More Extraordinary Still

There were rumors and whispers of a trade truce between China and the US. Wages domestically grew by the most since 2009, better than 3% last month. OPEC is going to be cutting oil production again. And most of all, for the mainstream narrative anyway, the Fed is about to go on a break.

Why didn’t markets react positively to all the good news?

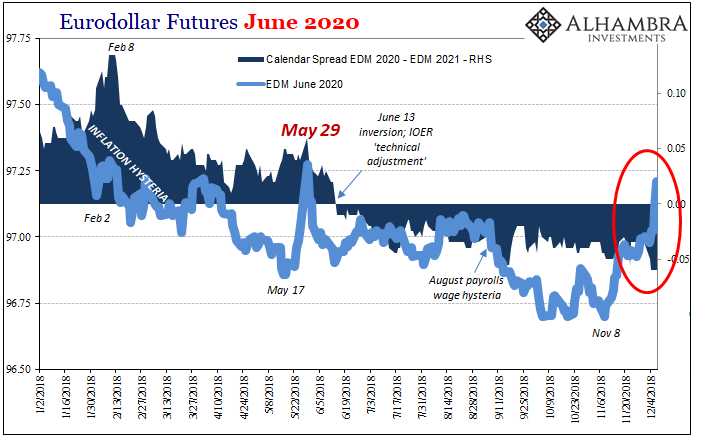

The last couple of days have been money crazy. Start with eurodollar futures. The so-called Fed pause is pretty obvious:

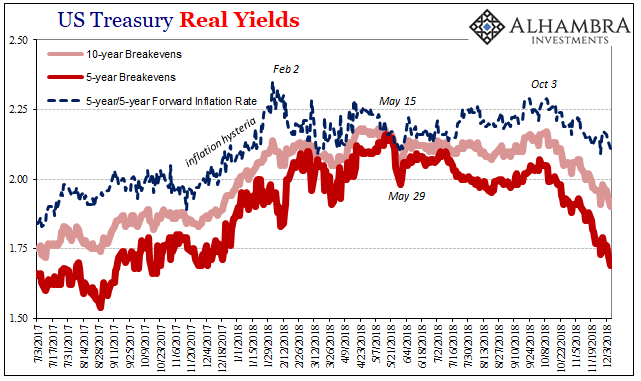

Prices have been bid over the last three days like we haven’t seen since the last couple of weeks in May leading up to May 29. That means expectations for lower overall interest rates in the near-term years ahead, starting in 2019 (where the inversion begins). But as predicted rates seem lower (higher futures prices) the curve has inverted even more right in this space.

In other words, the market is saying that not only is Powell more likely to be wrong (about inflation and economic acceleration) the more he confirms these concerns the greater the probability they turn out even more significant than they seemed yesterday. If the Fed Chair of all people can see it, then it really can’t be good.

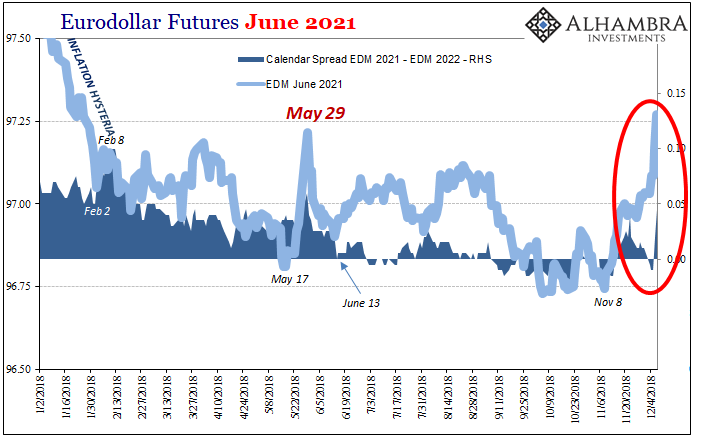

Ironically, that’s what the curve is saying a little further out to 2022. The 2021 to 2022 calendar spread had been negative (inverted), too, but over the last two days, it has really steepened as investors pile on the Fed pause. It’s not a positive sign at all, not with the 2020 to 2021 spread more deeply negative alongside.

This suggests the market is zeroing in on downside risks and they aren’t as distant or fuzzy as perhaps banks (that’s who is in this market) were thinking before. The problems, or, more accurately, the consequences of economic and monetary destabilization, are being judged closer to now (and more likely) than they were over the past few months.

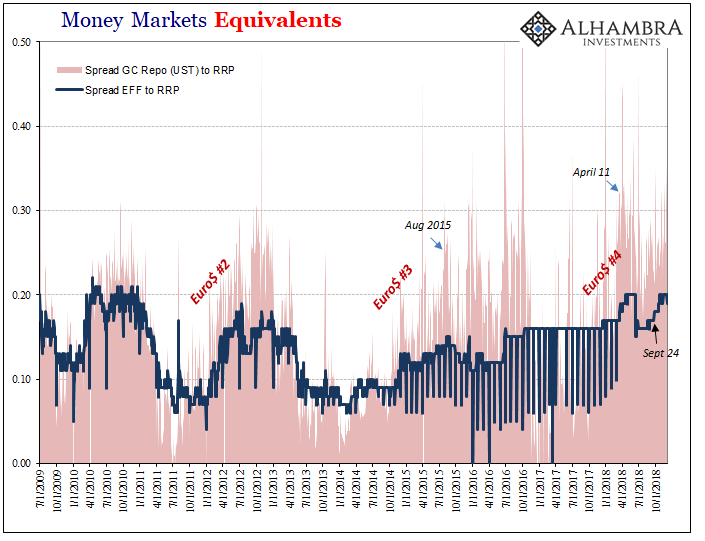

This is why during a week when the Fed’s display of confusion hit the tape across-the-board money rates more broadly rose. If there are fewer perhaps not even any more “rate hikes” in the near term, why does LIBOR keep going up? What has the GC repo (on any collateral) rate jumping through the roof?

It’s not Jay Powell and “rate hikes”, prospective and those already done, that is choking off liquidity in the global system. Agreeing with the FOMC for once, there’s no sign of QT, either. That’s the asymmetry and often the upside-down nature of the current arrangement for monetary policy and central banks. Powell almost has to keep raising RRP and IOER else he signals just how bad things really are – and then rates really go up.

Together, LIBOR, TED, repo, etc., all propose greater illiquidity as well as, obviously, liquidity risks. Sounds about right especially this week. Just like July 2006 to September 2007, a Fed pause isn’t going to help.

If this reversal of mainstream fortunes seems awfully quick, it hasn’t been. Most people have been unaware of all these things going on for months already. It’s only UST curve inversion that has anyone paying attention. We’ve now got 2s5s at -2 bps (inverted), also pretty much aligned with the spreading chaos indicated across money markets.

The direction everything is now taking is pretty obvious, thus, Powell’s sudden “dovish” turn. When it’s this obvious it’s more difficult for central bankers to remain in denial especially being worried they could be blamed (the real difference between now and 2014-16).

That goes for those policymakers residing elsewhere, too. The PBOC, for one, has made it plain (by action rather than words and statements) it won’t readily tolerate CNY below 7.0. They’ve carved out a cushion at ~6.96 which over the past few months has held up – but not without detection.

If you look close enough you can see it as plain as day:

For two straight months “something” has pushed CNY upward at the beginning of each calendar turn. The one in December was pretty substantial but doesn’t seem to have helped much anywhere globally (like the Fed, the PBOC’s big fat footprints can have a reverse effect).

Desperation is not going to contribute much to global monetary stability. China or not, things turned sour for India, too, in December. After having a very tough September leading to a whole bunch of white-knuckle days in October, the pressure was off for a while. Some of that was oil’s collapse which helps India by reducing its dollar funding requirements.

But at the start of this month INR which had been on a good run inverse to global crude benchmarks turned around right in time for December’s global eurodollar crazy. State intervention with IL&FS, India’s big shadow eurodollar conduit rescued in October, wasn’t the full extent of that country’s funding issues.

Thus, it might be time for Urjit Patel to write another op-ed in the Financial Times chastising US monetary officials, though for what? The Fed’s going to pause, everyone thinks, so what can Patel blame Powell for now? I wrote back in June how they always have it all backwards:

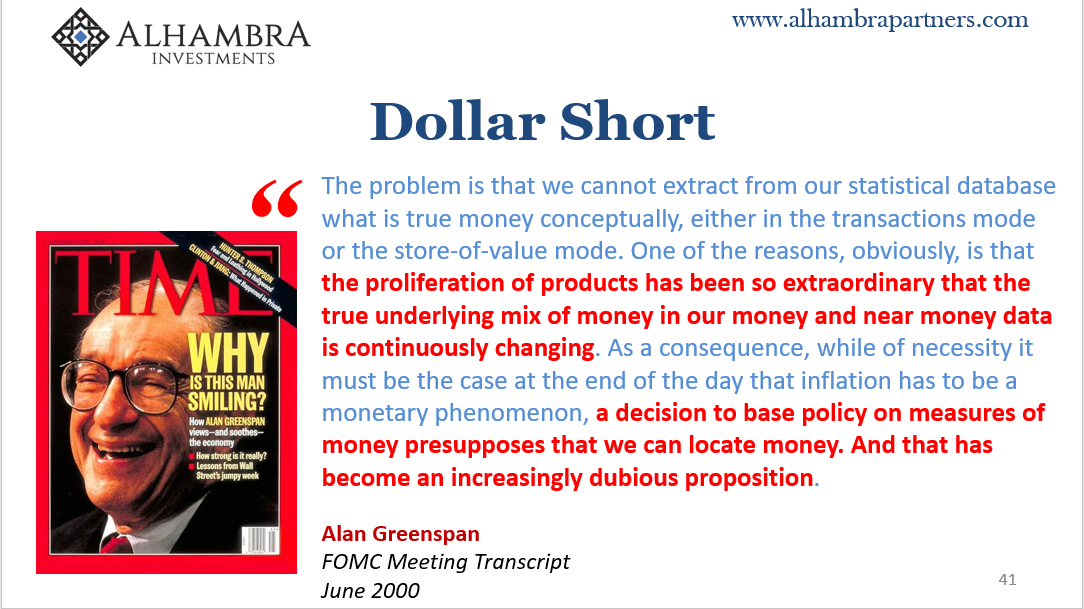

Even as Greenspan’s Fed raised the federal funds rate during the middle 2000’s, there was no slowing the monetary factory system. In fact, during those RHINO’s the global banking system actually kicked it up a notch or two more. The “weak dollar” continued without fail until Bear Stearns nearly did.

In trying to explain what has been going on this year, central bankers all over the world have put forth a lot of ridiculous ideas to avoid the main issue. That isn’t bank reserves, though they all seem to think it is (it’s not hard to imagine why central bankers would think this way; would only think this way). Our own FOMC tried to blame T-bills for the recent bout in LIBOR…

I can understand Dr. Patel’s emotional position. The Indian economy is, out of all the EM’s, particularly well positioned as of right now. If there is one place you would not expect the looming outlines of currency problems, it is India. Despite that, the rupee has been sucked into the “dollar” vortex anyway. That fact alone describes extraordinary circumstances, not the simple crowding out inside of a fixed system.

The closer we get to the end of 2018, the more extraordinary the circumstances. That’s about the only thing that is perfectly clear. I’ll write it again (and again and again); they really don’t know what they are doing. In the big picture observing it all far above these nitty gritty details, that’s really all this is.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more