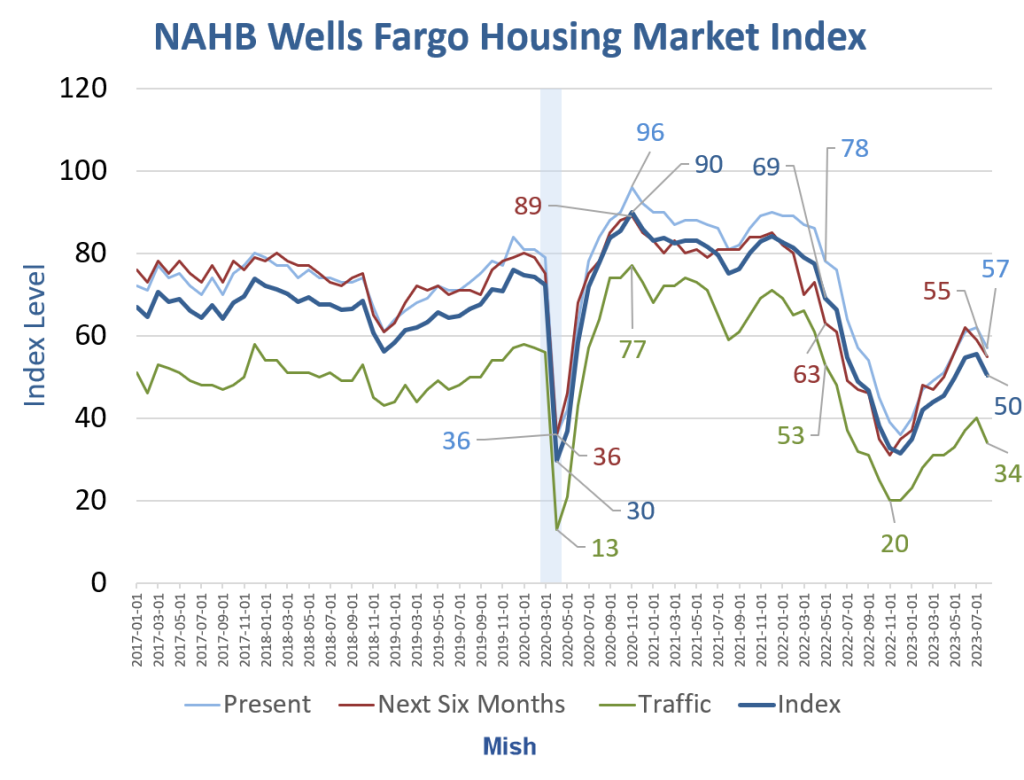

NAHB Wells Fargo Housing Market Index Dips 10.7 Percent In August

The NAHB/Wells Fargo Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market.

The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.

NAHB Wells Fargo Housing Market Index Since 1985

Traffic remains depressed. Traffic is at levels generally associated with recessions.

Conditions rebounded from even deeper levels earlier this year when mortgage rates briefly fell. Also, homebuilders were able to pass on falling lumber prices and they built smaller homes.

30-year fixed mortgage rates are 7.26 percent according to Mortgage News Daily.

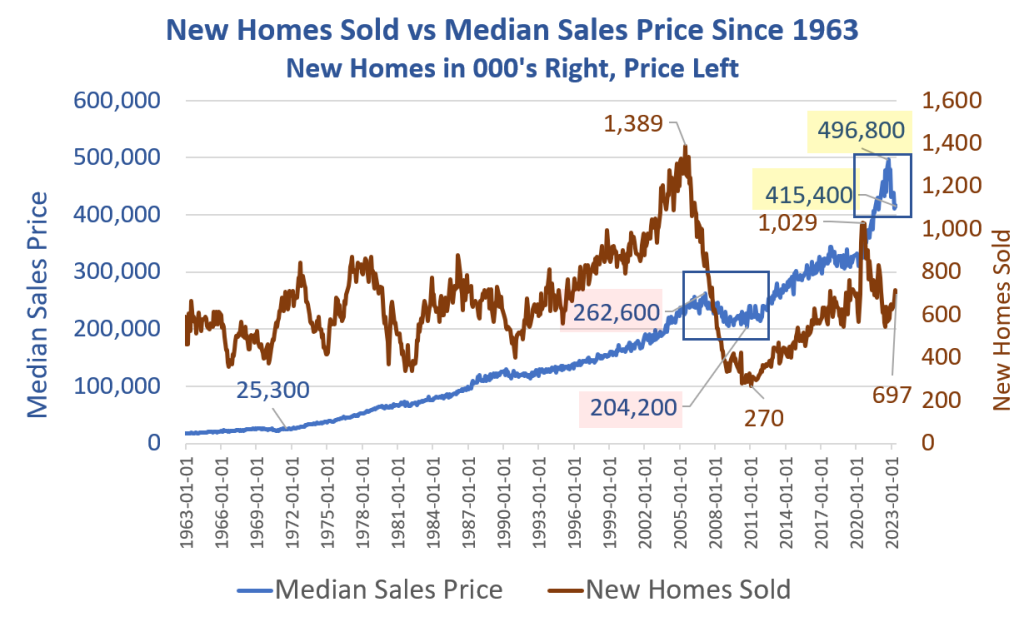

How Much More Will Homebuilders Have to Reduce Prices to Increase Sales?

Median new home sales prices vs new home sales, data from the Census Department, chart by Mish

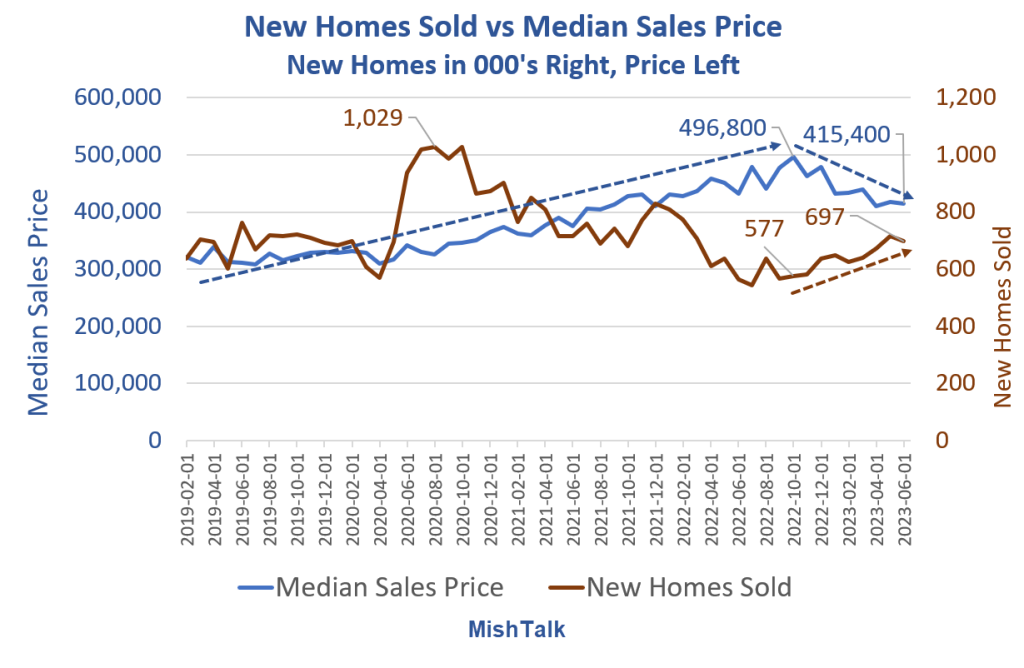

New Home Sales vs Median Sales Price Detail

Buyers hit a brick wall on price with a peak of $496,800 in October of 2022. Median price has fallen 16.4 percent since then.

For discussion, please see How Much More Will Homebuilders Have to Reduce Prices to Increase Sales?

More By This Author:

Retail Sales Surge 0.7 Percent In July But Autos Decline 0.3 PercentBond Market Carnage Sends Mortgage Rates Soaring Towards 23-Year Highs

Producer Price Index Rises 0.3 Percent Led By A 0.5% jump In Services

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more