Money Supply Shrinks In 2022 For The First Time On Record

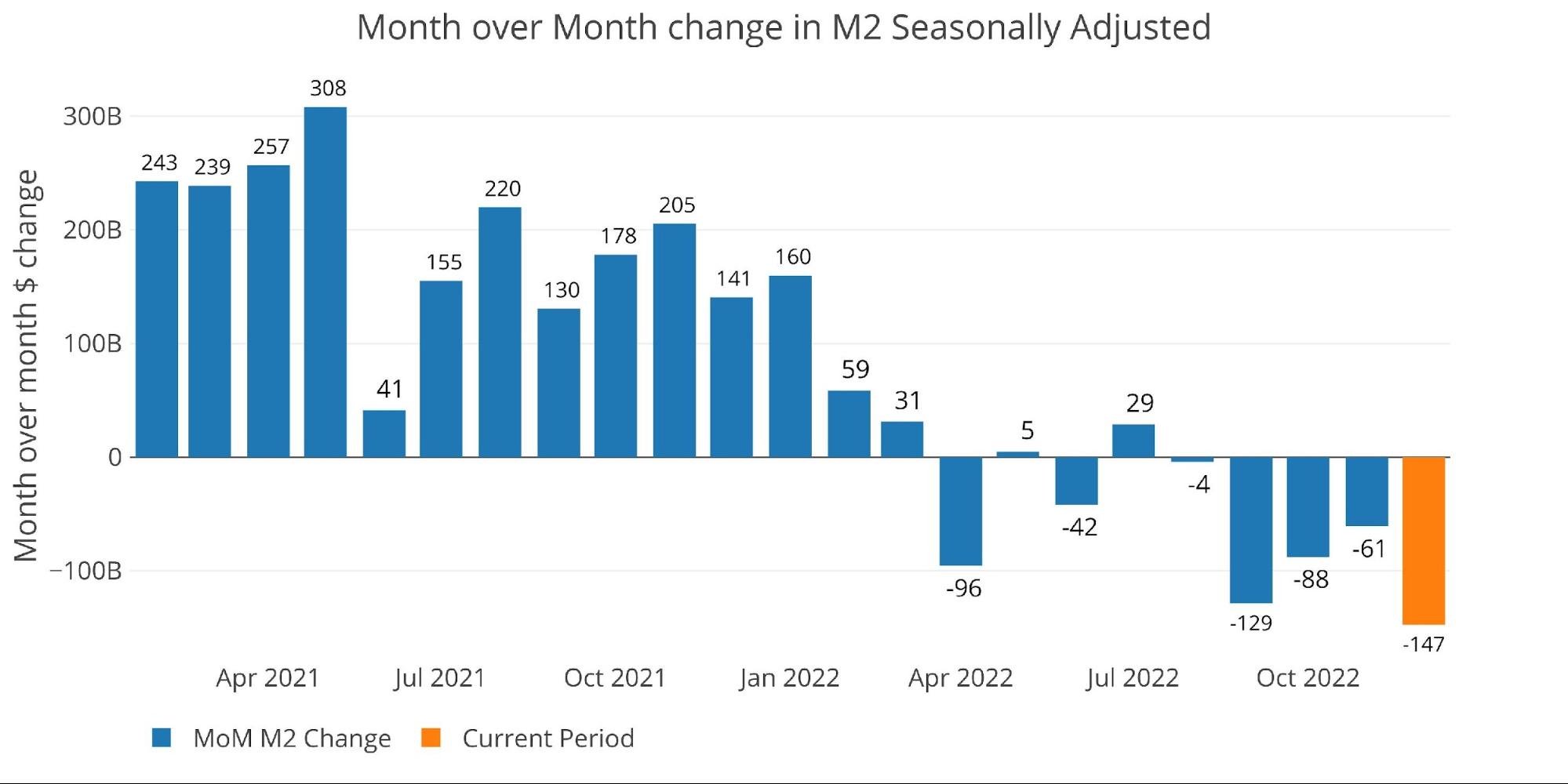

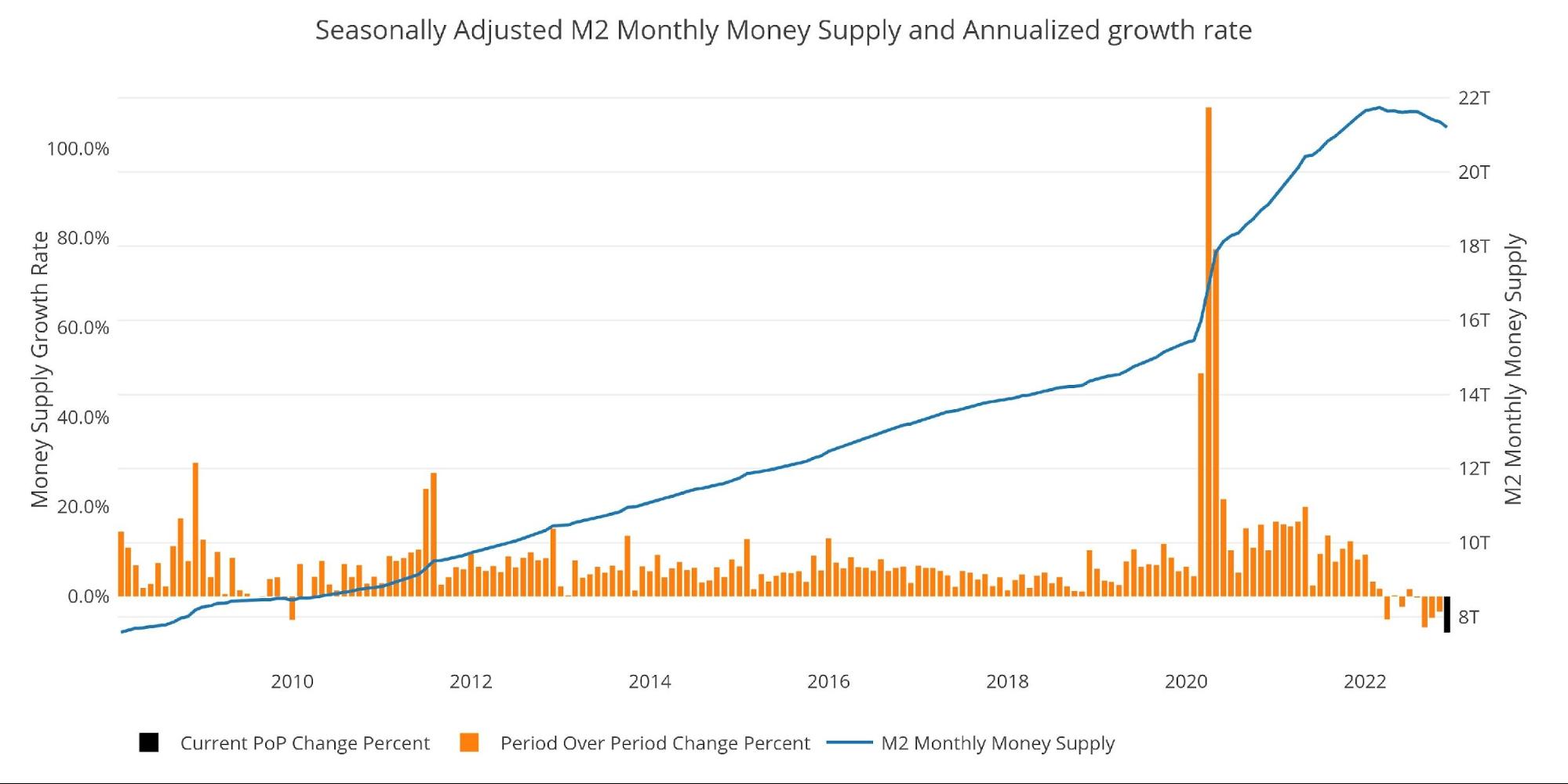

Seasonally Adjusted Money Supply in December was negative for a fifth consecutive month, coming in at -$147B. This is the largest monthly contraction in M2 going back to 1959. This type of contraction does not happen!

On an absolute basis, the 6 largest contractions in Money Supply all occurred in 2022. On a percentage basis, December 2022 is still the largest contraction ever, followed by September 2022 and then February 1970! On a percentage basis, 2022 owns 5 of the top 10 largest monthly contractions on record. The other 5 months occurred in 1970, 1994, 2000, 2003, and 2010.

(Click on images to enlarge)

Figure: 1 MoM M2 Change (Seasonally Adjusted)

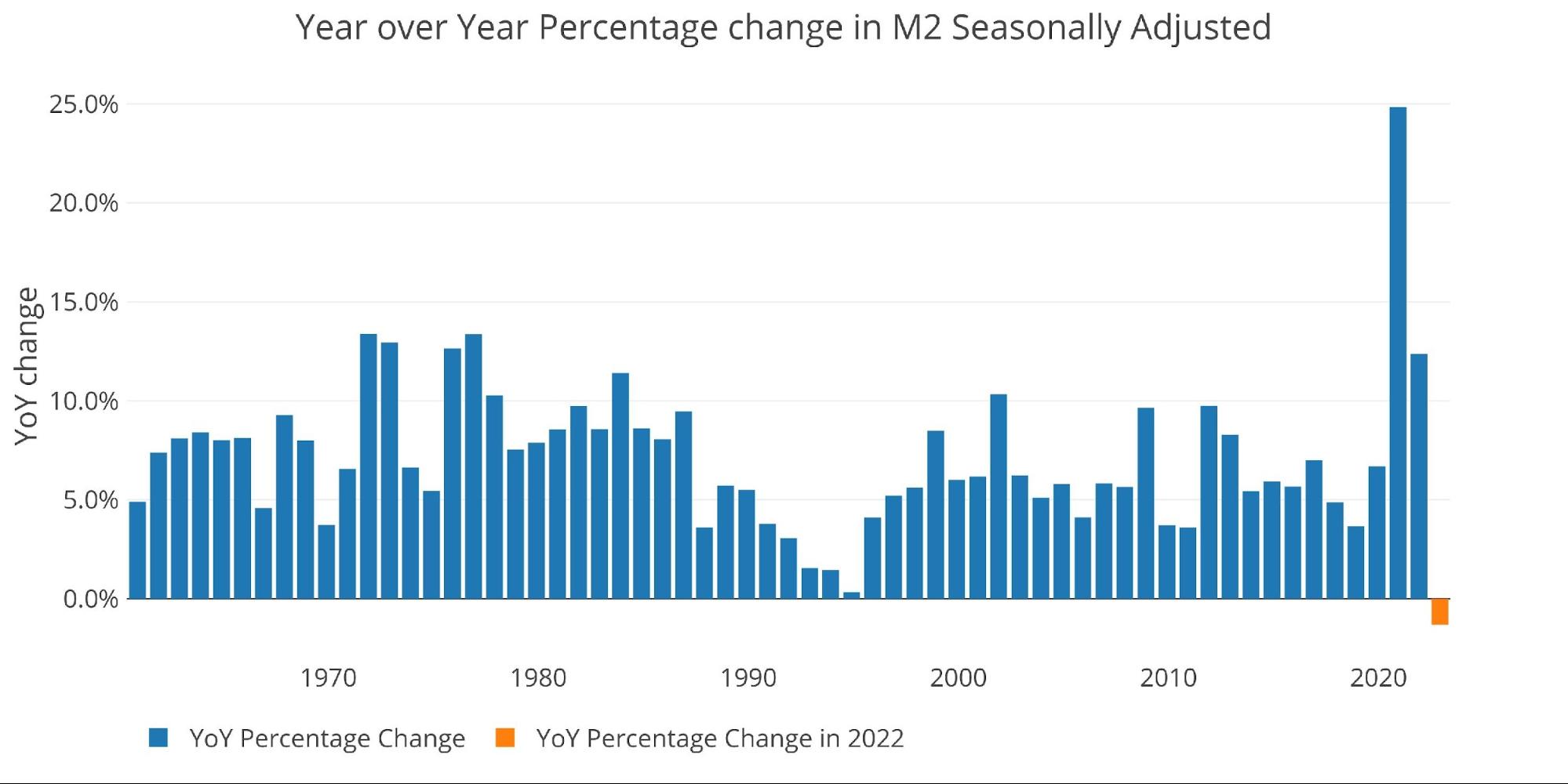

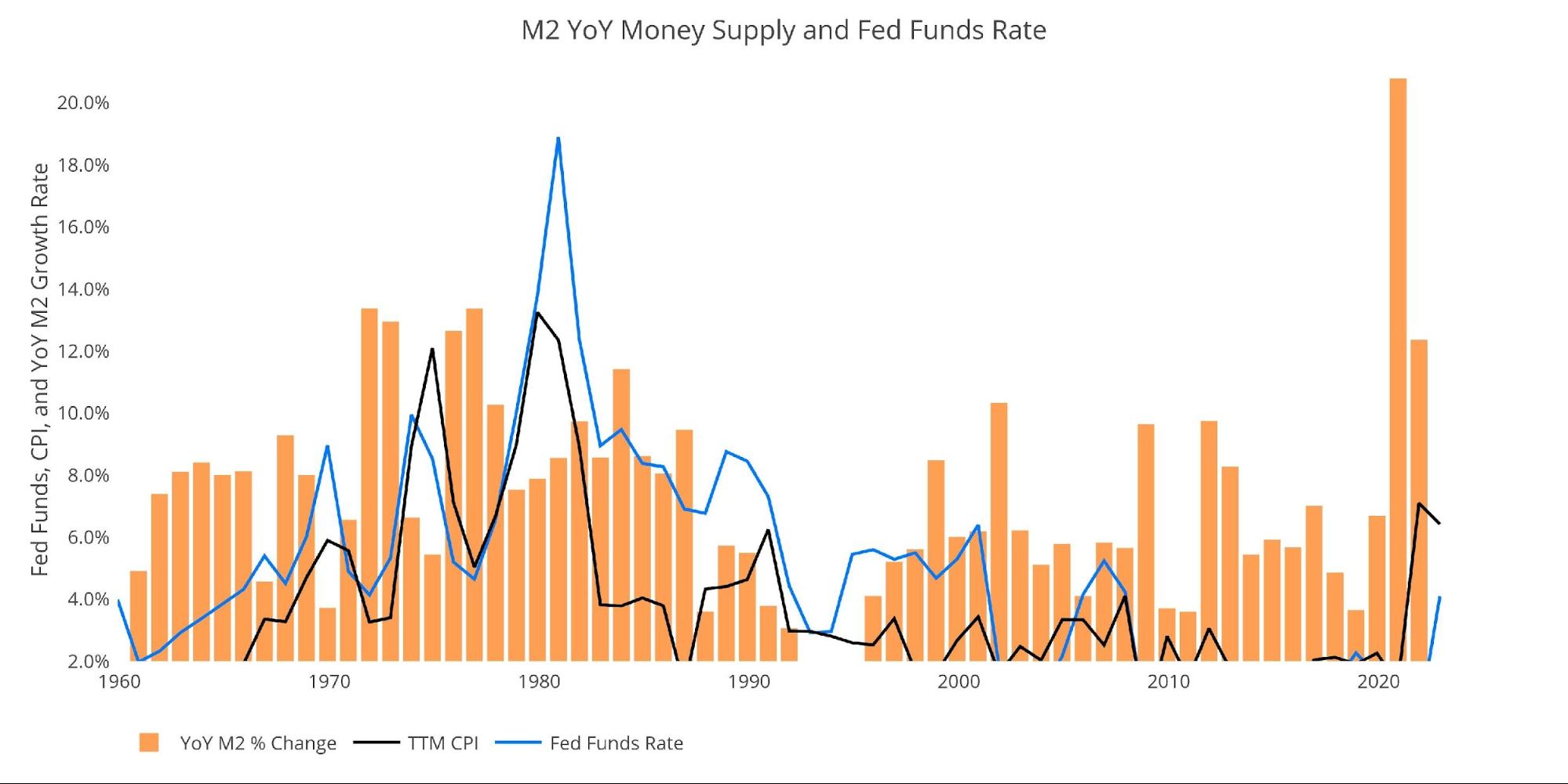

The chart below shows the YoY growth rate in aggregate going back to 1960. 2022 has become a major outlier in the data as being the only negative year on record. Unfortunately, despite the pain this has caused, it has done very little to undo the massive expansion seen in 2020 and 2021. This is why Peter Schiff can confidently say that the recent easing in prices is transitory.

Figure: 2 YoY M2 Change

The latest month is well below the 6-month average growth rate (-8% vs -3.7%). The 1-year growth rate dropped to -1.3% while the 3-year has fallen to 11.5%. Please note that last January, the 3-year growth rate was as high as 14.6% with 1-year growth at 13.1%

Figure: 3 M2 Growth Rates

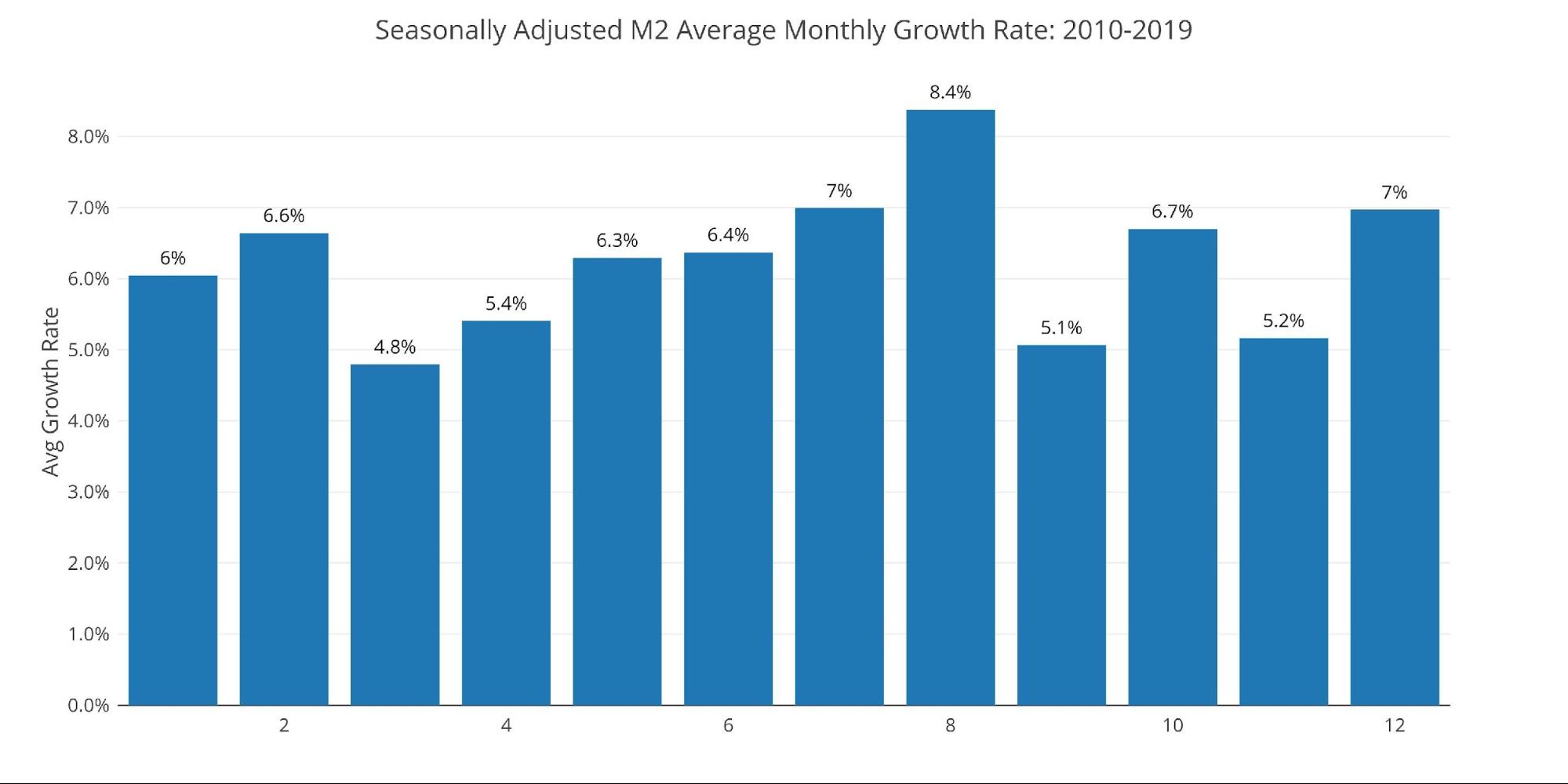

When looking at the average monthly growth rate, before Covid, December historically expands at an annualized rate of 7%. This year missed by an incredible 1500 bps!

Figure: 4 Average Monthly Growth Rates

The Fed only offers weekly data that is not seasonally adjusted. As the chart below shows, the last two weeks have both been negative, but early December saw a meaningful increase that prevented a bigger fall in the non-seasonally adjusted number. The non-seasonally adjusted data is a few weeks ahead of the seasonally adjusted data.

Figure: 5 WoW M2 Change

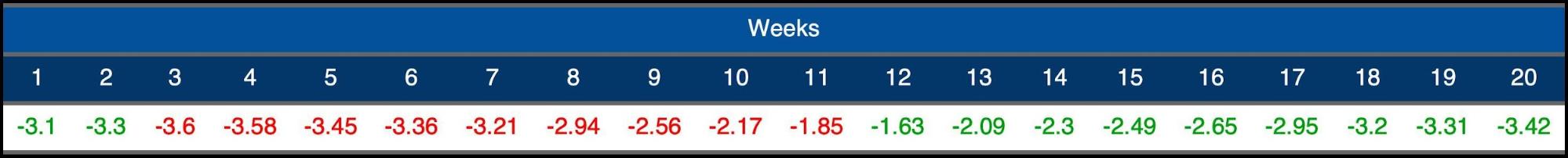

The “Wenzel” 13-week Money Supply

The late Robert Wenzel of Economic Policy Journal used a modified calculation to track Money Supply. He used a trailing 13-week average growth rate annualized as defined in his book The Fed Flunks. He specifically used the weekly data that was not seasonally adjusted. His analogy was that in order to know what to wear outside, he wants to know the current weather, not temperatures that have been averaged throughout the year.

The objective of the 13-week average is to smooth some of the choppy data without bringing in too much history that could blind someone from seeing what’s in front of them. The 13-week average growth rate can be seen in the table below. Decelerating trends are in red and accelerating trends in green.

Despite the massive fall in M2 seasonally adjusted, the non-seasonally adjusted number is actually showing a slight improvement. The deceleration seems to have bottomed 2 weeks prior at -3.6% and has since reversed to only down by -3.1%.

![]()

![]()

Figure: 6 WoW Trailing 13-week Average Money Supply Growth

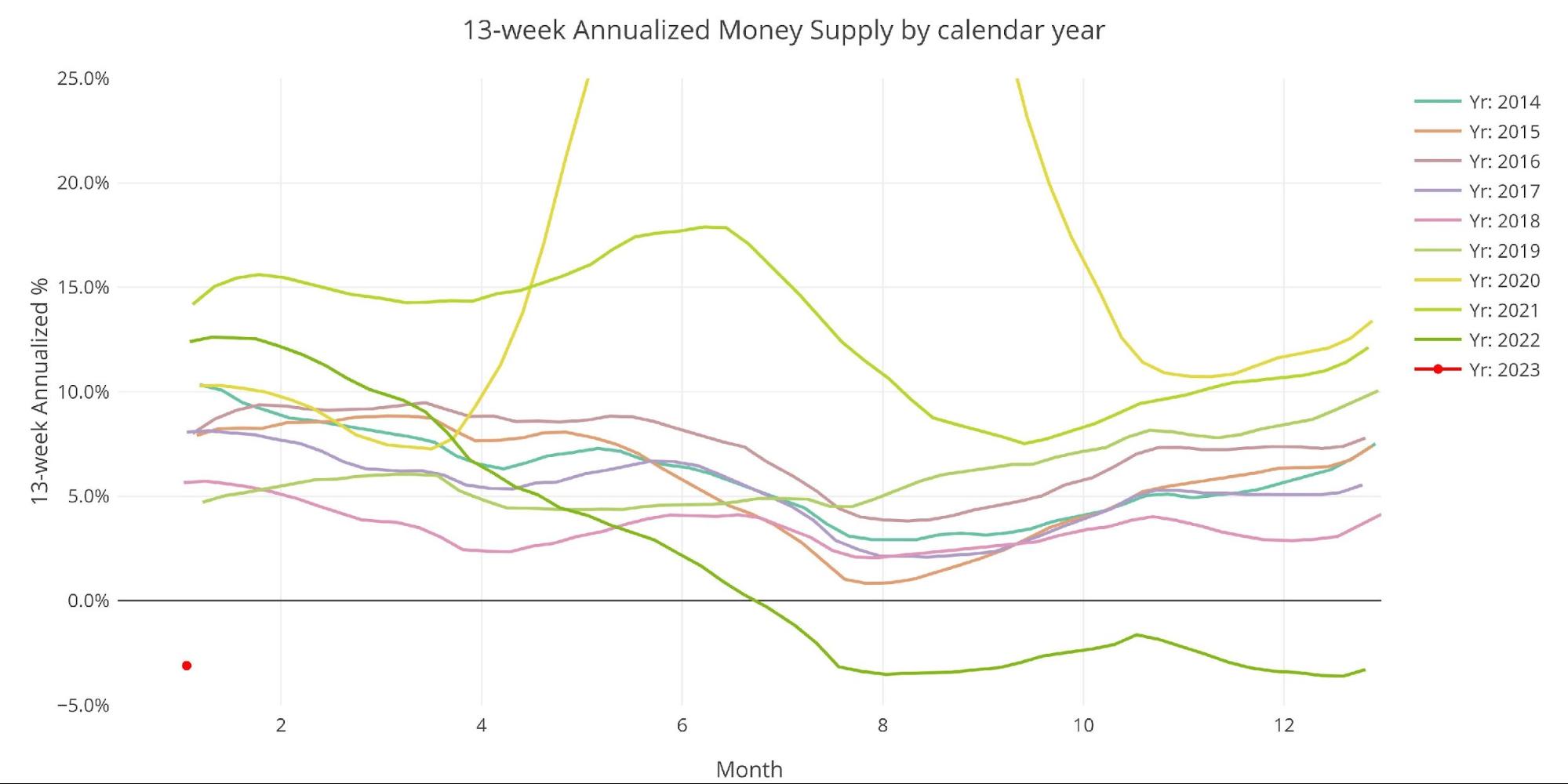

The plot below really helps show the current divergence seen in 13-week M2. While only 10 years are shown, even showing 25 years would highlight 2022 as a major divergence from history. January 2023 started at 780bps below the next closest year which was 2019. This is an epic slowdown in money supply growth that is unprecedented.

The Fed may be confident in their rate hikes and the resiliency of the economy, but they are playing with serious fire. They have put the entire economy at risk for a major event as the liquidity has dried up extremely fast.

Figure: 7 Yearly 13-week Overlay

Behind the Inflation Curve

Incredibly, even with the contracting money supply, the Fed is still not doing enough to solve the inflation problem. To combat rising prices, the Fed would need to undo most of the money it has created over the last several years. This would require bringing interest rates above the rate of inflation to really collapse the money supply.

This can be seen in the chart below. The black line and blue line are converging, but they have not inverted yet. The blue line (interest rates) has always risen above the black line (inflation) to combat high inflation in the past. Remember, the CPI has been greatly modified since the 1970s and 80s to understate current inflation. Thus, the magnitude of the current divergence is definitely understated.

Figure: 8YoY M2 Change with CPI and Fed Funds

Historical Perspective

The charts below are designed to put the current trends into historical perspective. The orange bars represent annualized percentage change rather than raw dollar amount. The current slowdown can be seen clearly on the right side.

The Money Supply slowdown is a major driver of the weakness seen in the stock market over the last several months. The massive increase seen in 2020 is what pushed the market to explode higher. Now the stock market is out of fuel which has left it directionless over the last several months.

2023 has started strong, but that is the market starting to price in a Fed pivot. When the Fed pivots in response to a major market event and inflation is not yet fully contained, things could get ugly in a hurry.

Figure: 9 M2 with Growth Rate

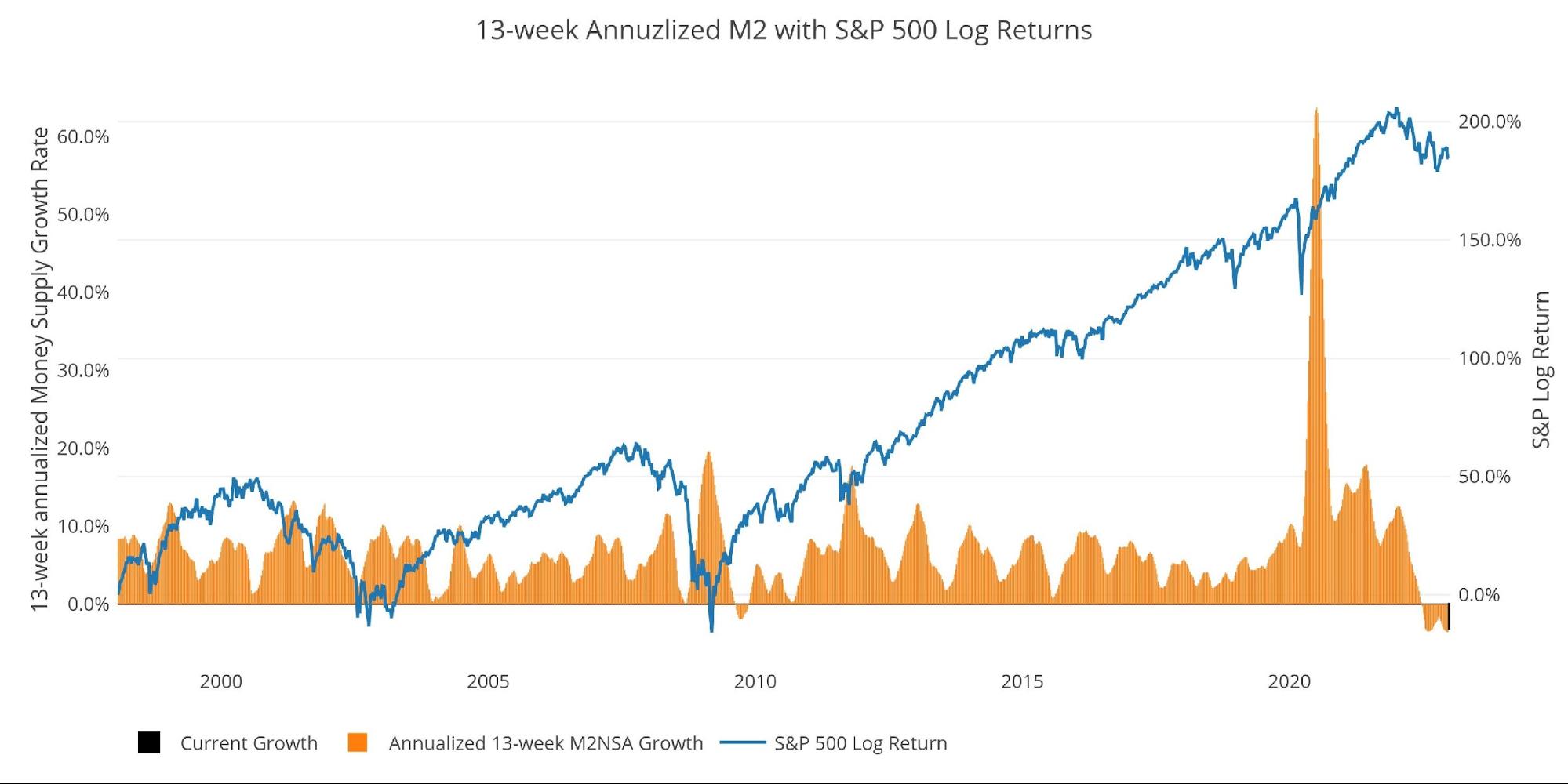

Taking a historical look at the 13-week annualized average also shows the current predicament. This chart overlays the log return of the S&P. Mr. Wenzel proposed that large drops in Money Supply could be a sign of stock market pullbacks. His theory, derived from Murray Rothbard, states that when the market experiences a shrinking growth rate of Money Supply (or even negative) it can create liquidity issues in the stock market, leading to a sell-off.

While not a perfect predictive tool, many of the dips in Money Supply precede market dips. Specifically, the major dips in 2002 and 2008 from +10% down to 0%. The economy is now grappling with a peak growth rate of 63.7% in July 2020 down to -3.6%. This is a major collapse.

Amazingly, the stock market has held up as well as it has, but likely that is because the major events have not yet manifested themselves. The collapse has been so sudden and significant that it hasn’t had time to be fully digested by the market. As time wears on, the rot from 12 years of easy money will begin to manifest.

Please note the chart only shows market data through January 2nd to align with available M2 data.

Figure: 10 13-week M2 Annualized and S&P 500

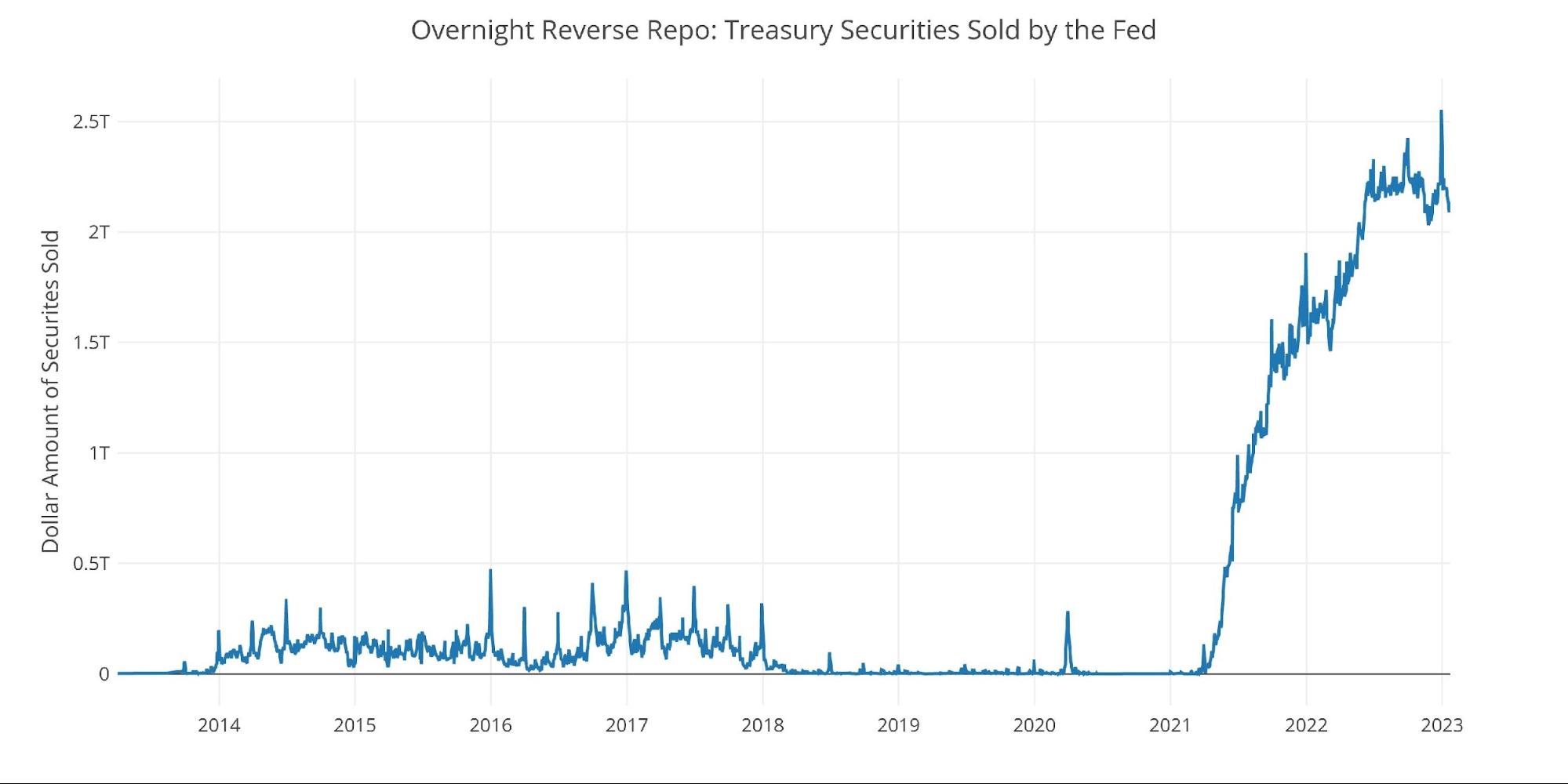

One other consideration is the massive liquidity buildup in the system. The Fed offers Reverse Repurchase Agreements (reverse repos). This is a tool that allows financial institutions to swap cash for instruments on the Fed balance sheet.

Current Reverse Repos peaked at $2.55T on Dec 30. This broke the previous record from September. The value always tops out at quarter end. Since then, it has pulled back to $2.13T. This is below the entire second half of 2022, but still well above where it typically sits around $1B.

(Click on image to enlarge)

Figure: 11 Fed Reverse Repurchase Agreements

What it means for Gold and Silver

The collapse in Money Supply has been sudden and epic. The risk it poses for the market at large cannot be understated. The Fed seems to be oblivious to the potential carnage it could cause. In 2018, it took interest rates around 2.5% to bring the market to its knees. Rates are now almost double that. How much longer can things go on without a black swan event?

Most market participants anticipate a recession in 2023, but everyone has concluded it will be a mild recession. Why will it be mild? The epic fall in Money Supply paints a picture of what could unfold. Money Supply effects work on a lag, sometimes in the range of 12-24 months. There is no ignoring that the market is used to loads of cheap and easy money. While stock prices are hinting at a pivot by year-end, it seems to be ignoring the effects of this tight money on an over-levered economy.

Something will break, and it will take everyone by surprise. Especially the Fed. Their response will be cheap money. Expect them to claim victory over inflation to try and restore confidence before turning the printing presses back on. It’s highly unlikely the market will buy it, and this is when gold and silver really launch into another gear higher.

Data Source: https://fred.stlouisfed.org/series/M2SL and also series WM2NS and RRPONTSYD. Historical data changes over time so numbers of future articles may not match exactly. M1 is not used because the calculation was recently changed and backdated to March 2020, distorting the graph.

Data Updated: Monthly on the fourth Tuesday of the month on a 3-week lag

Most recent data: Jan 02, 2023

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

More By This Author:

Comex Update: Gold Deliveries Pick Up Late In The ContractThe Trillion-Dollar Coin: A Dumb Idea That Won’t Go Away

Indian Silver Imports Set Record in 2022