Money Supply Growth Continues To Support The Stock Market

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

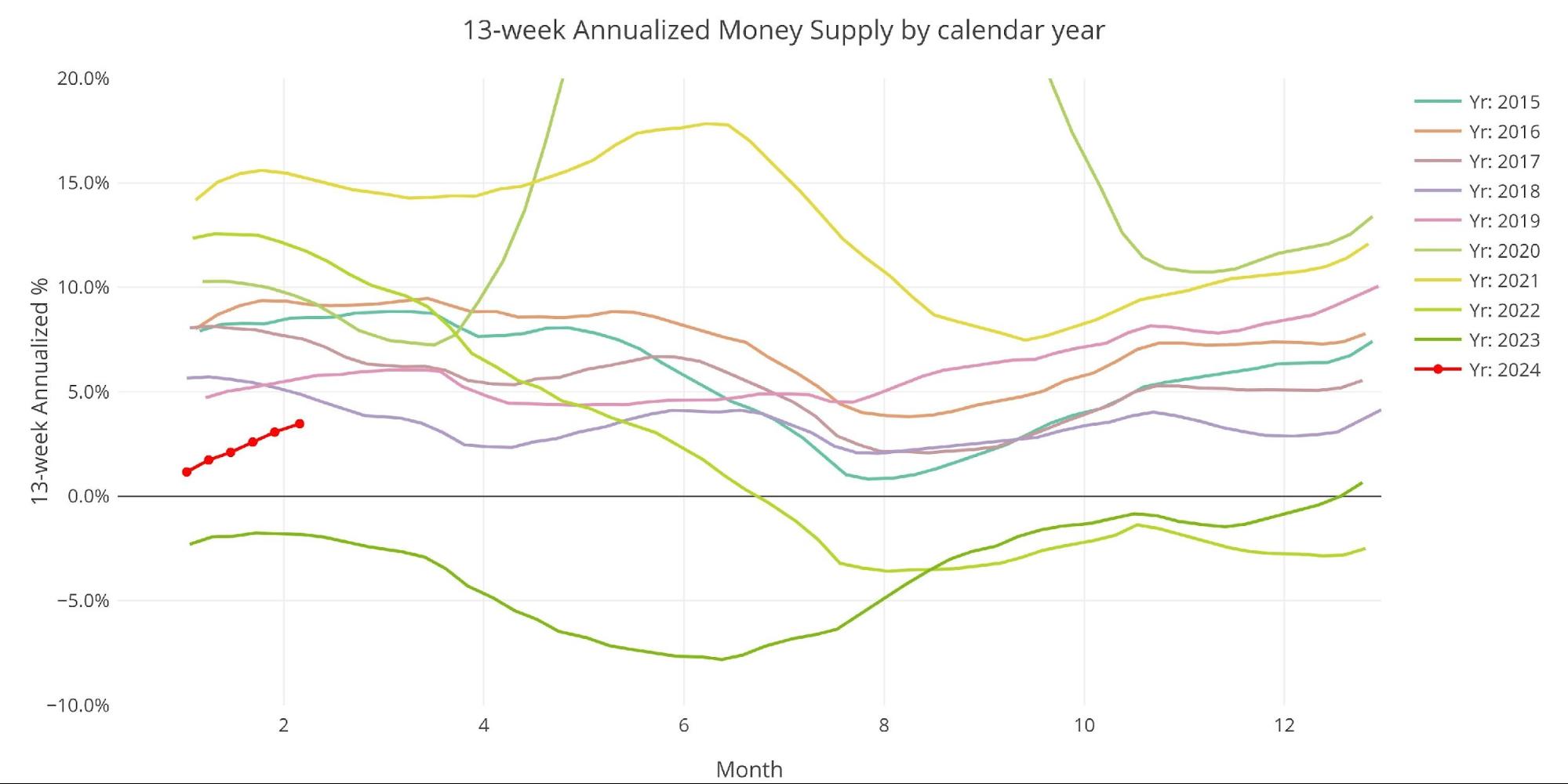

One key metric shown below is the “Wenzel” 13-week annualized money supply figure. It was made popular by the late Robert Wenzel who tracked the metric weekly as an indicator of where the economy might be headed.

Recent Trends

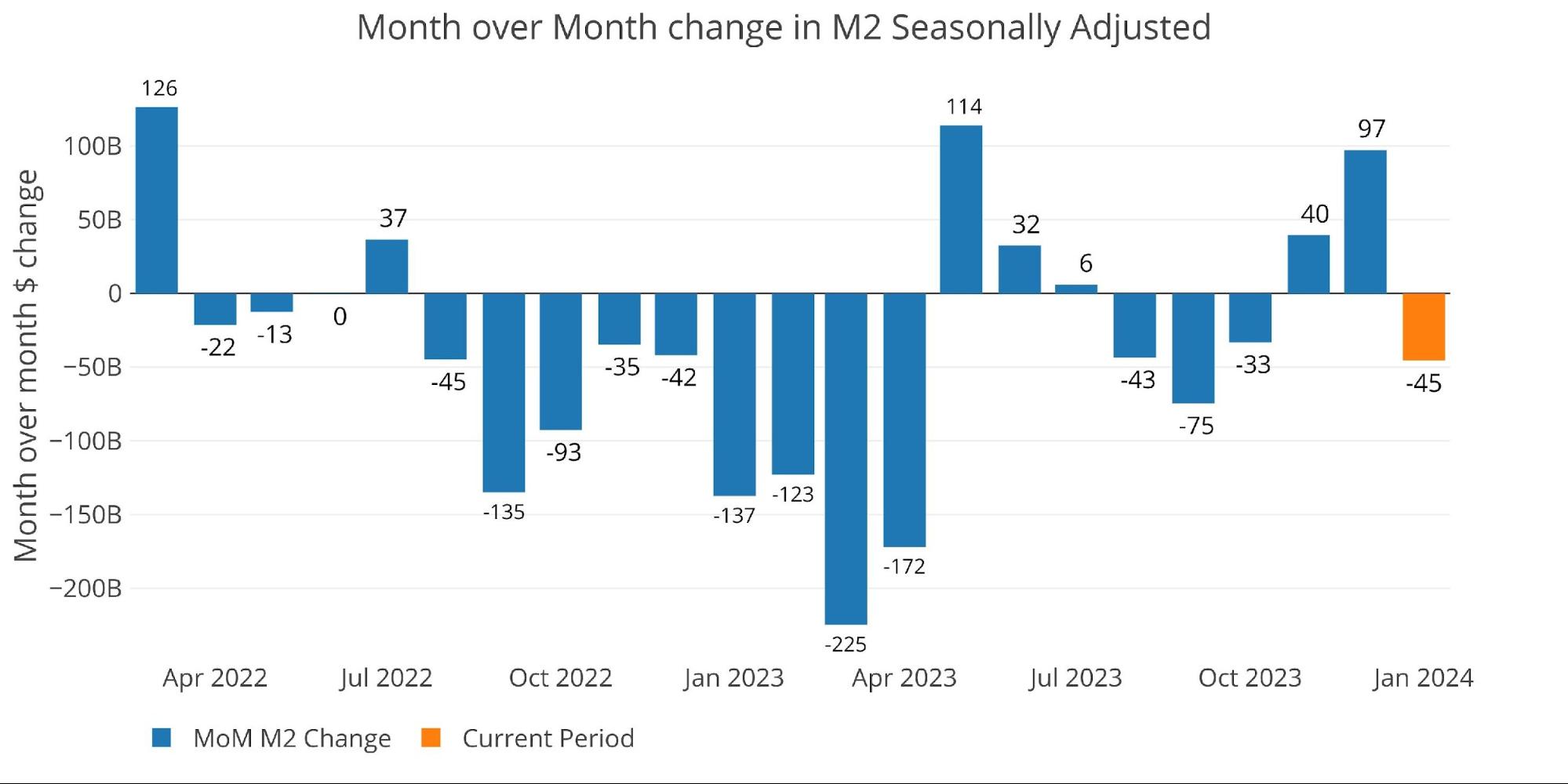

Seasonally Adjusted Money Supply is delayed by a month. The slowdown shown below is from January.

(Click on image to enlarge)

Figure: 1 MoM M2 Change (Seasonally Adjusted)

January was a pretty big drop of -2.6%.

(Click on image to enlarge)

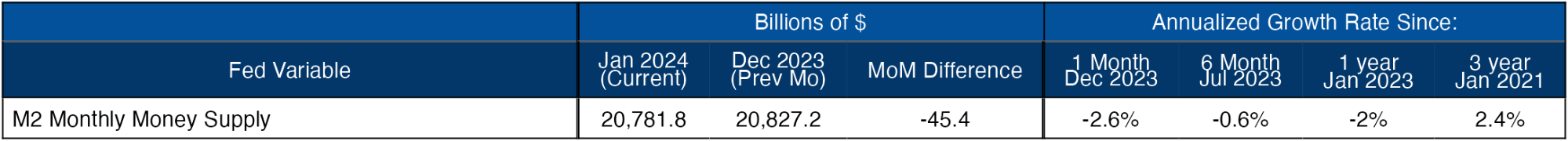

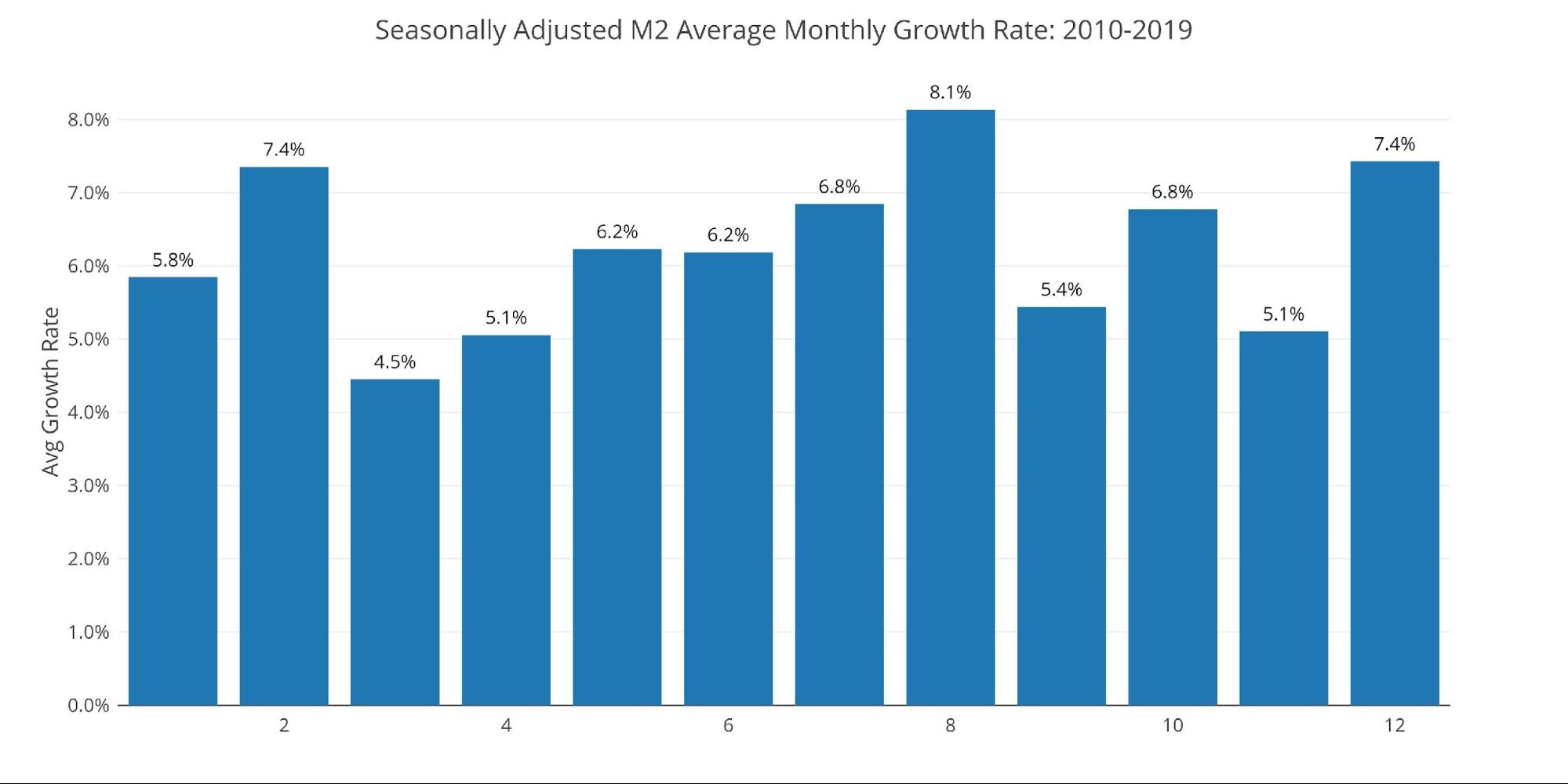

Figure: 2 M2 Growth Rates

This is well below the January average of +5.8%.

(Click on image to enlarge)

Figure: 3 Average Monthly Growth Rates

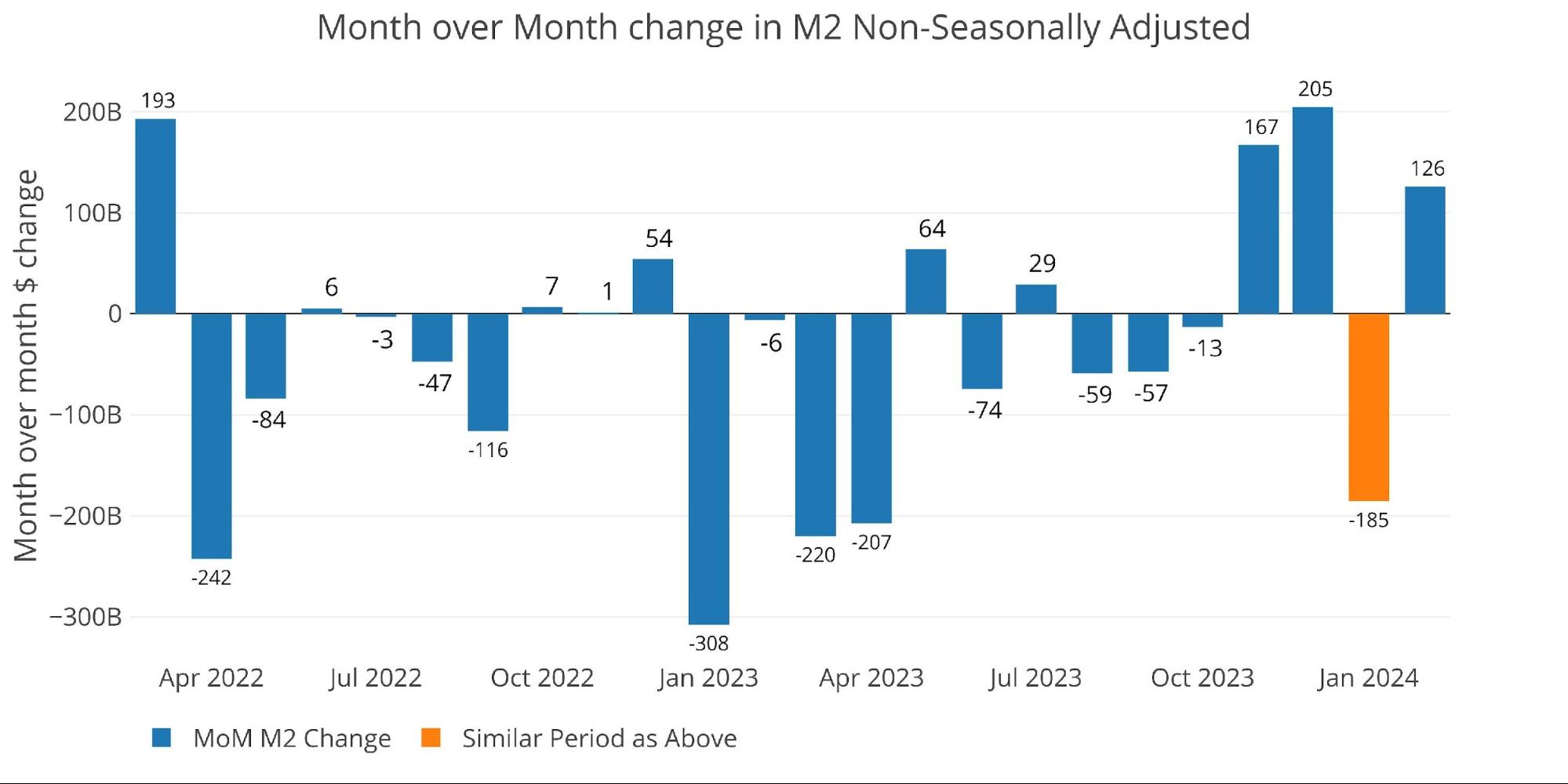

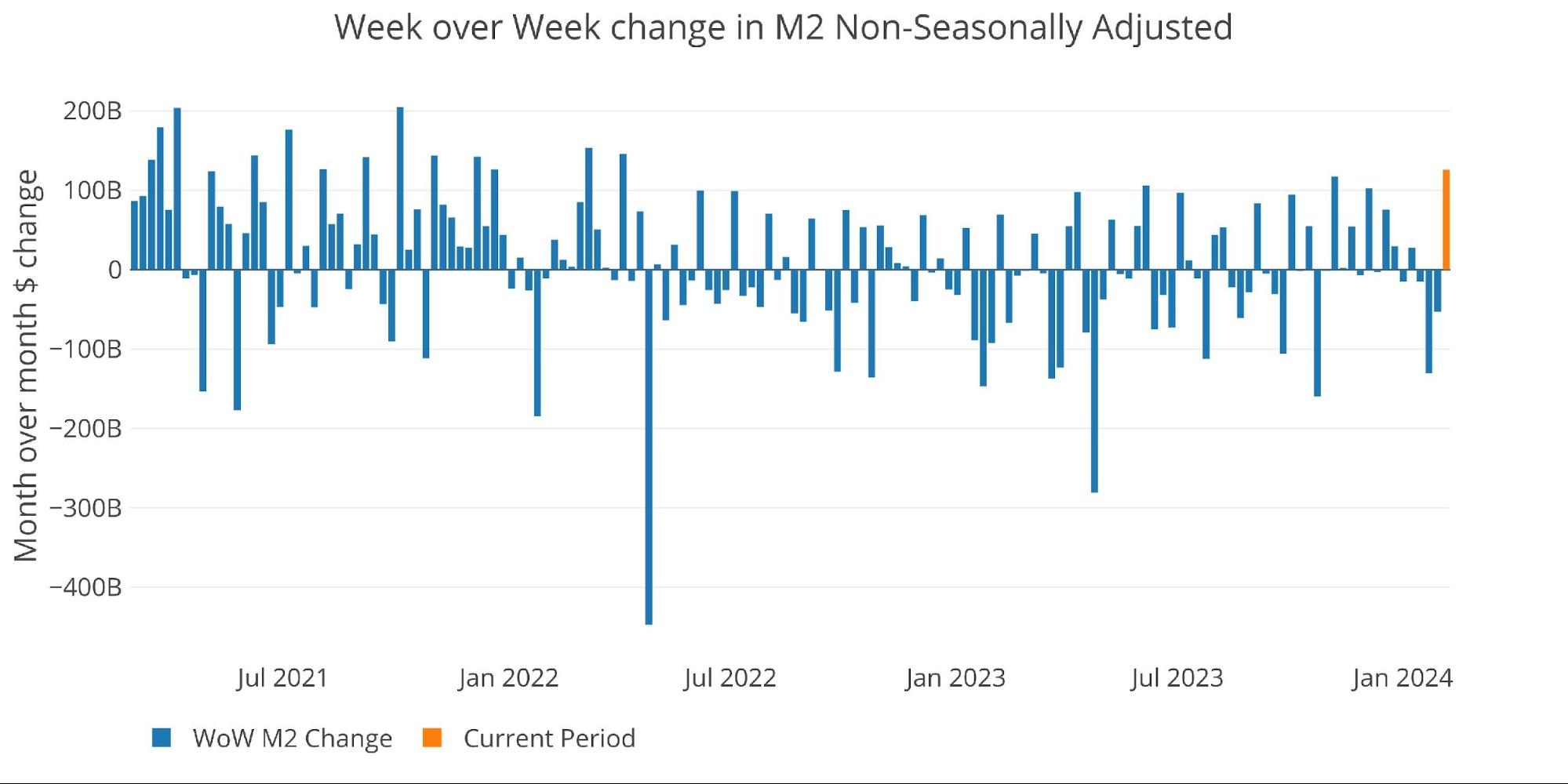

Non-seasonally adjusted numbers show data through early February, with a large uptick in the most recent period.

(Click on image to enlarge)

Figure: 4 MoM M2 Change (Non-Seasonally Adjusted)

The weekly data below shows the activity over the last month in unadjusted money supply. You can see the big jump in the most recent week.

(Click on image to enlarge)

Figure: 5 WoW M2 Change

The “Wenzel” 13-week Money Supply

The late Robert Wenzel of Economic Policy Journal used a modified calculation to track Money Supply. He used a trailing 13-week average growth rate annualized as defined in his book The Fed Flunks. He specifically used the weekly data that was not seasonally adjusted. His analogy was that in order to know what to wear outside, he wants to know the current weather, not temperatures that have been averaged throughout the year.

The objective of the 13-week average is to smooth some of the choppy data without bringing in too much history that could blind someone from seeing what’s in front of them. The 13-week average growth rate can be seen in the table below. Decelerating trends are in red and accelerating trends are in green.

(Click on image to enlarge)

![]()

![]()

![]()

Figure: 6 WoW Trailing 13-week Average Money Supply Growth

The plot below shows how this year compares with previous years. The 13-week average reached an all-time low back in May of last year but has been accelerating ever since. This could be one of the components driving the stock market higher. Record negative Money Supply growth turning positive will certainly provide a tailwind to equities.

(Click on image to enlarge)

Figure: 7 Yearly 13-week Overlay

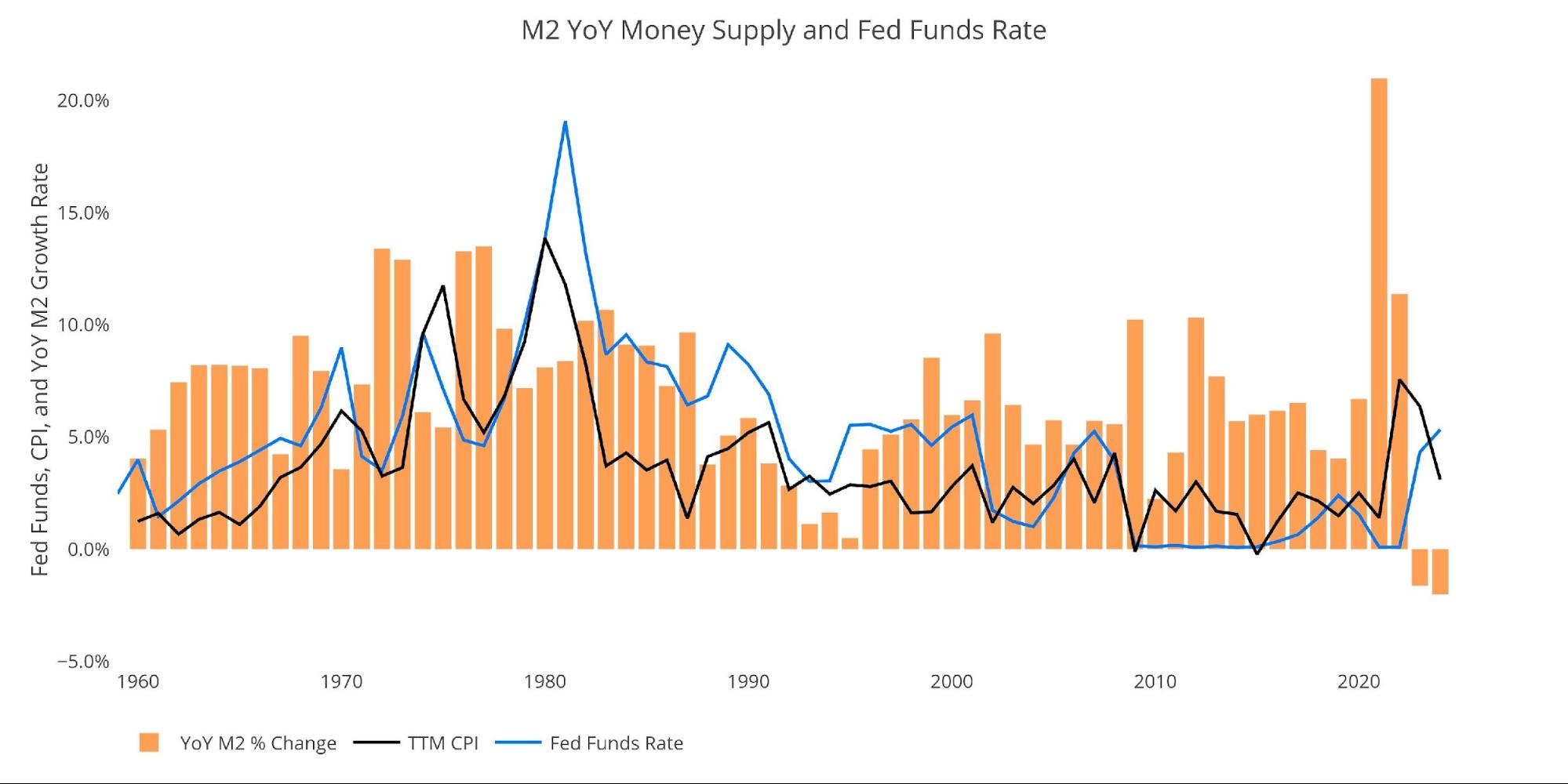

Inflation and Money Supply

The chart below shows the history of inflation, Money Supply, and Fed Funds. As shown, in 1970 inflation worked with 2 year lag compared to Money Supply. Given this, another bout of inflation may be lurking just under the surface.

(Click on image to enlarge)

Figure: 8 YoY M2 Change with CPI and Fed Funds

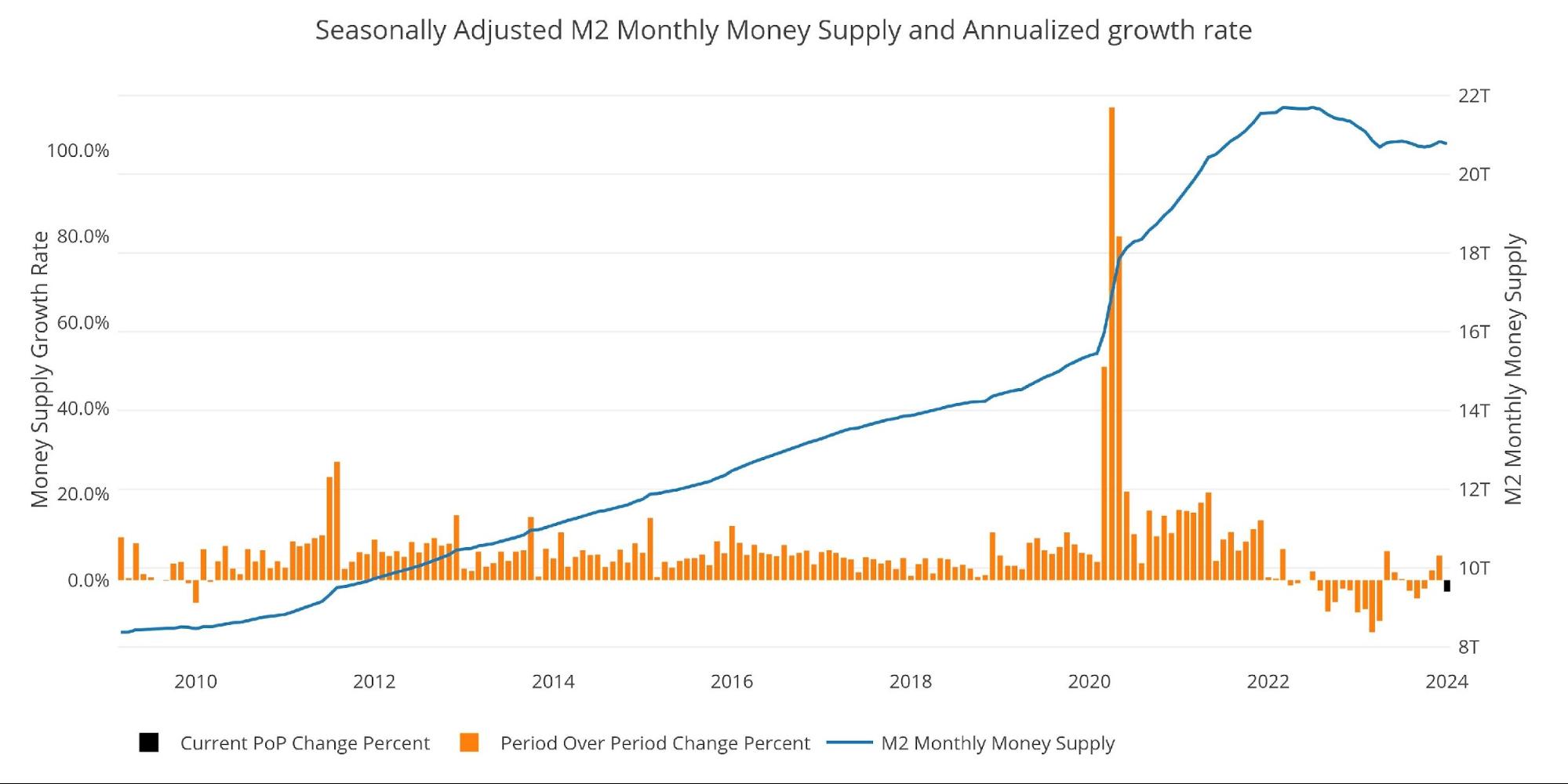

Historical Perspective

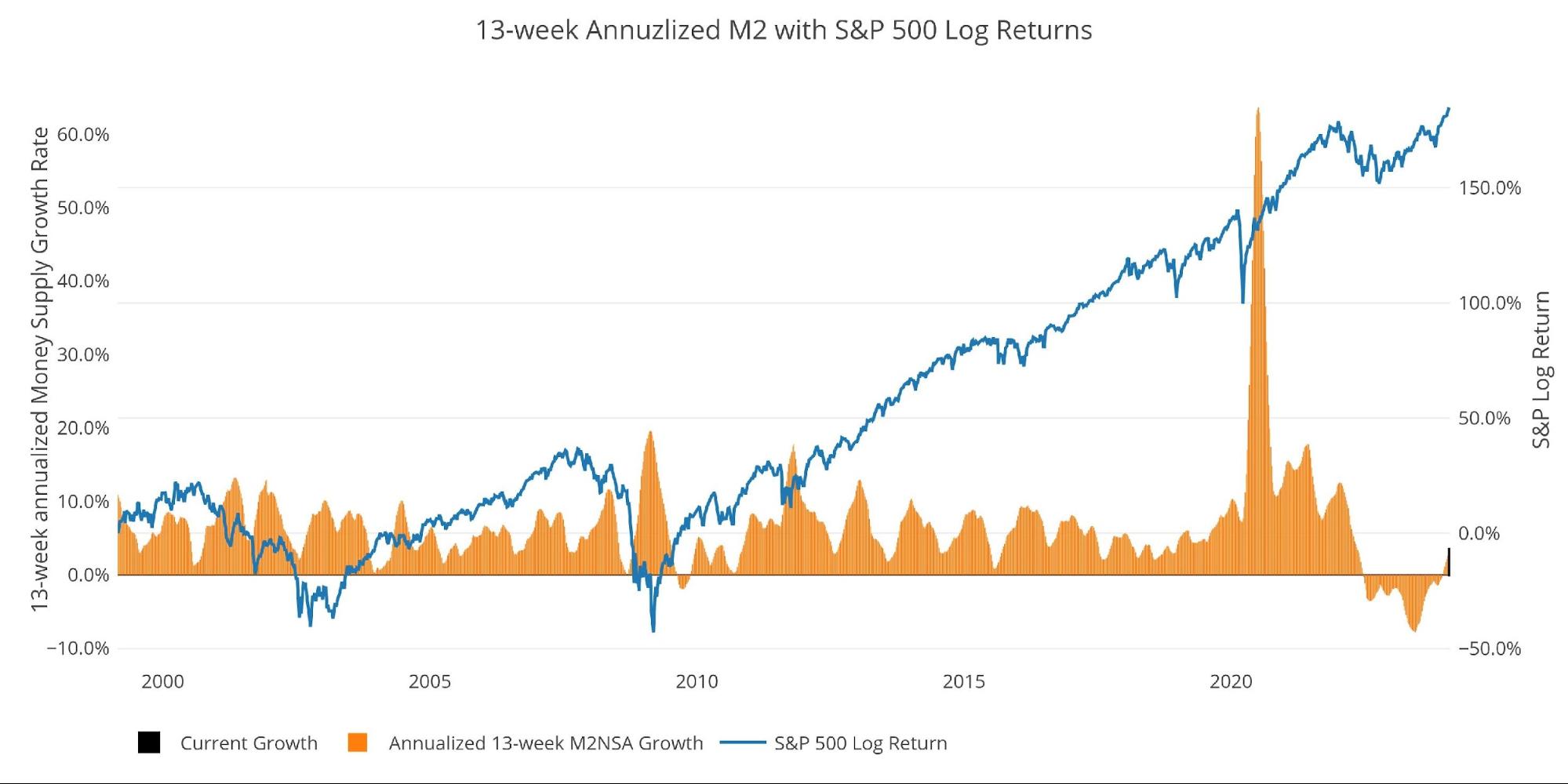

The charts below are designed to put the current trends into historical perspective. The orange bars represent annualized percentage change rather than a raw dollar amount.

(Click on image to enlarge)

Figure: 9 M2 with Growth Rate

Below is the 13-week annualized average over history. This chart overlays the log return of the S&P. Mr. Wenzel proposed that large drops in Money Supply could be a sign of stock market pullbacks. His theory, derived from Murray Rothbard, states that when the market experiences a shrinking growth rate of Money Supply (or even negative) it can create liquidity issues in the stock market, leading to a sell-off.

While not a perfect predictive tool, many of the dips in Money Supply precede market dips. Specifically, the major dips in 2002 and 2008 from +10% down to 0%. 2022 was highly correlated with a fall in Money Supply and the rebound has corresponded with the big stock market move we have seen recently.

Please note the chart only shows market data through Feb 5th to align with available M2 data.

(Click on image to enlarge)

Figure: 10 13-week M2 Annualized and S&P 500

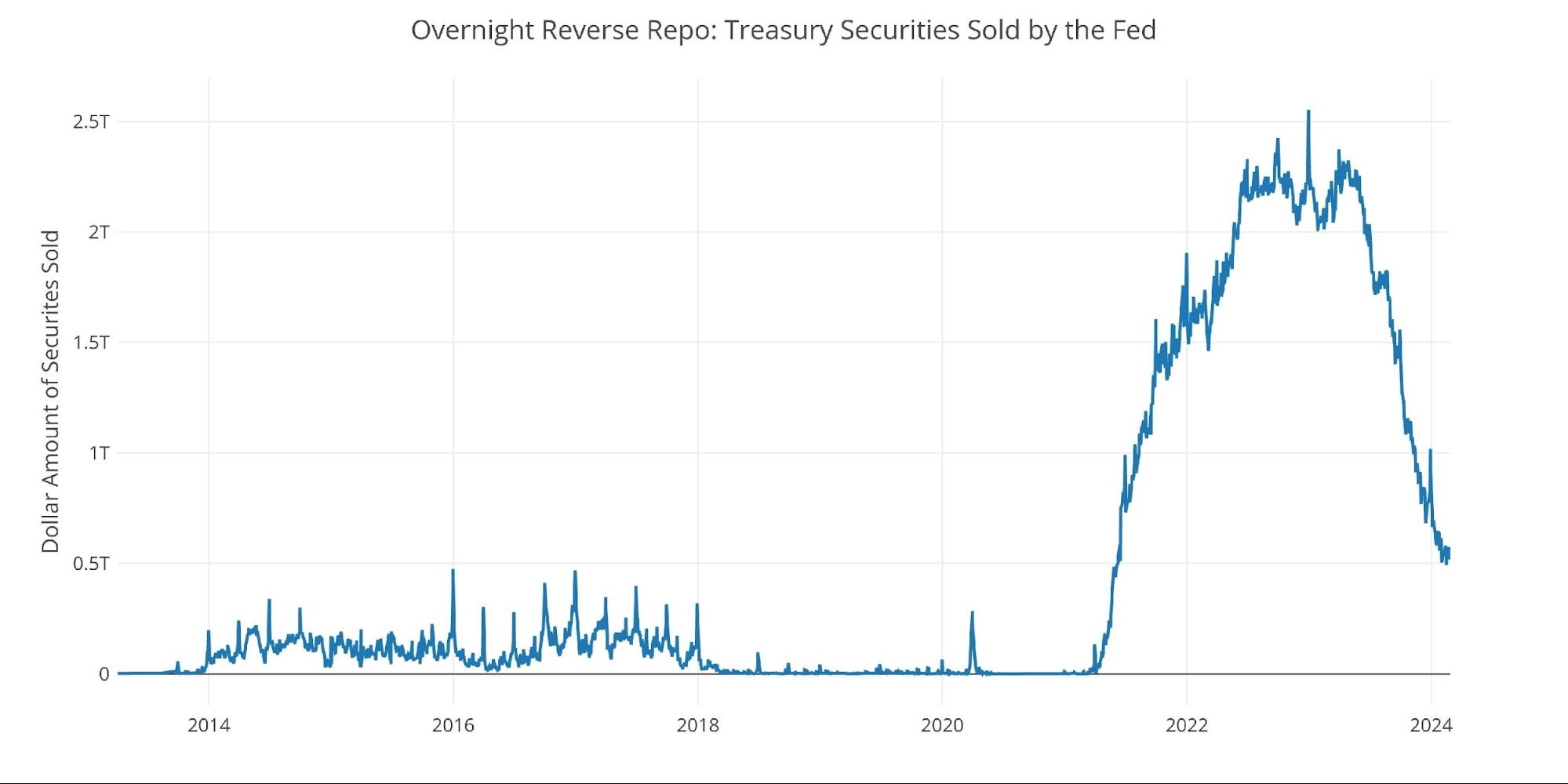

One other consideration is the reverse repo market at the Fed. This is a tool that allows financial institutions to swap cash for instruments on the Fed balance sheet.

Reverse Repos peaked at $2.55T on Dec 30, 2022. Money has been gushing out ever since. While the Fed has been maintaining higher interest rates, this drop in reverse repos is certainly providing liquidity to the economy, driving Money Supply and the stock market higher.

(Click on image to enlarge)

Figure: 11 Fed Reverse Repurchase Agreements

Wrapping Up

Money Supply can be a leading indicator and help explain the action in the stock market. Money Supply fell the entire year of 2022, bottomed in early 2023, and has been rising since. Keeping an eye on Money Supply can help one understand how much wind the stock market has at its back.

Data Source: https://fred.stlouisfed.org/series/M2SL and also series WM2NS and RRPONTSYD. Historical data changes over time so the numbers of future articles may not match exactly. M1 is not used because the calculation was recently changed and backdated to March 2020, distorting the graph.

Data Updated: Monthly on fourth Tuesday of the month on 3-week lag

Most recent data: Feb 05, 2024

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

More By This Author:

Inflation’s Impact: The Penny’s Plunge Into Irrelevance

A Byte-Sized Bubble?

Is a Weak Yen Feeding the Global Gold Bull?