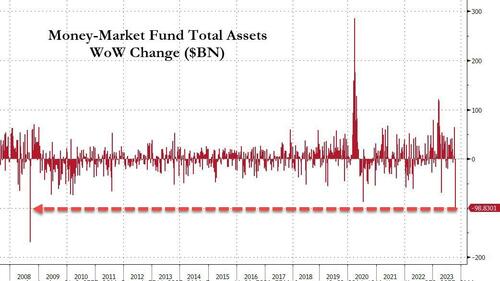

Money-Market Fund Assets Crash 'Most Since Lehman' As Bank Deposits Rose Last Week

Money-market funds saw the largest weekly outflow since Lehman (Q3 2008), plunging $99BN...

Source: Bloomberg

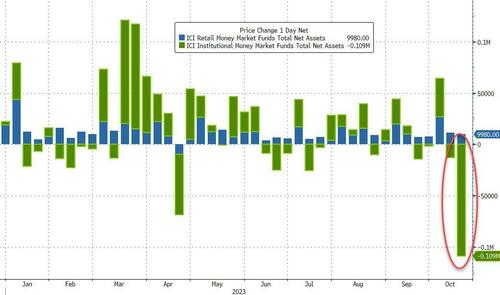

The outflows were all from institutional funds (retail funds saw another inflow)...

Source: Bloomberg

Presumably this was driven by tax-extension deadline payments - or else something serious is happening.

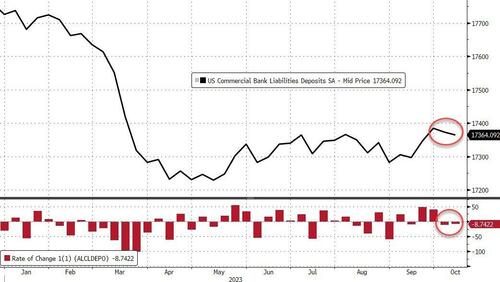

Total bank deposits - on a seasonally-adjusted basis - dropped for the second week in a row (-$$8.7BN)...

Source: Bloomberg

Non-seasonally-adjusted, total deposits saw inflows for the 3rd week in a row (+$20.6BN)...

Source: Bloomberg

Is this the start of a major reversal... or just the one-off tax flows?

Source: Bloomberg

Domestically, excluding foreign banks, there were deposit inflows on both an SA and NSA basis...

Source: Bloomberg

Which has narrowed the delta between SA and NSA deposit outflows since SVB to just $38BN (the outflows are still over $200BN total)...

Source: Bloomberg

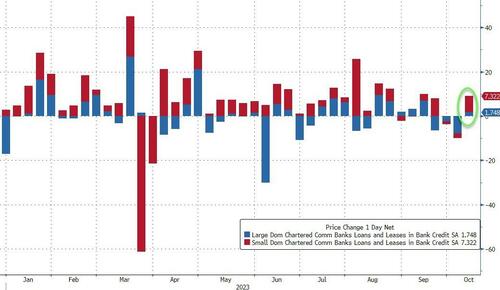

On the other side of the ledger, bans increased their lending volumes modestly last week - after 2 weeks of shrinkage - op around $9BN...

Source: Bloomberg

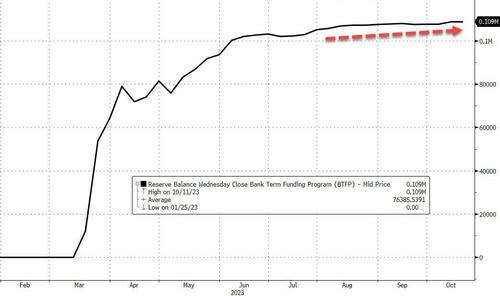

The Fed's balance sheet shrank by around $19BN last week, but usage of its emergency funding facility for banks remained at record highs around $109BN...

Source: Bloomberg

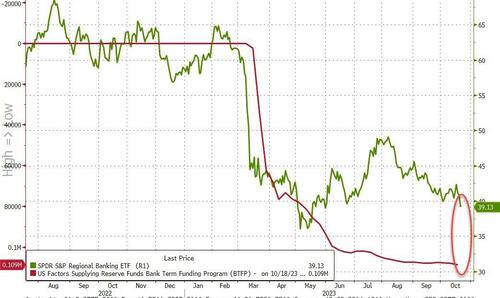

Bank reserves at The Fed and US equity market appear to be converging back together...

Source: Bloomberg

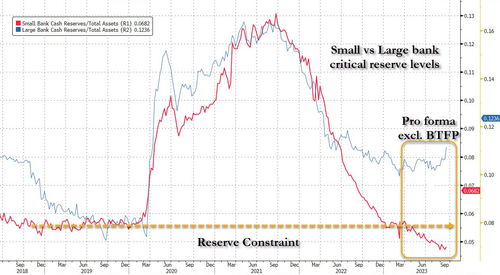

The key warning sign continues to trend lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now).

Source: Bloomberg

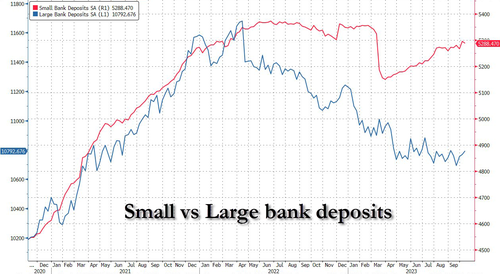

Notably above, Large bank cash is surging (as those money-market fund outflows move?) - is it time to sacrifice another small bank for the greater good?

Source: Bloomberg

Finally, if you're wondering why regional banks were clubbed like a baby seal this week... wonder no more...

Source: Bloomberg

They have a $109BN (at least) hole in their balance sheets that needs to be filled by March-ish...

...(and with rates going higher, good luck!)

Tl;dr:...

- QT is shrinking Fed BS.

— zerohedge (@zerohedge) October 20, 2023

- Shrinking Fed BS means commercial bank deposits have to drop.

- Since deposits (especially at small banks) refuse to drop (normally they would be reallocated to risk but high rates make that unattractive), small bank deposits will be forced to drop. pic.twitter.com/OpWwQs4x5t

More By This Author:

Futures Slide As Oil And Gold Jump, Treasuries Find Tentative Buyers With Yields At 2007 HighsUS Leading Indicators Tumble For 18th Straight Month, "Shallow Recession" In 1H24

Philly Fed Future Expectations For Shipments/CapEx Near 'Worst Since Lehman' Levels

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more