Michigan Consumer Sentiment: September Prelim Up Slightly

The September Preliminary came in at 71.0, up 0.7 (1%) from the August Final. Investing.com had a forecast 72.0. Since its beginning in 1978, consumer sentiment is 17.5 percent below the average reading (arithmetic mean) and 16.6 percent below the geometric mean.

Surveys of Consumers chief economist, Richard Curtin, makes the following comments:

The steep August falloff in consumer sentiment ended in early September, but the small gain still meant that consumers expected the least favorable economic prospects in more than a decade. Just two components posted additional declines: buying attitudes for household durables fell again in early September to a low reached only once before in 1980, and long term economic prospects fell to a decade low. The decline in assessments of buying conditions for homes, vehicles, and household durables left all three near all-time record lows (see the chart), with the declines due to spontaneous references to high prices. Some observers anticipated that the early August plunge in confidence would quickly disappear since it was driven by emotions. Emotions have long been known to speed responses, the so-called fight or flight response, which was the adaptive function they performed in early August. Many other sources of economic data have since shifted in the same direction, and point toward slower growth in consumer expenditures and purchases of housing to the end of 2021.

There are at least three potential reactions to inflation. Consumers have initially reacted by viewing the rise in inflation as transitory, believing that prices will stabilize or could even fall in the future. As a result, postponing purchases is seen as a viable strategy. This implies a slowdown of spending in the months ahead and a more robust rebound later in 2022. The main alternative is that inflation will not be transient but will rise further due to an unprecedented expansion in fiscal and monetary policies. The resulting rise in inflationary psychology will lessen resistance to rising prices and stiffen demands for increased wage gains. This reaction takes a long time to fully develop, and is contingent on significant increases in long-term inflation expectations, which have yet to be observed. The final alternative is that consumers may believe that the most effective strategy to maintaining their purchasing power is to emphasize increases in their incomes, net of taxes and transfers. The effectiveness of pandemic transfers were shown by their successes in offsetting hardships among those most vulnerable to economic disparities. Transfers to offset the inflationary erosion of living standards could be justified in a similar manner. [More...]

See the chart below for a long-term perspective on this widely watched indicator. Recessions and real GDP are included to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy.

To put today's report into the larger historical context since its beginning in 1978, consumer sentiment is 17.5 percent below the average reading (arithmetic mean) and 16.6 percent above the geometric mean. The current index level is at the

15th percentile of the 525 monthly data points in this series.

Note that this indicator is somewhat volatile, with a 3.0 point absolute average monthly change. The latest data point saw a 0.7 point increase from the previous month. For a visual sense of the volatility, here is a chart with the monthly data and a three-month moving average.

For the sake of comparison, here is a chart of the Conference Board's Consumer Confidence Index (monthly update here). The Conference Board Index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan Index.

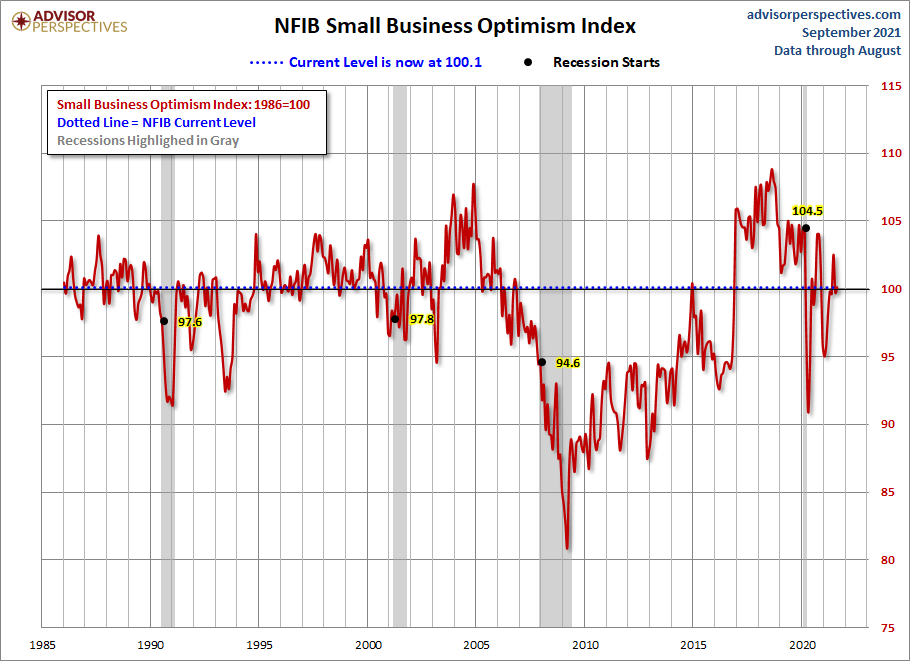

And finally, the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB Business Optimism Index (monthly update here).

The next update to this report will be published on October 1.