Minor Losses For Indices Change Little For The Big Picture

Image Source: Unsplash

While coming in as a technical distribution day, the general low volume is a sign that Thanksgiving trading has come early. I won't be expecting much until next Monday, but Black Friday is more likely to be bullish.

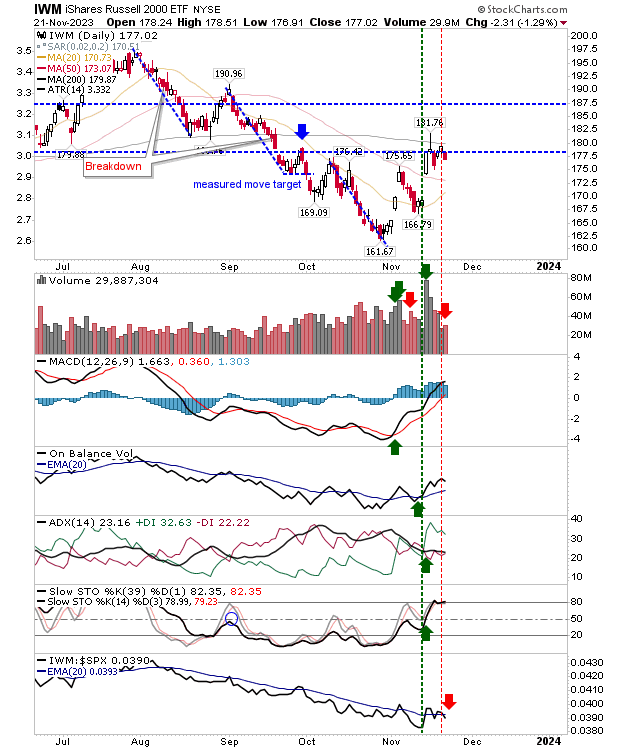

The Russell 2000 (IWM) experienced the largest loss. The 50-day MA is a potential support area although it may not be needed.

Bears could view today's DOJ in the Nasdaq as a bearish harami cross, one of the most reliable reversal signals. If this was to be true it would need a gap lower to confirm. The good news is that there is plenty of support to lean on with the 20-day MA a probable level to test should weakness emerge.

It's a similar story for the S&P as it returns to a relative outperformance against the Russell 2000. Technicals are net positive and the potential for a bearish harami cross reversal is there as it is for the Nasdaq.

It has been a strong advance from the October low. The attempt at a correction in early November was quickly snuffed out, will now be the time we see this happen?

More By This Author:

Excellent Strength Across Indices Sets Up The Coming WeekRussell 2000 Rebuffed By 200-day MA As S&P And Nasdaq Hold Gains

Big Gains On Weaker Than Expected Inflation Data

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more