'Most Divided' Fed In 37 Years Cuts Rates; Restarts Balance Sheet Growth

Image source: Wikipedia

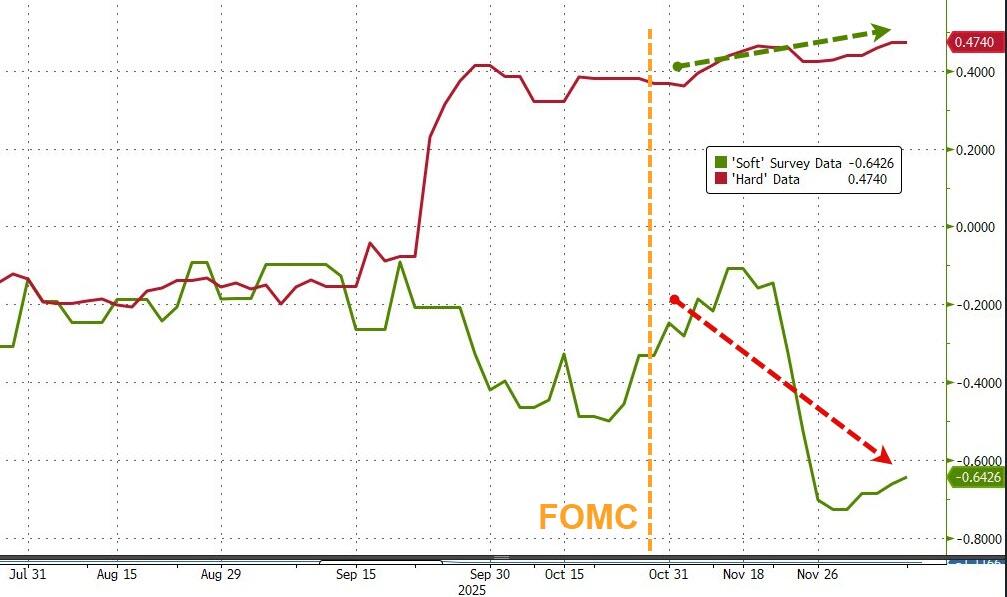

Since the last FOMC meeting (on October 29th), The Fed has largely been flying blind from a macro data perspective (thanks to the government shutdown) with the sporadic 'hard' data outperforming while 'soft' data has shit the bed and alternative labor market insights remain mixed at best (and extremely lagged at worst)...

Source: Bloomberg

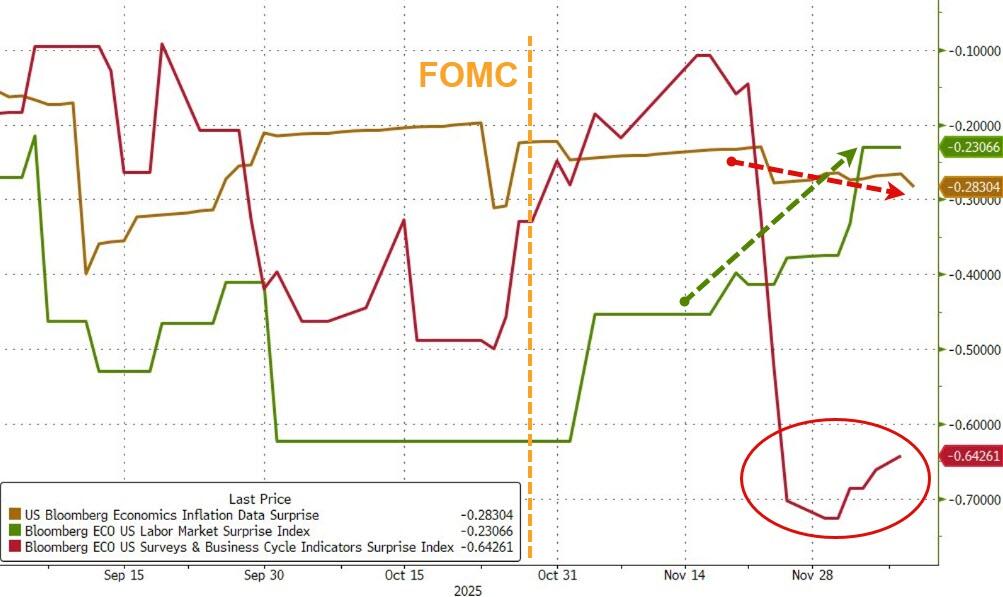

Interestingly, it is labor market data that has 'outperformed' since the last FOMC (so the hawks have a point) while surveys and inflation data has faded (doves can point to)...

Source: Bloomberg

Gold has been the biggest gainer since the last FOMC as bonds and crude oil plunged. Stocks and the dollar are basically unchanged...

Source: Bloomberg

Rate-cut odds have been jawboned wildly since the last FOMC, tumbling on Powell's hawkish bias (and plunging later on follow-on hawkish FedSpeak) only to surge back to a lock (100%) following Fed's Williams dovish comments right before the blackout began...

Source: Bloomberg

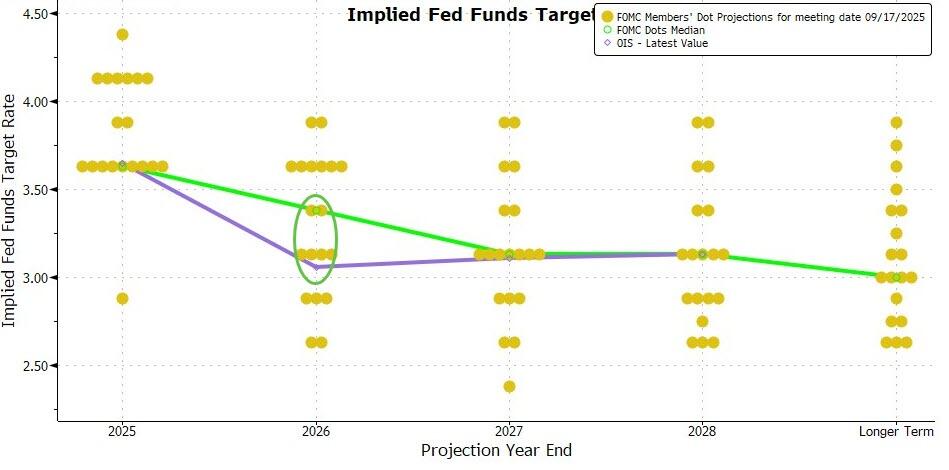

Today, we also get a fresh set of Dots, which many expect to shift more hawkishly. As the chart below shows, the market is already dramatically more dovish than the 'old' Dots...

Source: Bloomberg

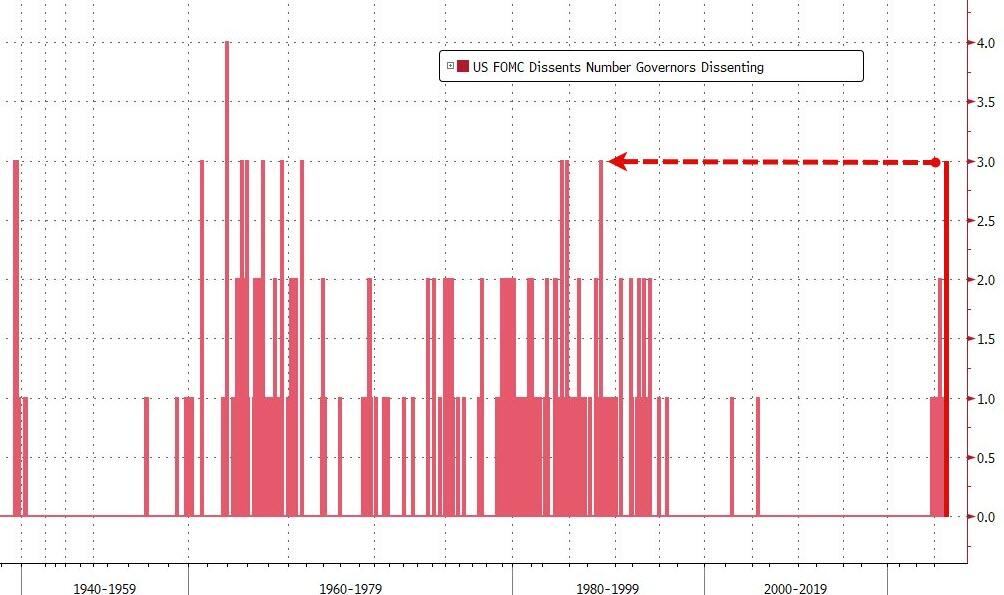

The number of dissents will be on many people's watchlist with WSJ's Fed Whsiperer, Nick Timiraos, noting that "as many as five of the 12 voting members of the Fed’s policy committee, and 10 of all 19 members, have signaled in speeches or public interviews that they didn’t see a strong case to cut. Of those, only one formally dissented from the central bank’s decision to cut rates in October."

Hey @AskPolymarket what are the odds December FOMC meeting will have 4 dissenters or more.

— zerohedge (@zerohedge) November 21, 2025

The market is expecting 3 or more dissents...

So, we have five things to watch in today's Fed discussions: Rate-change (cut is a done deal, but then what), Dissents (record split), Dots (hawkish bias), Balance Sheet (QE begins?), Presser (hawkish?).

FOMC

As was 100% expected, The Fed cut rates...

- *FED CUTS BENCHMARK RATE TARGET RANGE TO 3.5%-3.75% IN 9-3 VOTE

But, also - as expected - there were dissents... the most since 1988

- Fed Governor Stephen Miran voted against the decision in favor of lowering rates by a half-point, while Kansas City Fed President Jeff Schmid and Chicago Fed President Austan Goolsbee dissented in favor of holding rates steady

FORWARD GUIDANCE (flying blind?):

-

Fed to assess incoming data, evolving outlook and balance of risks in considering extent and timing of further adjustments

-

Fed says it will monitor implications of incoming information for economic outlook

-

Fed prepared to adjust policy stance if risks emerge impeding goal attainment

-

Fed assessments to consider labor market conditions, inflation pressures, inflation expectations, financial and international developments

LABOR MARKET

- Fed says job gains slowed and unemployment edged up through September

INFLATION

-

Fed says inflation moved up since earlier in year and remains somewhat elevated GDP GROWTH

-

Fed says economic activity expanding at a moderate pace

BALANCE OF RISKS

-

Fed says uncertainty about economic outlook remains elevated

-

Fed judges downside risks to employment rose in recent months

But the “Dot plot” of rate projections did not signal a much more hawkish trajectory:

The median official expected to lower rates by a quarter-point in 2026 and another quarter-point in 2027, the same as they projected in September

In fact, arguably 2026 dots show a very slight dovish tilt from September (with the number of Fed voters wanting no cuts or a hike down from 8 to 7...

BALANCE SHEET (full details here)

-

On December 10, 2025, the Federal Open Market Committee (FOMC) directed the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York to increase System Open Market Account (SOMA) securities holdings to maintain an ample level of reserves through purchases in the secondary market of Treasury bills (or, if needed, of Treasury securities with remaining maturities of 3 years or less).

-

These reserve management purchases (RMPs) will be sized to accommodate projected trend growth in the demand for Federal Reserve liabilities as well as seasonal fluctuations, such as those driven by tax payment dates.

-

Monthly amounts of RMPs will be announced on or around the ninth business day of each month alongside a tentative schedule of purchase operations for the subsequent approximately thirty days.

-

The Desk plans to release the first schedule on December 11, 2025, with a total amount of RMPs of approximately $40 billion in Treasury bills; purchases will start on December 12, 2025.

-

The Desk anticipates that the pace of RMPs will remain elevated for a few months to offset expected large increases in non-reserve liabilities in April. [ZH: and in May Powell is out and Trump replaces him with a dovish surrogate].

-

After that, the pace of total purchases will likely be significantly reduced in line with expected seasonal patterns in Federal Reserve liabilities. Purchase amounts will be adjusted as appropriate based on the outlook for reserve supply and market conditions.

-

The Desk was also directed in October to reinvest all principal payments from the Federal Reserve's holdings of agency securities into Treasury bills via secondary market purchases. The monthly schedule of planned purchases will include RMPs as well as these purchases.

-

The Desk plans to distribute the monthly secondary market purchases across two Treasury bill sectors. Purchase amounts in each sector will be determined by sector weights. These sector weights will be based on the 12-month average of the par amount of Treasury bills outstanding in each sector relative to the total amount outstanding across the two sectors as initially measured at the end of September 2025.

For the purists this is "Reserve Management Purchases", for the non-purists, QE is back with us.

SEP PROJECTIONS:

Fed Funds

- 2025: 3.625% (exp. 3.625%, prev. 3.625%)

- 2026: 3.375% (exp. 3.375%, prev. 3.375%)

- 2027: 3.125% (exp. 3.125%, prev. 3.125%)

- 2028: 3.125% (exp. 3.125%, prev. 3.125%)

- Longer run: 3.00% (exp. 3.125%, prev. 3.00%)

GDP Growth

- 2025:1.7% (exp. 1.8%, prev. 1.6%)

- 2026: 2.3% (exp. 1.8%, prev. 1.8%)

- 2027: 2.0% (exp. 1.9%, prev. 1.9%)

- 2028:1.9% (exp. 1.8%, prev. 1.8%)

- Longer run: 1.8% (exp. 1.8%, prev. 1.8%)

Unemployment rate

- 2025: 4.5% (exp. 4.5%, prev. 4.5%)

- 2026: 4.4% (exp. 4.5%, prev. 4.4%)

- 2027: 4.2% (exp. 4.4%, prev. 4.3%)

- 2028: 4.2% (exp. 4.2%, prev. 4.2%)

- Longer run: 4.2% (exp. 4.2%, prev. 4.2%)

PCE Inflation

- 2025: 2.9% (exp. 2.9%, prev. 3.0%)

- 2026: 2.4% (exp. 2.6%, prev. 2.6%)

- 2027: 2.1% (exp. 2.1%, prev. 2.1%)

- 2028: 2.0% (exp. 2.0%, prev. 2.0%)

- Longer run: 2.0% (exp. 2.0%, prev. 2.0%)

Core PCE Inflation

- 2025: 3.0% (exp. 3.0%, prev. 3.1%)

- 2026: 2.5% (exp. 2.6%, prev. 2.6%)

- 2027: 2.1% (exp. 2.2%, prev. 2.1%)

- 2028: 2.0% (exp. 2.1%, prev. 2.0%)

(Click on image to enlarge)

Finally, in a difference from the state of play into December 2024's hawkish cut, we note that equity positioning into the Fed looked skewed toward expectations for a benign or mildly hawkish cut that leaves the high-beta rotation intact, with the SPX still contained in a wider trading range.

Implied, realized and vol-of-vol are all back at more normal levels after November’s turbulence, while correlations and the tail-risk indexes sit in the middle or lower end of recent bands. The SPX term structure was in gentle backwardation into the FOMC, with forward implied vols pointing to only a modest post-meeting decline due to the importance of next week’s CPI and jobs report data.

SPX options are pricing a +/-0.7% move for FOMC day, largely in-line with expectations ahead of the past 8 FOMC events (+/-0.8%).

Will we get a surprise?

On average, the S&P 500 has moved +/-0.6% during the last 8 FOMC meetings with realized moves coming lower than expectations during all events except the December FOMC (hawkish cut) which saw an outsized move (-2.9%) relative to unusually low expectations (+/-0.7%).

Read the full red-line below...

More By This Author:

Intel Shares Fall After Lawsuits Claim US Chipmakers Aided Russian WeaponsOil Trading Giant Warns Of Looming "Super Glut" Due To Supply Surge

Exxon Jumps 4% After Company Boosts 2030 Cash-Flow Outlook

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more