Morning Call For Wednesday, Jan 10

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 -0.35%) this morning are down -0.40% as a surge in U.S. bond yields spurs long liquidation in stocks. The 10-year T-note yield jumped to a 9-3/4 month high of 2.59% after Chinese officials were said to recommend slowing or halting purchases of U.S. Treasuries. On the positive side is strength in energy stocks with Feb WTI crude oil (CLG18 +1.08%) up +0.94% at a new 3-year high. Crude oil is moving higher on signs of tighter supplies after the API reported late yesterday that U.S. crude inventories fell -11.2 million bbl last week. European stocks are down -0.44% as they follow U.S. equity markets lower. Asian stocks settled mixed: Japan -0.26%, Hong Kong +0.20%, China +0.23%, Taiwan -0.77%, Australia -0.64%, Singapore -0.12%, South Korea -0.80%, India -0.03%. Japanese stocks declined as exporters moved lower on reduced earnings prospects after USD/JPY tumbled -1.15% to a 1-1/4 month low. The yen surged on speculation the BOJ may be closer to ending its QE program after it cut its long-dated government bond purchases for the first time since 2016.

The dollar index (DXY00 -0.59%) is down -0.59%. EUR/USD (^EURUSD) is up +0.62%. USD/JPY (^USDJPY) is down -1.15% at a 1-1/4 month low.

Mar 10-year T-note prices (ZNH18 -0.20%) are down -10 ticks at a new contract low and the 10-year T-note yield jumped to a 9-3/4 month high of 2.59% on concern about Chinese demand for U.S. debt. T-notes declined after people familiar with the mater said officials reviewing China's foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries. China is the world's largest holder of U.S. Treasuries and holds the largest foreign-exchange reserves at $3.1 trillion.

UK Nov industrial production rose +0.4% m/m, right on expectations. Nov manufacturing production rose +0.4% m/m, stronger than expectations of +0.3% m/m.

China Dec CPI rose +1.8% y/y, weaker than expectations of +1.9% y/y. Dec PPI rose +4.9% y/y, stronger than expectations of +4.8% y/y.

U.S. STOCK PREVIEW

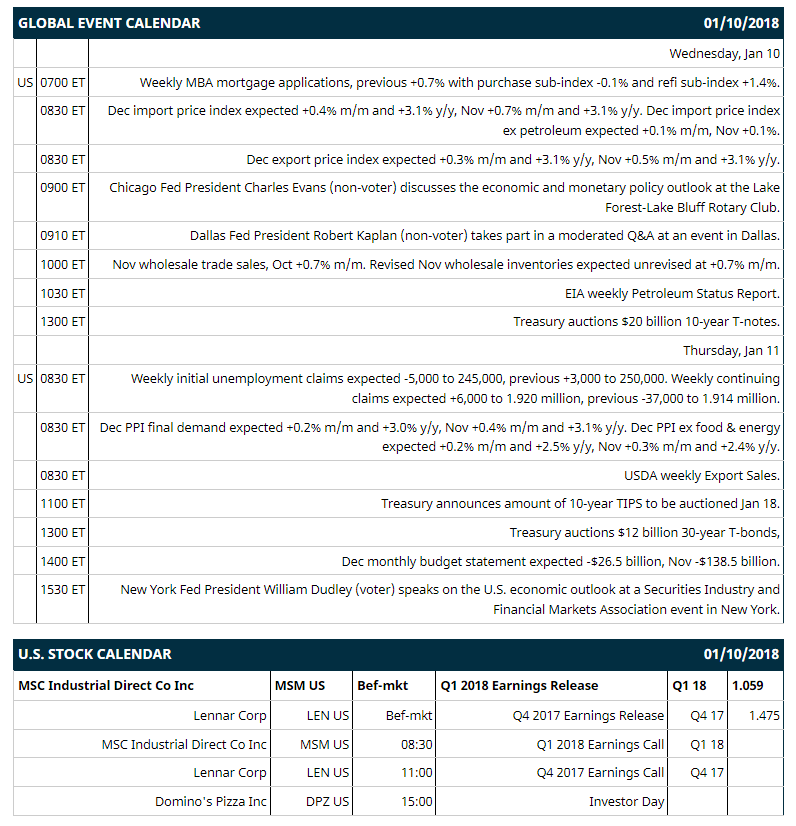

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +0.7% with purchase sub-index -0.1% and refi sub-index +1.4%), (2) Dec import price index (expected +0.4% m/m and +3.1% y/y, Nov +0.7% m/m and +3.1% y/y) and Dec import price index ex petroleum (expected +0.1% m/m, Nov +0.1%), (3) Chicago Fed President Charles Evans (non-voter) discusses the economic and monetary policy outlook at the Lake Forest-Lake Bluff Rotary Club, (4) Dallas Fed President Robert Kaplan (non-voter) takes part in a moderated Q&A at an event in Dallas, (5) Nov wholesale trade sales (Oct +0.7% m/m), (6) EIA weekly Petroleum Status Report, (7) Treasury auctions $20 billion 10-year T-notes.

Notable Russell 1000 earnings reports today include: Lennar (consensus $1.48), MSC Industrial Direct (1.06).

U.S. IPO's scheduled to price today: Muscle Maker (MMB).

Equity conferences this week: J.P. Morgan Health Care Conference on Mon-Thu, Citi Global TMT West Conference on Tue-Wed.

OVERNIGHT U.S. STOCK MOVERS

Hersey (HSY -0.25%) was downgraded to 'Underweight' from 'Equal-Weight' at Morgan Stanley with a price target of $105.

Deere & Co (DE +2.79%) was upgraded to 'Outperform' from 'Sector Perform' at RBC Capital Markets with a price target of $190.

Legg Mason (LM +1.04%) was downgraded to 'Hold' from 'Buy' at Jeffries.

Acuity Brands (AYI -14.96%) was downgraded to 'Hold' from 'Buy' at Williams Capital who cut their target price on the stock to $175 from $204.

United Continental Holdings (UAL -0.04%) gained 2% in after-hours trading after it said it saw Q4 consolidated PRASM unchanged, better than a prior view of down -1% to -3%, and it reported Q4 preliminary pre-tax margin as adjusted of 6%-7%, higher than prior view of 3%-5%.

WD-40 Co (WDFC -0.88%) rose 4% in after-hours trading after it said it sees full-year 2018 net income of $54.4 million to $55.3 million, better than consensus of $54 million.

Domino's Pizza (DPZ +1.52%) fell 2% in after-hours trading after CEO Patrick Doyle said he plans to leave the company in June and Richard Allison will take over as CEO effective July 1.

Ocean Rig UDW (ORIG -1.39%) rallied nearly 9% in after-hours trading after people familiar with the matter said the company was working with Credit Suisse Group AG to explore strategic options including a sale of the company.

Nordstrom (JWN -0.79%) lost 1% in after-hours trading after it said it sees 2017 full-year EPS of $2.90-$2.95, the mid-point below consensus of $2.94.

Patterson-UTI (PTEN -3.00%) was rated a new 'Overweight' at Stephens with a 12-month target price of $25.

Tivity Health (TVTY unch) jumped 10% in after-hours trading after Humana extended an existing partnership with the company through Dec 31, 2022.

Helios & Matheson Analytics (HMNY +3.47%) spiked over 7% in after-hours trading after CEO Ted Farnsworth said it would consider an initial coin offering as he commented with MoviePass CEO Mitch Lowe at the end of a Yahoo Finance interview.

AmTrust Financial Services (AFSI +0.10%) jumped over 20% in after-hours trading after Stone Point Capital Partners said it will buy the AmTrust shares not controlled by the Karfunkel-Zyskind family for $12.25 a share in cash.

Eastman Kodak (KODK +119.35%) soared over 30% in after-hours trading on top of the +119% surge in Tuesday's session after the company said it will launch some new blockchain-based rights-management service in which it will use a blockchain to track the online use of photographs licensed through its system.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 -0.35%) this morning are down -11.00 points (-0.40%). Tuesday's closes: S&P 500 +0.13%, Dow Jones +0.41%, Nasdaq +0.02%. The S&P 500 on Tuesday rallied to a fresh all-time high and closed higher on strength in energy stocks after crude oil prices rose +1.99% to a 3-year high. Stocks were also boosted by optimism about robust Q4 S&P 500 corporate earnings results that will begin to be reported later this week. Stocks were undercut by the unexpected -46,000 decline in U.S. Nov JOLTS job openings to a 6-month low of 5.879 million, weaker than expectations of +29,000 to 6.025 million.

Mar 10-year T-note prices (ZNH18 -0.20%) this morning are down -10 ticks at a fresh contract low. Tuesday's closes: TYH8 -14.00, FVH8 -4.75. Mar 10-year T-notes on Tuesday fell to a contract low and the 10-year T-note yield rose to a 9-3/4 month high. T-note prices were undercut by speculation the BOJ may be closer to ending QE after it cut its purchase of 10-year to 25-year Japanese government bonds by 10 billion yen ($89 million), the first cut since 2016. T-notes were also undercut by increased U.S. inflation expectations that are hawkish for Fed policy after the 10-year T-note breakeven inflation rate rose to 9-3/4 month high.

The dollar index (DXY00 -0.59%) this morning is down -0.544 (-0.59%). EUR/USD (^EURUSD) is up +0.0074 (+0.62%) and USD/JPY (^USDJPY) is down -1.30 (-1.15%) at a 1-1/4 month low. Tuesday's closes: Dollar Index +0.170 (+0.18%), EUR/USD -0.0030 (-0.25%), USD/JPY -0.44 (-0.39%). The dollar index on Tuesday climbed to a 1-week high and closed higher on improved interest rate differentials for the dollar after the 10-year T-note yield rose to a 9-3/4 month high. The dollar was also boosted by an increase in inflation expectations that bolsters the case for additional Fed rate hikes after the 10-year T-note breakeven inflation rate jumped to 9-3/4 month high.

Feb crude oil (CLG18 +1.08%) this morning is up +59 cents (+0.94%) at a new 3-year high and Feb gasoline (RBG18 +0.77%) is +0.0118 (+0.64%) at a new 4-1/4 month high. Tuesday's closes: Feb WTI crude +1.23 (+1.99%), Feb gasoline +0.0444 (+2.48%). Feb crude oil and gasoline on Tuesday closed higher with Feb crude at a 3-year nearest-futures high and Feb gasoline at a 4-1/4 month high. Crude oil prices were boosted by expectations for Wednesday's EIA crude inventories to fall by -3.75 million bbl, the eighth consecutive weekly decline, and by expectations that Wednesday's EIA data will show crude supplies at Cushing, the delivery point for WTI futures, will decline by -1.5 million bbl to a 2-3/4 year low.

Metals prices this morning are higher with Feb gold (GCG18 +0.80%) +11.5 (+0.88%), Mar silver (SIH18 +0.94%) +0.175 (+1.03%), and Mar copper (HGH18 +1.35%) +0.053 (+1.63%). Tuesday's closes: Feb gold -6.7 (-0.51%), Mar silver -0.134 (-0.78%), Mar copper -0.0080 (-0.25%). Metals on Tuesday closed lower with Mar silver at a 1-week low and Mar copper at a 2-week low. Metals prices were undercut by a rally in the dollar index to a 1-week high and by speculation the BOJ may be closer to ending QE after it cut the size of its long-dated government bond purchases for the first time since 2016.

(Click on image to enlarge)

Disclosure: None.