Mr. Market And A Valuation Of The Dow For Value Investors – January 2017

(Click on image to enlarge)

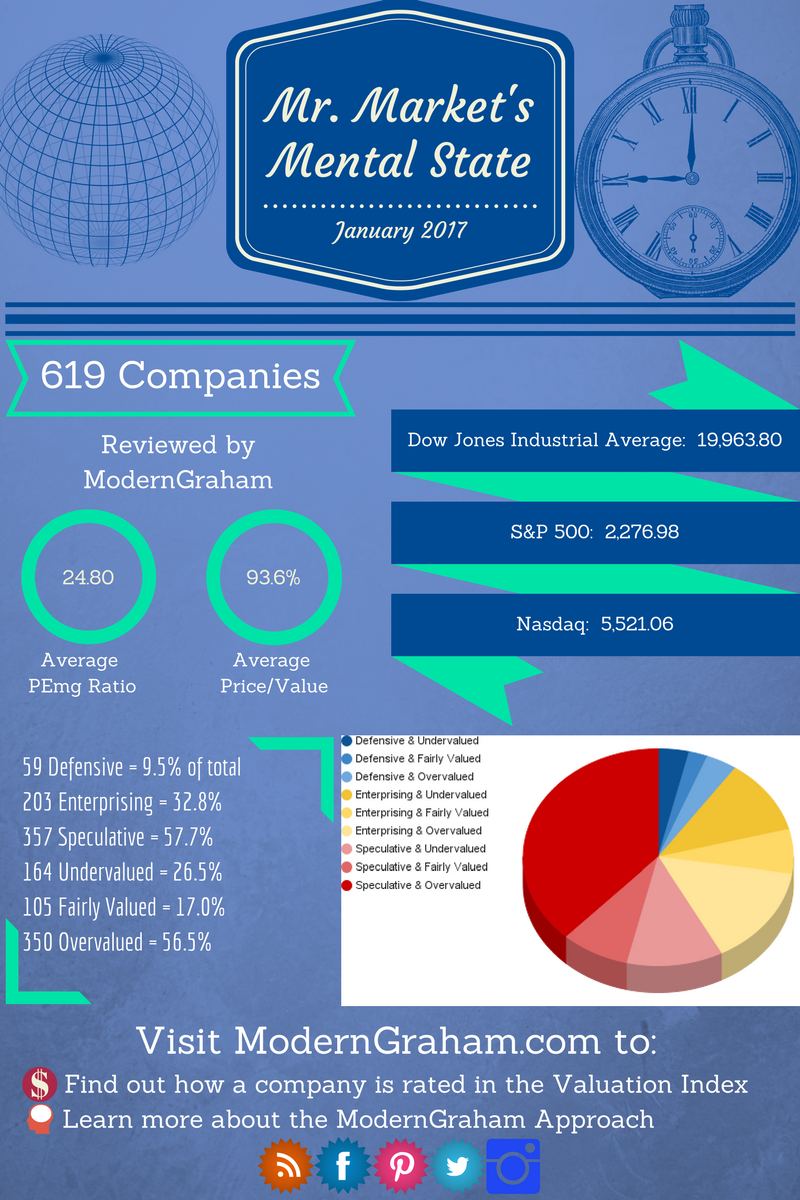

Mr. Market’s Mental State

Legendary value investor Benjamin Graham is probably most famous for his Mr. Market parable. In the story, an investor is greeted each day by Mr. Market, who offers to purchase the investor’s stocks. Every offer is different, and sometimes the price is insanely high, sometimes it seems fair, and other times it is clearly too low. But one thing remains the same – the intrinsic value of the investments does not change. As a result, the investor is left to decide when to buy and sell based on the relationship between the intrinsic value and the price Mr. Market is offering.

All value investors today should keep the analogy in mind, and implement the overall concept. To assist in that goal, ModernGraham has various tools available, and the infographic shown above is one of them, displaying a summary of the valuations of 619 companies reviewed by ModernGraham.

This month, out of the 619 companies reviewed by ModernGraham, the average PEmg ratio (price over normalized earnings) is 24.80 and the average company is trading at 93.6% of its intrinsic value. Last month, the average PEmg ratio was 24.56 and the average company was trading at 93.20% of its intrinsic value.

The highest PEmg average we have seen while tracking this information was 26.17 in December 2014 while the lowest PEmg average was 22.25 in February 2016. The highest average intrinsic value was 93.6% in January 2017 and the lowest average intrinsic value was 79.54% in February 2016.

| Month | Average PEmg | Average % of value | Defensive % | Enterprising % | Speculative % | Undervalued % | Fairly Valued % | Overvalued % |

| August 2014 | 24.36 | 90.57% | n/a | n/a | n/a | n/a | n/a | n/a |

| September 2014 | 25.37 | 93.37% | n/a | n/a | n/a | n/a | n/a | n/a |

| October 2014 | 24.29 | 90.24% | 12% | 35% | 53% | 31% | 21% | 48% |

| November 2014 | 25.32 | 90.61% | 12% | 35% | 53% | 29% | 21% | 50% |

| December 2014 | 26.17 | 92.28% | 11% | 34% | 55% | 28% | 23% | 49% |

| January 2015 | 25.63 | 93.48% | 10% | 34% | 55% | 30% | 20% | 50% |

| February 2015 | 25.79 | 92.72% | 10% | 35% | 55% | 33% | 19% | 49% |

| March 2015 | 25.79 | 88.03% | 10% | 35% | 55% | 31% | 19% | 49% |

| April 2015 | 25.64 | 86.18% | 9.9% | 35.2% | 54.9% | 32.1% | 19.4% | 48.5% |

| May 2015 | 25.17 | 86.64% | 9.1% | 36.1% | 54.8% | 32.1% | 20.4% | 47.4% |

| June 2015 | 25.47 | 86.43% | 8.7% | 34.7% | 56.5% | 30.0% | 21.2% | 48.8% |

| July 2015 | 25.24 | 85.65% | 9.6% | 33.1% | 57.3% | 30.9% | 19.3% | 49.6% |

| August 2015 | 25.08 | 86.79% | 9.8% | 32.7% | 57.5% | 29.5% | 21.0% | 49.5% |

| September 2015 | 23.2 | 82.45% | 9.4% | 32.6% | 57.9% | 35.7% | 18.9% | 45.5% |

| October 2015 | 22.95 | 81.80% | 10.5% | 31.7% | 57.8% | 35.5% | 18.7% | 45.8% |

| November 2015 | 23.97 | 84.84% | 10.1% | 32.2% | 57.7% | 32.0% | 19.2% | 48.7% |

| December 2015 | 23.27 | 84.55% | 10.6% | 31.5% | 57.8% | 33.0% | 17.8% | 49.2% |

| January 2016 | 22.87 | 82.61% | 10.9% | 30.8% | 58.3% | 35.9% | 16.8% | 47.3% |

| February 2016 | 22.25 | 79.54% | 10.9% | 30.7% | 58.4% | 36.7% | 16.3% | 47.0% |

| March 2016 | 23.07 | 83.92% | 11.3% | 29.9% | 58.8% | 33.4% | 19.0% | 47.6% |

| April 2016 | 23.37 | 83.65% | 11.3% | 29.9% | 58.8% | 32.5% | 18.8% | 48.7% |

| May 2016 | 23.78 | 82.90% | 11.4% | 29.9% | 58.8% | 31.3% | 18.5% | 50.2% |

| June 2016 | 24.21 | 84.77% | 11.6% | 30.0% | 58.5% | 30.7% | 17.3% | 52.0% |

| July 2016 | 23.83 | 86.40% | 11.8% | 29.9% | 58.2% | 30.1% | 19.0% | 50.8% |

| August 2016 | 24.68 | 89.40% | 11.9% | 30.7% | 57.4% | 29.6% | 19.3% | 51.1% |

| September 2016 | 23.86 | 91.21% | 11.2% | 30.1% | 58.7% | 28.6% | 18.4% | 53.0% |

| October 2016 | 24.07 | 91.41% | 11.2% | 30.2% | 58.6% | 28.4% | 18.5% | 53.2% |

| November 2016 | 24.2 | 92.55% | 11.0% | 30.3% | 58.7% | 28.0% | 17.8% | 54.2% |

| December 2016 | 24.56 | 93.20% | 10.5% | 31.1% | 58.4% | 28.0% | 17.6% | 54.4% |

| January 2016 | 24.8 | 93.57% | 9.5% | 32.8% | 57.7% | 26.5% | 17.0% | 56.5% |

Valuation of the Dow

Each month ModernGraham takes a look at the Dow Jones Industrial Average, listing out each individual component in an easy to read table, and calculates a value for the index that is based on the ModernGraham valuation model’s estimates for intrinsic values for each component. Over time this figure can be useful for determining whether the market as a whole is undervalued or overvalued.

(Click on image to enlarge)

At the time of writing, the Dow Jones Industrial Average (DJIA) was at 19,963.80. The ModernGraham Valuation of the DJIA was 19,445.11. As a result, the DJIA was trading at 102.67% of its estimated value. This figure is within the ModernGraham margin of error, and therefore it appears the DJIA is presently fairly valued.

To see the individual valuation articles, please click on the company name in the table below. For the investor type, a “D” indicates the company is suitable for the Defensive Investor, an “E” indicates the company is suitable for the Enterprising Investor, and an “S” indicates the company is considered speculative at this time.

| Ticker | Name with Link | Investor Type | Latest Valuation Date | MG Value | Recent Price | Price as a percent of Value | PEmg Ratio | Dividend Yield |

| AXP | American Express Company | D | 5/19/2016 | $117.34 | $75.47 | 64.32% | 14.83 | 1.54% |

| AAPL | Apple Inc. | S | 8/16/2016 | $294.16 | $117.91 | 40.08% | 15.41 | 1.81% |

| BA | Boeing Co | E | 6/13/2016 | $201.69 | $159.10 | 78.88% | 21.65 | 2.40% |

| CAT | Caterpillar Inc. | S | 8/27/2016 | $0.00 | $93.04 | N/A | 21.10 | 3.31% |

| CSCO | Cisco Systems, Inc. | D | 8/14/2016 | $37.53 | $30.23 | 80.55% | 16.52 | 2.94% |

| CVX | Chevron Corporation | S | 8/18/2016 | $0.00 | $116.84 | N/A | 24.97 | 3.66% |

| DD | E I Du Pont De Nemours And Co | E | 8/28/2016 | $36.35 | $73.38 | 201.87% | 22.30 | 2.07% |

| DIS | Walt Disney Co | S | 12/10/2015 | $157.29 | $108.98 | 69.29% | 23.54 | 1.26% |

| GE | General Electric Company | S | 7/21/2016 | $0.26 | $31.61 | 12157.69% | 35.52 | 2.91% |

| GS | Goldman Sachs Group Inc | S | 6/20/2016 | $174.21 | $244.90 | 140.58% | 18.11 | 1.06% |

| HD | Home Depot Inc | S | 11/10/2015 | $166.55 | $133.53 | 80.17% | 30.84 | 1.77% |

| IBM | International Business Machines Corp. | S | 11/10/2015 | $200.54 | $169.53 | 84.54% | 12.60 | 3.07% |

| INTC | Intel Corporation | D | 5/20/2016 | $26.44 | $36.48 | 137.97% | 16.97 | 2.69% |

| JNJ | Johnson & Johnson | E | 8/15/2016 | $105.21 | $116.30 | 110.54% | 21.15 | 2.62% |

| JPM | JPMorgan Chase & Co. | D | 7/24/2016 | $96.69 | $86.12 | 89.07% | 15.95 | 2.09% |

| KO | The Coca-Cola Co | S | 7/28/2016 | $10.76 | $41.74 | 387.92% | 23.45 | 3.21% |

| MCD | McDonald’s Corporation | S | 11/20/2016 | $49.98 | $120.76 | 241.62% | 23.63 | 2.95% |

| MMM | 3M Co | E | 12/13/2016 | $135.24 | $178.23 | 131.79% | 23.61 | 2.45% |

| MRK | Merck & Co., Inc. | E | 8/29/2016 | $26.80 | $60.27 | 224.89% | 24.70 | 3.04% |

| MSFT | Microsoft Corporation | E | 8/16/2016 | $18.92 | $62.84 | 332.14% | 27.32 | 2.21% |

| NKE | Nike Inc | E | 11/19/2016 | $59.52 | $53.91 | 90.57% | 27.09 | 1.19% |

| PFE | Pfizer Inc. | S | 8/16/2016 | $27.24 | $33.48 | 122.91% | 19.02 | 3.46% |

| PG | Procter & Gamble Co | S | 7/8/2016 | $17.20 | $85.03 | 494.36% | 24.72 | 3.12% |

| TRV | Travelers Companies Inc | D | 12/1/2016 | $320.65 | $118.27 | 36.88% | 11.98 | 1.65% |

| UNH | UnitedHealth Group Inc | S | 11/16/2015 | $130.87 | $162.41 | 124.10% | 28.39 | 1.23% |

| UTX | United Technologies Corporation | D | 5/18/2016 | $174.94 | $112.55 | 64.34% | 14.71 | 2.27% |

| V | Visa Inc | E | 6/26/2016 | $89.37 | $82.21 | 91.99% | 35.44 | 1.68% |

| VZ | Verizon Communications Inc. | S | 7/28/2016 | $124.10 | $53.26 | 42.92% | 16.54 | 4.24% |

| WMT | Wal-Mart Stores, Inc. | S | 5/20/2016 | $39.55 | $68.26 | 172.59% | 15.07 | 2.87% |

| XOM | Exxon Mobil Corporation | S | 8/18/2016 | $0.00 | $88.50 | N/A | 18.44 | 3.32% |

Disclaimer: The author did not hold a position in any company mentioned in this article at the time of publication and had no intention of changing that position within the next 72 ...

more

how did you get $WMT so low on price? it was on your Graham list D&E only recently... what changed? Conversely, how can you get a 320 price on $TRV? it has been downgraded due to valuation recently... cheers

I think you must have me confused with someone else. I've had the value listed for $WMT as the same since May 2016. Nothing has changed.

Please visit my site to learn more about how I got the price on $TRV. The link to the TRV valuation provides more detail.

$WMT is worth 39 a share? How did you get that?

thanks for sharing. Happy new year