#NailedIt @AndrewThrasher, IWM & EWJ Year End Trade Plan, NVDA Earnings

Making short term market forecasts is extremely dicey but I have a roadmap into year end. With 6 data light weeks left in the year after this week, two of them holiday shortened, I believe that we’ll see an imminent 3-5% correction before rallying into year end on the euphoria over a #COVIDVaccine and a 2021 #ReOpen

– Top Gun, “Is The Market Too Strong?, WMT & HD Earnings, Copper & Bitcoin” , Wednesday, November 18, 1:08am PST (time the original email was sent. The blog was posted 21 minutes later at 1:29am PST)

Good thing I came across Andrew Thrasher’s blog post, asking the counterintuitive question of if the market was too strong, Tuesday afternoon in The Chart Report. I led with it in yesterday’s morning email and made it the focus of my premarket video commentary (~5:40am PST) for my morning workout Instagram post .

The market was having a very normal, boring even, day yesterday with the S&P up ~10 points at 9am PST when it started to roll over, picking up steam in the last hour and finishing at the day’s lows (3,568), down 51 points from the day’s 9am PST high (3,619) (SPX).

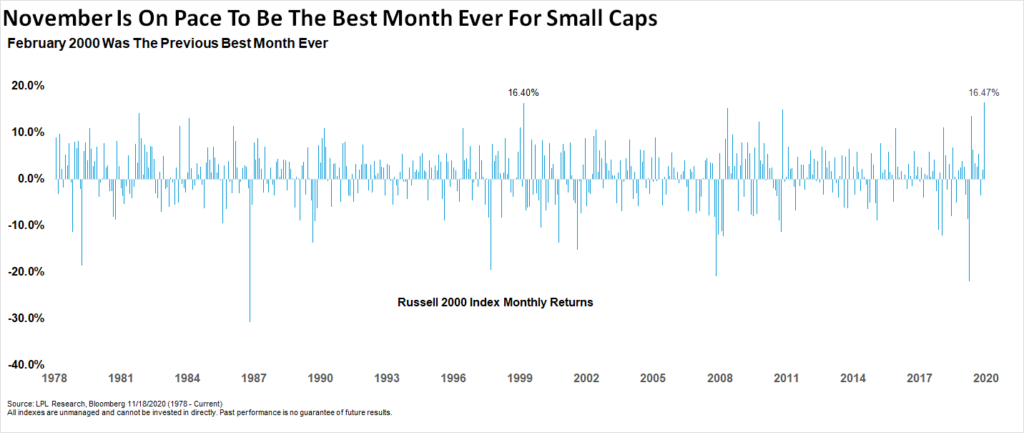

Before that, the Russell 2000, which had a similar type trading day, selling off from a middle of the day intraday high of 1,805 to close at 1,769, was having its best month ever, just beating out February 2000.

Thrasher had a little fun, tweeting a shrug emoji at 12:54pm PST, which I quote retweeted saying “That’s how you do it @AndrewThrasher” and linking to Jordan’s iconic shrug after he made 6 3 pointers in the first half of Game 1 of the 1992 NBA Finals versus the Portland Trailblazers.

It’s no coincidence that stocks are acting like they did in February 2000, at the top of the Dot Com Bubble, as we are currently in another massive stock market bubble. Nevertheless, I’m inclined to believe this bubble has further to inflate, at least through year end as investors anticipate a 2021 #ReOpen based off of all the #COVIDVaccine news the last two weeks in a data light, seasonably favorable final 6 weeks of the year.

That’s why I’m planning to buy the (IWM) when/if the Russell 2000 retests its breakout to new all-time highs in the 1740s. I will also be buying some (EWJ) if/when that happens. The plan is to put on half of this trade in the 1740s and half in the 1730s, with a stop ~1720, which would signal a failed breakout to me. When trading a bubble, one must practice tight risk management. The plan is to hold until the first trading day of 2021.

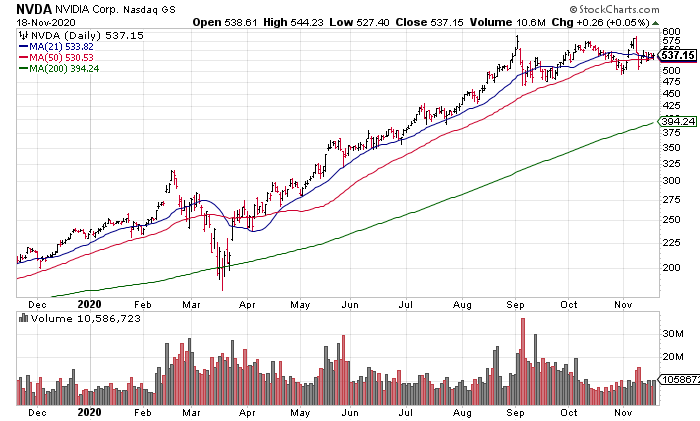

Lastly, I want to discuss Nvidia (NVDA) earnings from yesterday afternoon. The numbers were incredible with Revenue +57% and EPS +64% but the stock is trading down 2% in the premarket. We saw a similar phenomena on Tuesday with Walmart (WMT) and Home Depot (HD) earnings which sold off after reporting great numbers because, like NVDA, they were already priced in at current technical and valuation levels. It’s just another indicator that the market is extended and fully valued and supports my belief that we have a 3-5% correction, which likely started yesterday, before a nice year end rally.

An exercise in ignorance is often an exercise founded upon ignorance.