Most Markets Retreated Last Week

Nearly every slice of the major asset classes retreated in the trading week through Friday, Sep. 10, based on a set of ETFs. The upside exception: US inflation-indexed Treasuries.

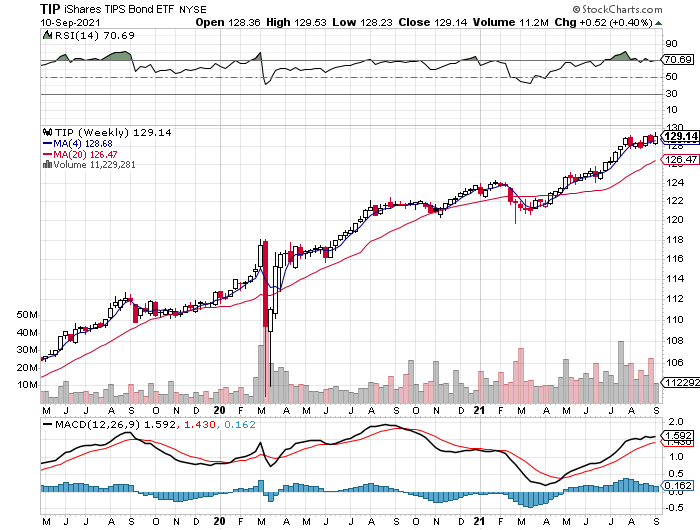

The iShares TIPS Bond ETF (TIP) rose 0.4% last week, providing a rare bit of upside action in an otherwise down week for markets around the world. Nonetheless, TIP appears to be churning in a range after a strong rise earlier in the year.

Otherwise, losses dominated. The biggest decline last week for the major asset classes: US real estate investment trusts (REITs). Vanguard Real Estate (VNQ) fell a hefty 4.1%, reversing the previous week’s surge.

A benchmark portfolio that holds all the major asset classes retreated last week. The Global Market Index (GMI.F) fell 1.3%, marking the first weekly decline in three weeks. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights via ETF proxies.

Reviewing asset classes via the one-year window continues to show US stocks in the lead. Vanguard Total US Stock Market (VTI) ended the week with a 38.1% total return.

VTI’s leading one-year performance is just slightly ahead of the 36.7% total return for Vanguard Real Estate (VNQ), the second-strongest gainer over the past 12 months.

The weakest one-year performance for the major asset classes: foreign government bonds in developed markets (in US dollar terms) via SPDR Bloomberg Barclays International Treasury Bond (BWX), which is down a fractional 0.3%.

GMI.F’s one-year performance: a strong 25.1%.

Looking at the major asset classes in terms of current drawdown continues to show most markets with little or no declines relative to the previous peaks. The main exceptions: commodities (GCC) and stocks and bonds in emerging markets (EMLC and VWO, respectively).

GMI.F’s current drawdown is a mild -1.3%.

Disclosures: None.