Money Market Fund Inflows Continue As Fed's Bank Bailout Fund Hits Another New High

Money-market funds saw inflows for the 4th straight week (since the biggest outflow since Lehman), adding $21.9BN to reach a new record high of $5.73TN...

(Click on image to enlarge)

Source: Bloomberg

In a breakdown for the week to Nov. 15, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.68 trillion, an $18.9 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets climb to $932 billion, a $5.6 billion increase.

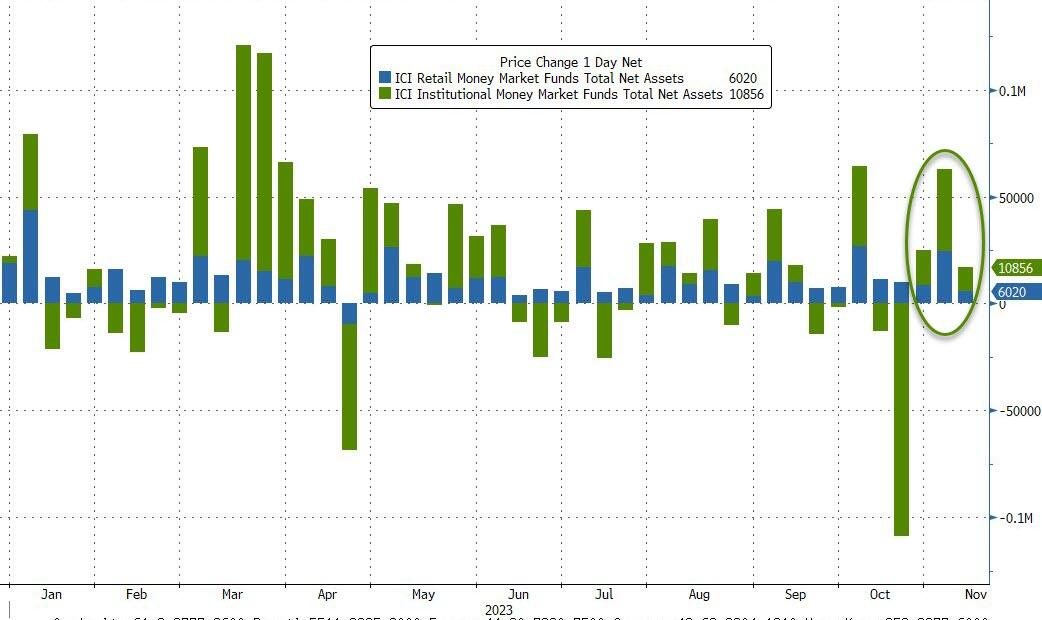

Flows into Retail funds continued their seven month streak and institutional funds saw inflows also...

(Click on image to enlarge)

Source: Bloomberg

The resurgence in money-market fund inflows is diverging from bank deposits (which are gently rising on a seasonally-adjusted basis)...

(Click on image to enlarge)

Source: Bloomberg

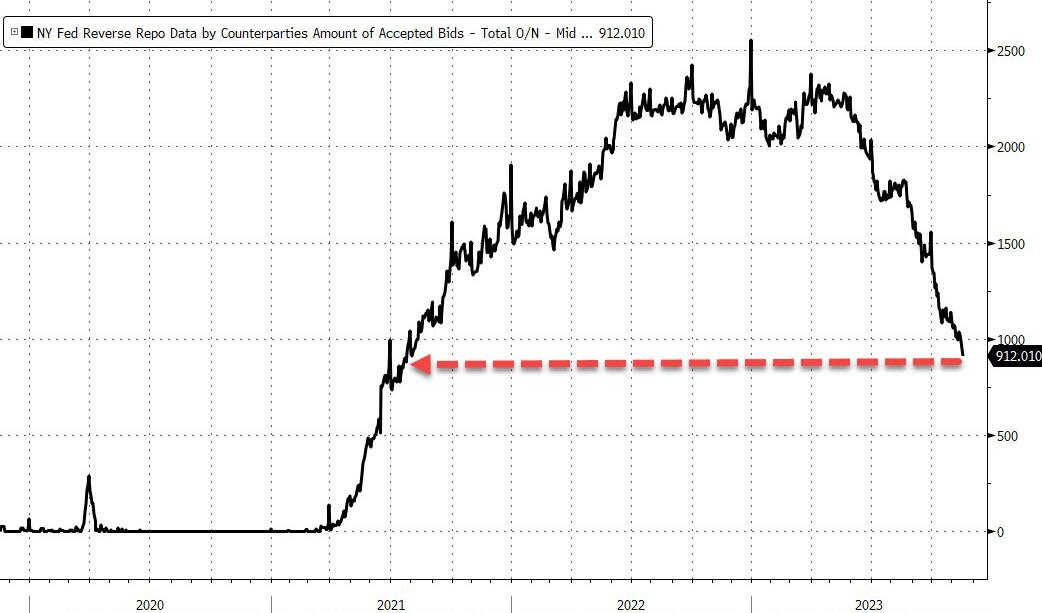

Meanwhile, as we detailed earlier, the amount of money that investors are parking at The Fed's reverse repo facility has accelerated below $1 trillion to its lowest since July 2021...

(Click on image to enlarge)

Source: Bloomberg

Demand for the facility, however, has been fading this year as the Treasury ramped up fresh bill issuance, offering an alternative for short-term investors.

It marks a steep decline from a record $2.554 trillion stashed on Dec. 30, and some are starting to worry about the consequences.

Wrightson ICAP economist Lou Crandall said in a note Monday that the Fed should stop paring its bond holdings before the facility is completely emptied to make sure that banks’ cash buffers don’t get too lean and increase pressure on short-term funding markets.

“We think banks should be encouraged to hold deep liquidity buffers, so our preference would be to adopt a generous definition of ‘ample,’” Crandall wrote.

“Surplus cash sitting in the RRP facility can be redeployed by money funds into the repo market in the event of a spike in financing needs.”

Reserve scarcity has caused overnight lending rates to jump in the past, notably in 2019, when the Treasury increased its borrowing and the Fed stopped buying as many Treasuries for its balance sheet.

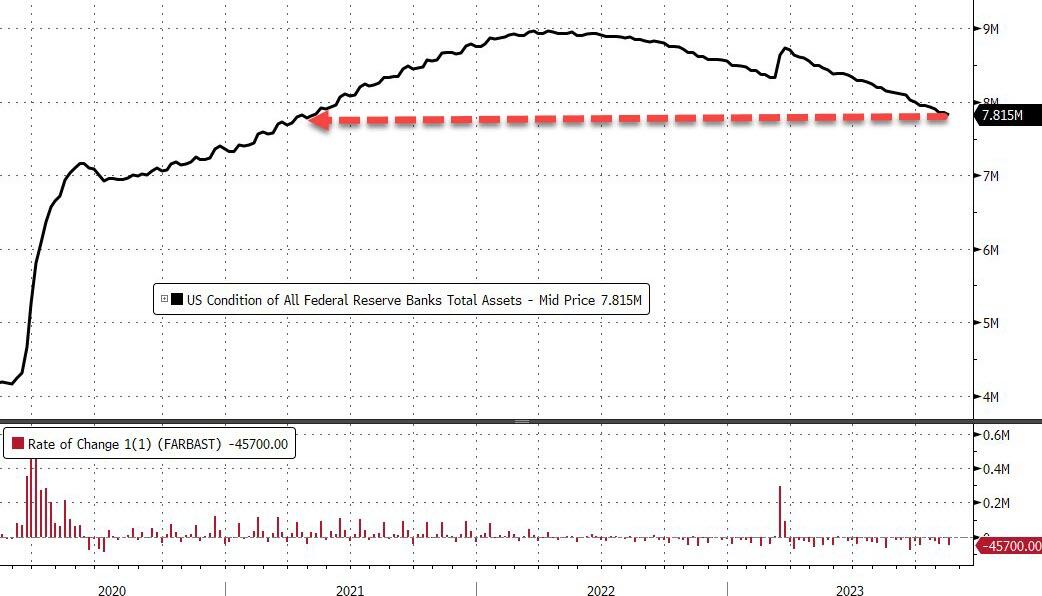

The Fed's balance sheet contracted by a huge $45.7BN last week to $7.815TN (the lowest since May 2021). The balance sheet is now down over $1.1TN from its highs, but in context, there's a long way to go...

(Click on image to enlarge)

Source: Bloomberg

After stalling the prior week, The Fed's QT program reaccelerated last week, with its securities-held dropping $30.3BN (its lowest since May 2021)...

(Click on image to enlarge)

Source: Bloomberg

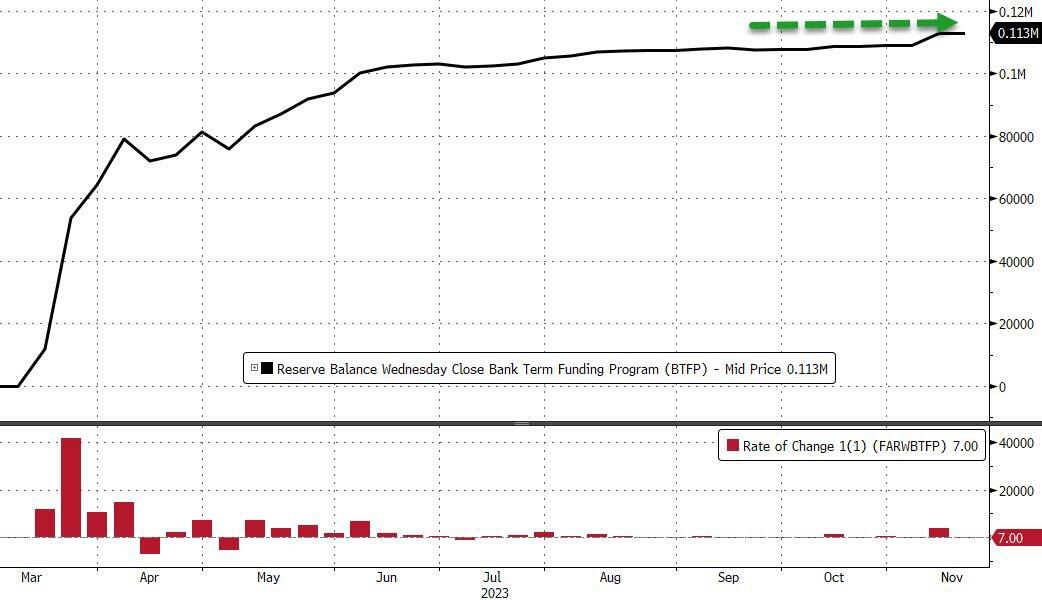

Most notably, usage of The Fed's emergency funding facility for the banks increased to a new record high again, up $7BN to $113BN...

(Click on image to enlarge)

Source: Bloomberg

Equity market cap continued to soar, having re-coupled with its years-long relationship with bank reserves at The Fed...

(Click on image to enlarge)

Source: Bloomberg

Regional banks are shrugging off the fact that are forced to borrow $113BN from The Fed at expensive costs...

(Click on image to enlarge)

Source: Bloomberg

Will there be a reckoning?

More By This Author:

Rivian Could Offer Up To $15 Billion In "Phantom Bonds" To Secure New Georgia CampusWalmart Crashes On Disappointing Guidance, Warns That Consumer Spending Is Deteriorating

SpaceX Prepares For Starlink IPO In 2024, Report Says

Disclosure: None