Morning Call For February 5, 2016

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH16 +0.07%) are up +0.16% and European stocks are up +0.32% ahead of the monthly U.S. payrolls report. Equity prices have been tracking crude oil prices for direction and Mar WTI crude (CLH16 +1.23%) is up +1.29%. Gains in European stocks were limited after German Dec factory orders declined more than expected. Asian stocks settled mixed: Japan -1.32%, Hong Kong +0.55%, China -0.63%, Taiwan closed for holiday, Australia -0.08%, Singapore +2.53%, South Korea +0.17%, India +1.14%. Japan's Nikkei Stock Index fell to a 2-week low as bank stocks fell after Citigroup cut its ratings on Japan's three biggest lenders by assets. Also, exporters moved lower after the yen slid to a 2-week low against the dollar and undercut the earnings prospects of Japanese exporters.

The dollar index (DXY00 +0.17%) is up +0.19%. EUR/USD (^EURUSD) is down -0.12%. USD/JPY (^USDJPY) is up +0.06%.

Mar T-note prices (ZNH16 +0.17%) are up +5 ticks.

German Dec factory orders fell -0.7% m/m and -2.7% y/y, weaker than expectations of -0.5% m/m and -1.4% y/y, with the -2.7% y/y drop the biggest annual decline in 3-1/4 years.

U.S. STOCK PREVIEW

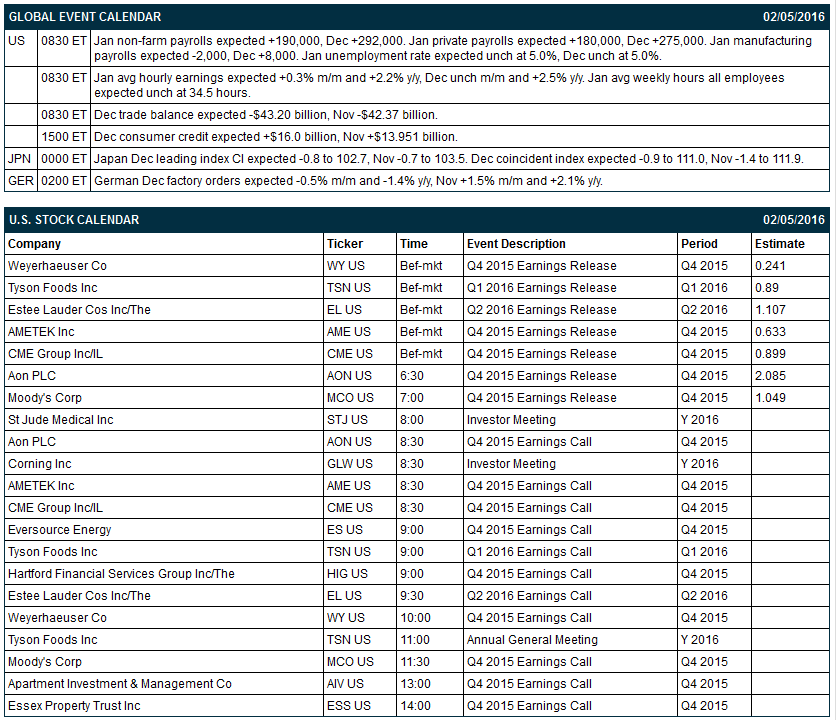

Key U.S. news today includes: (1) Jan non-farm payrolls (expected +190,000, Dec +292,000) and Jan unemployment rate (expected unch at 5.0%, Dec unch at 5.0%), (2) Dec trade balance (expected -$43.20 billion, Nov -$42.37 billion), and (3) Dec consumer credit (expected +$16.0 billion, Nov +$13.951 billion).

There are 7 of the S&P 500 companies that report earnings today: Tyson Foods (consensus $0.89), Weyerhaeuser (0.24), Estee Lauder (1.11), AMETEK (0.63), CME Group (0.90), Aon (2.09), Moody's (1.05).

U.S. IPO's scheduled to price today: none.

Equity conferences today include: none.

OVERNIGHT U.S. STOCK MOVERS

Symantec (SYMC -0.52%) jumped over 9% in pre-market trading after it reported Q3 adjusted EPS of 26 cents, better than consensus of 24 cents, and said it received a $500 million investment from Silver Lake Management LLC.

Aon PLC (AON +1.38%) reported Q4 EPS of $2.27, higher than consensus of $2.09.

CME Grup (CME -3.43%) reported Q4 EPS of 92 cents, higher than consensus of 90 cents.

LinkedIn (LNKD +0.54%) plummeted over 25% in pre-market trading after it lowered guidance on Q1 adjusted EPS to 55 cents, well below consensus of 75 cents, and forecast fiscal 2016 revenue of $3.6 billion-$3.65 billion, below consensus of $3.90 billion.

Hartford Financial Services Group (HIG +2.21%) climbed over 7% in after-hours trading after it reported Q4 core EPS of $1.07, better than consensus of 98 cents.

Amgen (AMGN -0.52%) gained nearly 1% in after-hours trading after it said its Blincyto showed improved overall survival in a Phase 3 Tower study in treatment of B-cell precursor acute lymphoblastic leukemia.

Qorvo (QRVO +4.64%) rose +0.5% in after-hours trading after it reported Q3 adjusted EPS of $1.03, higher than consensus of 95 cents.

Lions Gate Entertainment (LGF -0.70%) declined over 5% in after-hours trading after it reported Q3 adjusted EPS of 42 cents, below consensus of 51 cents.

Post Holdings (POST +1.07%) climbed nearly 6% in after-hours trading after it reported Q1 adjusted EPS of 52 cents, well above consensus of 32 cents.

Hanesbrands (HBI -3.48%) slid over 12% in after-hours trading after it reported Q4 EPS of 30 cents, below consensus of 34 cents, and said it sees 2016 net sales of $5.8 billion-$5.9 billion, weaker than consensus of $6.03 billion.

Ubiquiti Networks (UBNT -0.57%) jumped over 15% in after-hours trading after it reported Q2 adjusted EPS of 58 cents, stronger than consensus of 51 cents, and then raised guidance on Q3 adjusted EPS to 53 cents-60 cents, higher than consensus of 51 cents.

Deckers Outdoor (DECK -2.65%) fell 10% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to $4.49 from a prior view of $5.18, below consensus of $4.75.

Multi-Fineline Electronix (MFLX -3.41%) surged over 40% in after-hours trading after Suzhou Dongshan acquired the company for $23.95 a share, a 41% premium to Thursday's close.

Tableau Software (DATA +2.69%) plunged over 40% in pre-market trading after it reported Q4 license revenue of $133.1 million, less than expectations of $135 million.

MARKET COMMENTS

Mar E-mini S&Ps (ESH16 +0.07%) this morning are up +3.00 points (+0.16%). Thursday's closes: S&P 500 +0.15%, Dow Jones +0.49%, Nasdaq -0.10%. The S&P 500 on Thursday closed higher on strength in mining and raw-material producing stocks as a fall in the dollar index to a 3-1/4 month low boosted commodity prices. Stocks also received a boost from transportation stocks as Ryder System closed up by more than +9% and Union Pacific and Kansas City Southern both closed both up by more than +4%. Stocks prices were undercut by -3.0% decline in U.S. Q4 non-farm productivity (a bigger drop than expectations of -2.0% and the most since Q1-2014) and by the -2.9% fall in U.S. Dec factory orders, a bigger drop than expectations of -2.8% and the largest decline in a year.

Mar 10-year T-notes (ZNH16 +0.17%) this morning are up +5 ticks. Thursday's closes: TYH6 +8.00, FVH6 +3.75. Mar T-notes on Thursday closed higher on the larger-than-expected increase in U.S. weekly initial unemployment claims and the bigger-than-expected decline in U.S. Dec factory orders. T-notes were undercut by news that U.S. Q4 unit labor costs rose sharply +4.5%, which is negative for inflation.

The dollar index (DXY00 +0.17%) this morning is up +0.184 (+0.19%). EUR/USD (^EURUSD) is down -0.0013 (-0.12%). USD/JPY (^USDJPY) is up +0.07 (+0.06%). Thursday's closes: Dollar Index -0.711 (-0.73%), EUR/USD +0.0104 (+0.94%), USD/JPY -1.12 (-0.95%). The dollar index on Thursday tumbled to a 3-1/4 month low and closed lower on concern that U.S. economic weakness will keep the Fed from raising interest rates anytime soon after U.S. Dec factory orders fell -2.9%, the biggest decline in a year.

Mar crude oil (CLH16 +1.23%) this morning is up +41 cents (+1.29%) and Mar gasoline (RBH16 +0.18%) is up +0.0020 (+0.19%). Thursday's closes: CLH6 -0.56 (-1.73%), RBH6 +0.0147 (+1.45%). Mar crude oil and gasoline on Thursday settled mixed. Crude oil prices were undercut by negative carryover from Wednesday's EIA data that showed a +7.79 million bbl surge in EIA crude inventories to a record high of 502.7 million bbl. Crude oil prices were supported by the fall in the dollar index to a 3-1/4 month low, which spurred short-covering in energy futures.

(Click on image to enlarge)

Disclosure: None.