still in a major uptrend, and the fact that we started to buy back a lot of the losses at the end of the trading session on Tuesday telegraphed that the market was likely to continue going higher eventually. Now that there have been reports that perhaps the United States and China are closer to a deal then believed, despite the fact that the rhetoric has ratcheted up, the market has turned right back around.

Beyond that, the market has found its way back to the 20 day SMA, something that is followed quite often by the longer-term traders. It’s also the middle of the Bollinger band indicator, so that makes sense as well. In fact, if you look at the candlestick from the Tuesday session, we touched the very bottom of the Bollinger band before turning right back around. I suspect that a lot of the selling during the trading session on Tuesday was done by algorithm traders, as headlines came out and machines started selling drastically. At this point, the humans stepped back in and started picking up value, as they have learned that Donald Trump purposely manipulates the market. If the market is very high at the moment, he won’t hesitate to take a swipe at the Chinese in public. This is a pattern that continues to repeat itself, so I believe that cooler heads prevailed, and we started to stabilize. We do have the jobs number on Friday though, so that will come into play rather soon, and should be paid quite a bit of attention to. Ultimately, this is a market that I do think goes higher because quite frankly we are at a point that even if jobs are poor, the Federal Reserve will come into the picture and start loosening monetary policy, so Wall Street gets its fix.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more