Mixed US Activity Picture Supports July Hike Then Another Pause

Retail sales grew in June but these are dollar values and in volume terms, spending appears lackluster. Meanwhile, with the manufacturing sector languishing and inflation showing encouraging signs of slowing, the widely-anticipated July Federal Reserve interest rate hike may be the last.

Retail sales indicate a mixed spending picture

US June retail sales are a little bit softer than expected at the headline level, rising 0.2% month-on-month versus the 0.5% consensus expectation, but May's figure was revised up to 0.5% MoM growth from 0.3%. Meanwhile, the "control group" which strips out the volatile auto, building materials, gasoline and food service components was better-than-hoped, rising 0.6% MoM versus 0.3% consensus. There was also a 0.1pp upward revision to May for this series. This is important as this stripped-down version of retail sales tends to have a better correlation with broader consumer spending trends over time.

The details show auto sales were weaker-than-expected (+0.3% MoM), given decent unit volume figures from manufacturers, while gasoline station sales surprisingly fell despite rising prices. It was a good month for furniture (+1.4% MoM) and electronics (+1.1% MoM) and miscellaneous (+2%) and internet (+1.9%), but building materials fell 1.2%, sporting goods were down 1% and department store sales fell 2.4%, indicating a very mixed picture for spending.

Challenges mount as credit support fades and student loan repayments restart

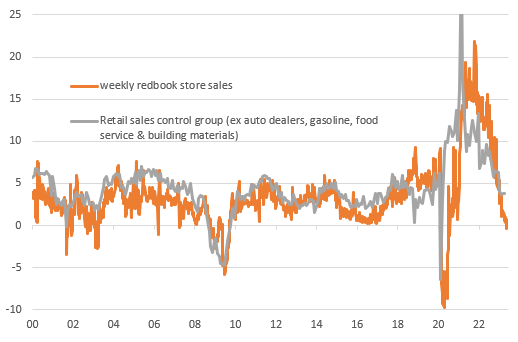

Looking at it in year-on-year percentage terms, retail sales are up 1.7% in aggregate while the "control group" is up 4.3%, but these are nominal dollar figures so accounting for inflation, sales volumes are pretty lacklustre. Moreover, weekly Johnson Redbook sales are in negative territory YoY in early July - also a dollar value figure. This tends to lead the official retail sales numbers, so doesn't bode well. Nor does the softness in restaurant dining, which according to Opentable is running at -2% YoY for July month-to-date.

Weekly Redbook sales point to decelerating retail activity (YoY%)

Macrobond, ING

Also check out the softer consumer credit numbers that have been coming through, for example rising only $7.2bn in May versus the $20bn consensus and the outright consecutive declines in the stock of consumer credit provided by commercial banks in the US over the past three weeks. With student loan repayments also restarting in the next few months the challenges facing the retail sector appear to be mounting, with a further slowing in consumer activity looking like the most likely path ahead.

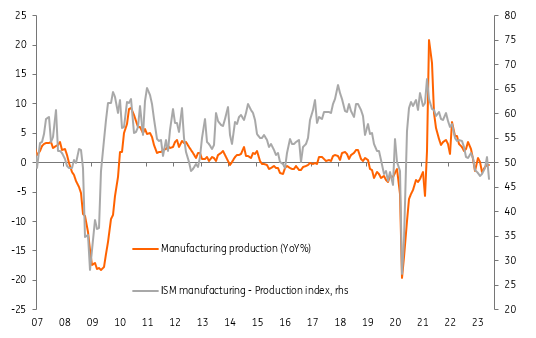

Softer data indicates a manufacturing recession

Unfortunately, US industrial production was much weaker than anticipated in June, falling 0.5% MoM versus expectations of 0% growth. Manufacturing output fell 0.3% MoM rather than coming in flat as predicted while mining fell 0.2% and utility output dropped 2.6%. We know that the ISM has been in contraction territory for the past eight months and we know that the Baker Hughes oil and gas rig count has fallen heftily over the past three months (from 748 at the beginning of March to 675 as of last week – the lowest since April 2020 when spot prices for oil were turning negative). Given this, we aren't expecting an imminent rebound in output from the manufacturing or mining sectors.

US manufacturing output versus the ISM index

Macrobond, ING

July utility output will be up sharply though, with AC units in overdrive, and this is the only hope for a positive number for industrial activity. So with the activity backdrop for the US looking more mixed and the inflation story looking more favourable, the data seemingly supports the narrative of the Fed hiking rates again in July, but pausing again in September, perhaps for a number of months.

More By This Author:

The Commodities Feed: Black Sea Grain Deal EndsFX Daily: Dollar Risk Premium Consolidating

UK Inflation Data To Make Or Break A 50bp August Rate Hike

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more