Most Of The Major Asset Classes Rebounded Last Week

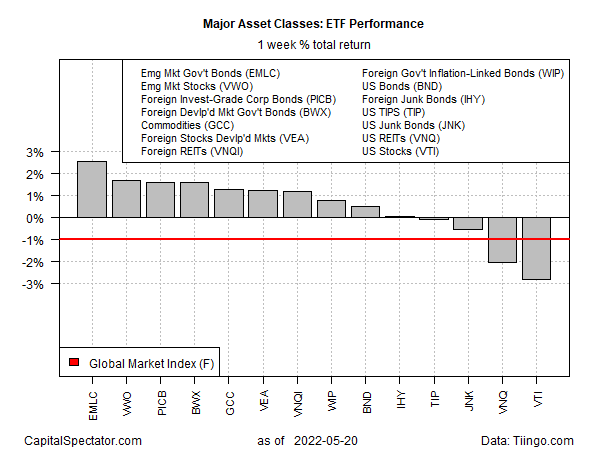

After weeks of widespread losses, markets around the world were mostly higher for the trading week through Friday, May 20, based on a set of ETFs. The main exceptions: stocks and real estate investment trusts in the US, which posted substantial weekly declines.

The strongest gain for the major asset classes last week: government bonds in emerging markets. After six straight weeks of loss, VanEck JP Morgan EM Local Currency Bond (EMLC) rose sharply, gaining 2.6%. Despite the upside reversal, it’s not obvious that the fund’s bearish trend has run its course, based on a price trend that still looks set for more downside risk.

Stocks in emerging markets were last week’s second-strongest gainer. Here, too, after six weeks of loss, Vanguard Emerging Markets Stock Index Fund (VWO) revived. But the 1.7% rise still looks like noise in an ongoing correction.

Emerging economies are headed for “tough terrain” in the near term because of blowback from the Russia-Ukraine war, predicts Atsi Sheth, global head of strategy and research for Moody’s Investors Service via Reuters, which reports: the Moody’s ratings agency “forecasts in a report that nearly 30% of rated non-financial companies in emerging markets would face ‘heightened credit risks’ in a worst-case scenario in which Russia’s invasion of Ukraine triggers a global recession and liquidity squeeze, including a suspension of energy trade between Europe and Russia.”

US stocks certainly endured rough terrain last week – again. Vanguard Total US Stock Market (VTI) shed 2.8% last week despite a heroic rally late in Friday’s session. The decline marks the seventh consecutive week of red ink for VTI.

US real estate fell nearly as much: Vanguard US Real Estate (VNQ) tumbled 2.0%, the fourth straight weekly slide.

The Global Market Index fell for a seventh week, shedding 1.0%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful benchmark for portfolio strategies overall.

For the one-year return, broadly defined commodities (GCC) are the only slice of the major asset classes with a positive change – by a huge margin: GCC is up nearly 30% over the past 12 months.

The biggest one-year loss for the major asset classes: foreign corporate bonds (PICB), which are down roughly 20%.

GMI.F’s one-year loss: -10.2%.

Drawdowns for the major asset classes range from moderate – roughly -7% for inflation-indexed Treasuries (TIP) – to steep: nearly -26% for emerging markets government bonds (EMLC).

GMI.F’s current drawdown: -16.6%.

Disclosures: None.