Mispriced Delusion

Recency bias is one thing. Back in late 2006/early 2007 when the eurodollar futures curve inverted, for example, it was a textbook case of mass delusion. All the schoolbooks and Economics classes had said that it couldn’t happen; not that it wasn’t likely, it wasn’t even a possibility. A full-scale financial meltdown was at the time literally inconceivable in orthodox thinking. A global panic, some sort of unserious joke.

Because of that hardened attitude, what followed was an almost perverse emotional response from those who believed in this. Central banks couldn’t possibly let things go so astray. Yet, the more everything was ripped apart the more fervently they held to the same belief. Bernanke said subprime was contained and only a very few responded with “how would he know?”

If there are rationalizations that hold up asset bubbles, these rationalizations put them to shame.

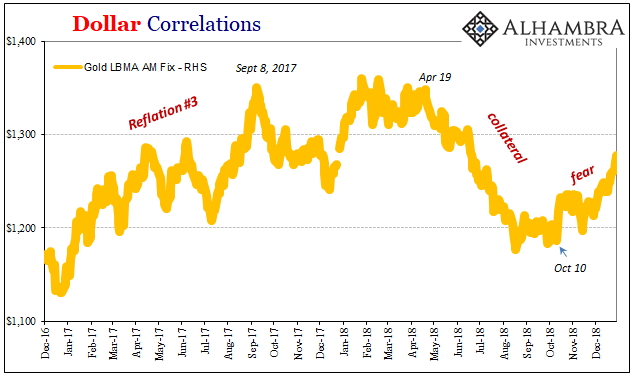

Again, it was recency bias in 2008 so what is everyone’s excuse in 2018? No one can make the case that bad things don’t happen because since 2007 bad things keep happening. There’s now a mappable regularity to it.

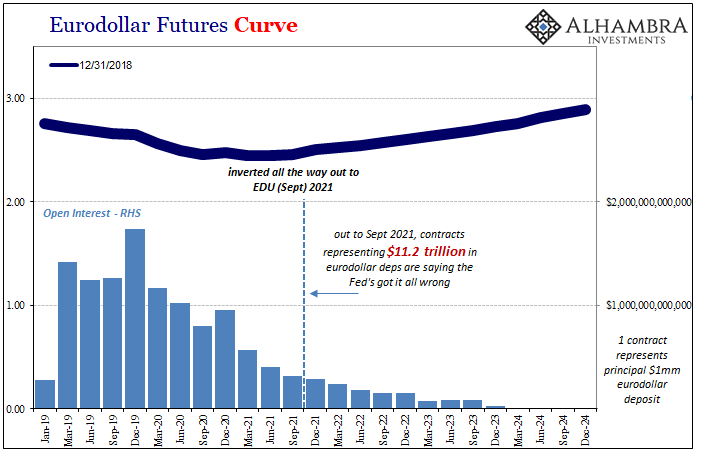

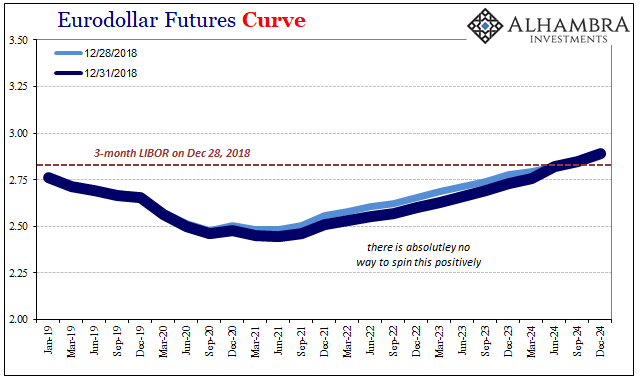

Eurodollar futures are again front and center right where they should be. They’ve been arguing against this whole “strong” economy nonsense all along, even during the rip-roaring inflation hysteria of late 2017. The flat UST curve was nothing compared to the eurodollar futures curve.

Now the curve is substantially inverted and in the short run contracts. Predictably, denial is rampant nurtured by what is an intellectual disease.

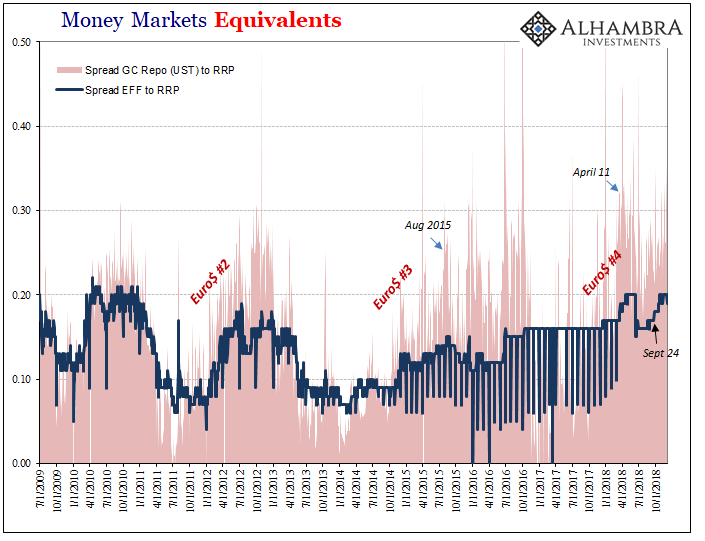

Money markets appear to have completely nixed the idea of Federal Reserve interest-rate hikes in 2019, although the outlook may not be so simple.

Some say the recent repricing may have gone too far, and one observer suggests that the signals across different fixed-income markets are more mixed.

Note the word “mixed” common in use again. I wrote a few days ago what the word really means in this context:

When any official, political outfit characterizes anything as “mixed signals from the global economy” they don’t actually mean mixed. The correct word to have used in this context would have been contradictory. They mean “mixed” in the sense that the evidence is increasingly going the other way which doesn’t comport with the hugely optimistic standard narrative.

The data is negative but the narrative remains positive nonetheless. That kind of “mixed.”

You have Jay Powell on the one side who is Chairman of the Federal Reserve. That’s it; the entire basis to his argument is this pedigree which somehow gives him license to say some pretty stupid things and then repeat them. Over the summer, we were treated to his (and the FOMC’s) constant insinuations that bond markets were “mispriced.” We would never associate the government with gross incompetence, right?

For some reason, despite the utterly humiliating performance of Fed Chairmen in all recent memory, this still means something for especially media and the mainstream narrative.

Stacked against Powell is the eurodollar futures market now pricing lower interest rates maybe early in 2019. They are mispriced, too?

Each eurodollar futures contract denotes a theoretical $1 million eurodollar deposit. It is priced based on 3-month LIBOR, settled at maturity 100 minus the 3-month LIBOR index.

As of today, that means there are more than a million contracts outstanding representing $11.2 trillion in prospective eurodollar deposits out to and including the September 2021 maturity. That’s an enormous, incomprehensible amount of market resources absorbing what can only be described as massive and still growing fear. That’s a lot to all at once declare Powell’s about to humiliated.

In a market that is this deep, what do you think would be required for it to “misprice” the situation so badly? Eleven trillion declares unambiguously that if the inverted curve was nothing more than the product of whimsy or thin reasoning it wouldn’t get very far. It couldn’t, not with so much on the line. A few stray contracts aren’t going to move the tiniest section of the curve even a little; for the whole to distort this far (and keep going) can only mean that there is widespread, worldwide agreement.

That open interest means the idea has been tested over and over and over at the same time not even the media will lob a mildly uncomfortable question Jay Powell’s way (anyone want to get the man talking about “technical adjustments”, plural?) And this eurodollar market testing is conducted by the people and trading desks who actually know a thing or two, unlike the constant bumbling failure that is and has been policymakers.

The eurodollar futures curve isn’t sending a “mixed” signal, it is unequivocal in its warning. You can argue for mass delusion, but to whose case is that most likely?

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more