Morning Call For Aug. 22, 2014

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU14 -0.10%) this morning are down -0.11% and European stocks are down -0.90% as investors lighten up positions ahead of speeches later today from Fed Chair Yellen and ECB President Draghi at the Fed's annual symposium in Jackson Hole, Wyoming. Stocks were also pressured on heightened tensions in Ukraine after Interfax reported that Ukraine sees a Russian aid convoy into the eastern part of its country as an invasion. The head of Ukraine's Security Council says that Russia is invading under cover of the Red Cross and that insurgents will use trucks now carrying humanitarian aid to transport weaponry. Asian stocks closed mostly higher: Japan -0.30%, Hong Kong +0.47%, China +0.47%, Taiwan +1.37%, Australia +0.12%, Singapore +0.04%, South Korea +0.66%, India +0.23%. Commodity prices are mixed. Oct crude oil (CLV14 -0.30%) is down -0.37%. Oct gasoline (RBV14 -0.02%) is down -0.08%. Dec gold (GCZ14 +0.46%) is up +0.50%. Sep copper (HGU14 +0.72%) is up +0.76% at a 1-1/2 week high on signs of tighter global supplies after weekly Shanghai copper inventories tumbled -10,297 MT to a 6-week low. Agriculture and livestock prices are higher. The dollar index (DXY00 +0.06%) is up +0.06%. EUR/USD (^EURUSD) is down -0.08%. USD/JPY (^USDJPY) is down-0.14%. Sep T-note prices (ZNU14 +0.09%) are up +4 ticks.

Weekly data shows the ECB's balance sheet fell to 2.02 trillion euros in the week ended Aug 15 from 2.03 trillion euros the previous week, the smallest in 3 years. ECB balance sheet lending to Eurozone credit institutions fell to 501 billion euros in the week ended Aug 15 from 504.9 billion euros the prior week, the lowest since Jul 2011.

The ECB's current account holdings fell to 211.2 billion euros on Thursday versus 221.4 billion euros on Wednesday, the lowest in 2 weeks. Excess liquidity (calculated as current account holdings plus deposit facility minus average reserve requirements) fell to 129.5 billion euros on Thursday versus 134.5 billion euros on Wednesday, the lowest since Aug 6.

U.S. STOCK PREVIEW

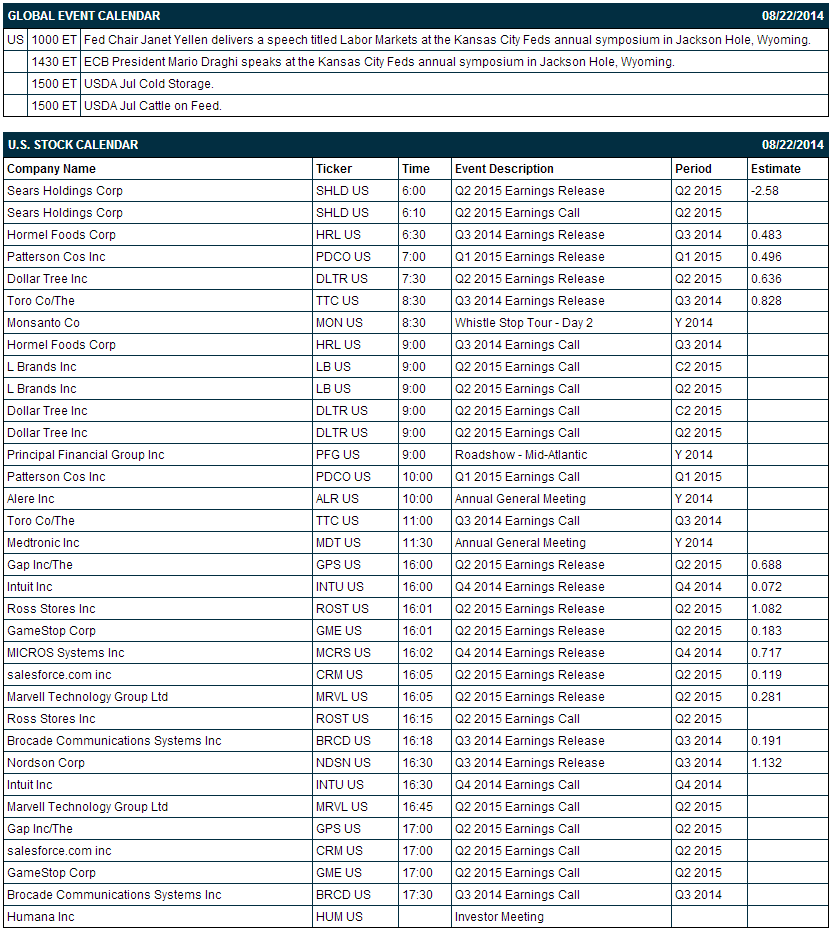

At today's Kansas City Fed conference in Jackson Hole, Fed Chair Janet Yellen at 10 AM ET will deliver a speech titled “Labor Markets." ECB President Mario Draghi will then deliver a speech at 4:30 ET. There is one Russell 1000 company that reports earnings today: Foot Locker (consensus $0.54). There are no equity conferences today.

OVERNIGHT U.S. STOCK MOVERS

PG&E (PCG +0.02%) was downgraded to 'Hold' from 'Buy' at Argus.

Ann Inc. (ANN +0.54%) reported Q2 EPS of 70 cents, better than consensus of 68 cents.

Foot Locker (FL +0.27%) reported Q2 adjusted EPS of 64 cents, well ahead of consensus of 54 cents.

Nordson (NDSN +0.09%) reported Q3 EPS of $1.21, stronger than consensus of $1.13.

Scansource (SCSC +2.53%) reported Q4 adjusted EPS of 60 cents, better than consensus of 59 cents.

The Fresh Market (TFM -1.68%) rose nearly 5% in after-hours trading after it reported Q2 adjusted EPS of 36 cents, better than consensus of 35 cents.

Marvell (MRVL +0.74%) reported Q2 EPS of 34 cents, well above consensus of 28 cents.

Ross Stores (ROST -0.89%) climbed over 5% in pre-market trading after it reported Q2 EPS of $1.14, higher than consensus of $1.08.

Aeropostale (ARO unch) reported a Q2 EPS ex-charges loss of -46 cents, a smaller loss than consensus of -49 cents.

Salesforce.com (CRM +0.58%) reported Q2 adjusted EPS of 13 cents, higher than consensus of 12 cents.

Brocade (BRCD +0.64%) reported Q3 EPS of 23 cents, better than consensus of 19 cents.

GameStop (GME -2.03%) jumped 10% in after-hours trading after it reported Q2 EPS of 22 cents, higher than consensus of 18 cents.

Intuit (INTU +0.63%) reported an unexpected Q4 adjusted EPS loss of -1 cent, much weaker than consensus of a 7 cent profit, and then lowered guidance on fiscal 2015 EPS to $2.45-$2.50, well below consensus of $3.97.

The Gap (GPS +0.16%) reported Q2 EPS of 75 cents, stronger than consensus of 69 cents, and then raised guidance on fiscal 2014 EPS view to $2.95-$3.00, above consensus of $2.95.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 -0.10%) this morning are down -2.25 points (-0.11%). The S&P 500 index on Thursday posted a record high and closed higher: S&P 500 +0.29%, Dow Jones +0.36%, Nasdaq +0.16%. Bullish factors for stocks included (1) the -14,000 fall in weekly jobless claims, more than expectations of -8,000, (2) the unexpected +2.4% increase in Jul existing home sales to a 10-month high of 5.15 million, better than expectations of -0.5% to 5.02 million, and (3) the +4.1 increase in the Aug Philadelphia Fed manufacturing index to a 3-1/3 year high of 28.0, stronger than expectations of a -4.2 decline to 19.7.

Sep 10-year T-notes (ZNU14 +0.09%) this morning are up +4 ticks. Sep 10-year T-note futures prices on Thursday fell to a 1-week low, but recovered and closed higher. Bearish factors for T-notes included (1) stronger than expected U.S. economic data on weekly jobless claims, Jul existing home sales and Aug Philadelphia Fed manufacturing activity, and (2) reduced safe-haven demand after the S&P 500 rose to a record high. T-notes recovered and closed higher on short-covering ahead of an expected dovish speech by Fed Chair Yellen on Friday. Closes: TYU4 +3.0, FVU4 +1.0.

The dollar index (DXY00 +0.06%) this morning isup +0.049 (+0.06%). EUR/USD (^EURUSD) is down -0.0011 (-0.08%) and USD/JPY (^USDJPY) is down -0.15 (-0.14%). The dollar index on Thursday posted an 11-1/2 month high, but gave up its advance and closed lower. Negative factors included (1) reduced safe-haven demand for the dollar after the S&P 500 rallied to a new record high, and (2) long liquidation and profit-taking ahead of Fed Chair Yellen’s speech Friday at the Fed’s annual symposium in Jackson Hole, Wyoming. Closes: Dollar index -0.072 (-0.09%), EUR/USD +0.00216 (+0.16%), USD/JPY +0.088 (+0.08%).

Oct WTI crude oil (CLV14 -0.30%) this morning is down -35 cents (-0.37%) and Oct gasoline (RBV14 -0.02%) is down -0.0022 (-0.08%). Oct crude and gasoline prices on Thursday shook off early losses and closed higher: CLV4 +0.51 (+0.55%), RBV4 +0.0291 (+1.13%). Oct crude rebounded from a 7-1/4 month low on bullish factors that included (1) weakness in the dollar, and (2) U.S. economic strength after Jul existing home sales unexpectedly rose to a 10-month high and the Aug Philadelphia Fed manufacturing index unexpectedly rose to a 3-1/3 year high.

Disclosure: None