Medical Tech M&A Analysis: Cardio And Vascular

A deal was announced earlier today, June 7th, 2016, with Zimmer Biomet (ZBH) agreeing to acquire LDR Holdings (LDRH) for $1, a 65% premium, and paying 4.6X FY17 sales. LDRH specialized in spinal medical technologies and was the best in class name versus peers in terms of FY17 sales growth and gross margins. LDRH also had no long term debt and a healthy cash hoard with 5 years of consistent sales growth.

I expect many more deals in Med-Tech the rest of this year, though the pool of sub $2B market cap companies is relatively small. I want to look across each industry within Med-Tech to find the best M&A candidate looking for growth and above industry-average margins as two keys for being an attractive target.

The next focus are I am going to take a look at is in the Cardio and Vascular areas of Med-Tech. There are quite a few potential buyers in this space including Medtronic (MDT), Boston Scientific (BSX), and Edwards (EW). There was recently a monster $25B deal in this area when Abbott (ABT) announced a $25B deal for St. Jude Medical (STJ). St. Jude (STJ) did a $3.4B deal in July 2015 for Thoratec (THOR) as well in this space.

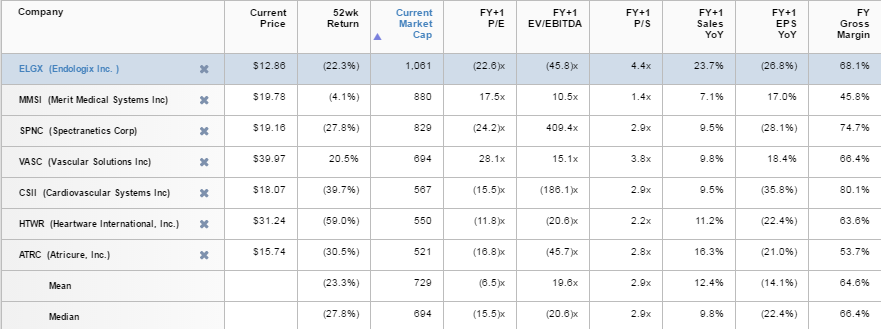

The group of small caps in this area include Endologix (ELGX), Merit Medical (MMSI), Spectranetics (SPNC), Vascular Solutions (VASC), AtriCure (ATRC), HeartWare (HTWR), and Cardiovascular Systems (CSII).

The table below shows these names broken into basic valuation, growth and margin figures.

(Click on image to enlarge)

Merit Medical (MMSI) is the clear value name of the group at 1.4X FY17 Sales and 17.75X Earnings, but also is on the low end of the spectrum for growth and margins. Vascular Solutions (VASC) is the most sound fundamental play on the list, seeing strong forward revenue and EPS growth with strong margins, but is already trading at a premium.

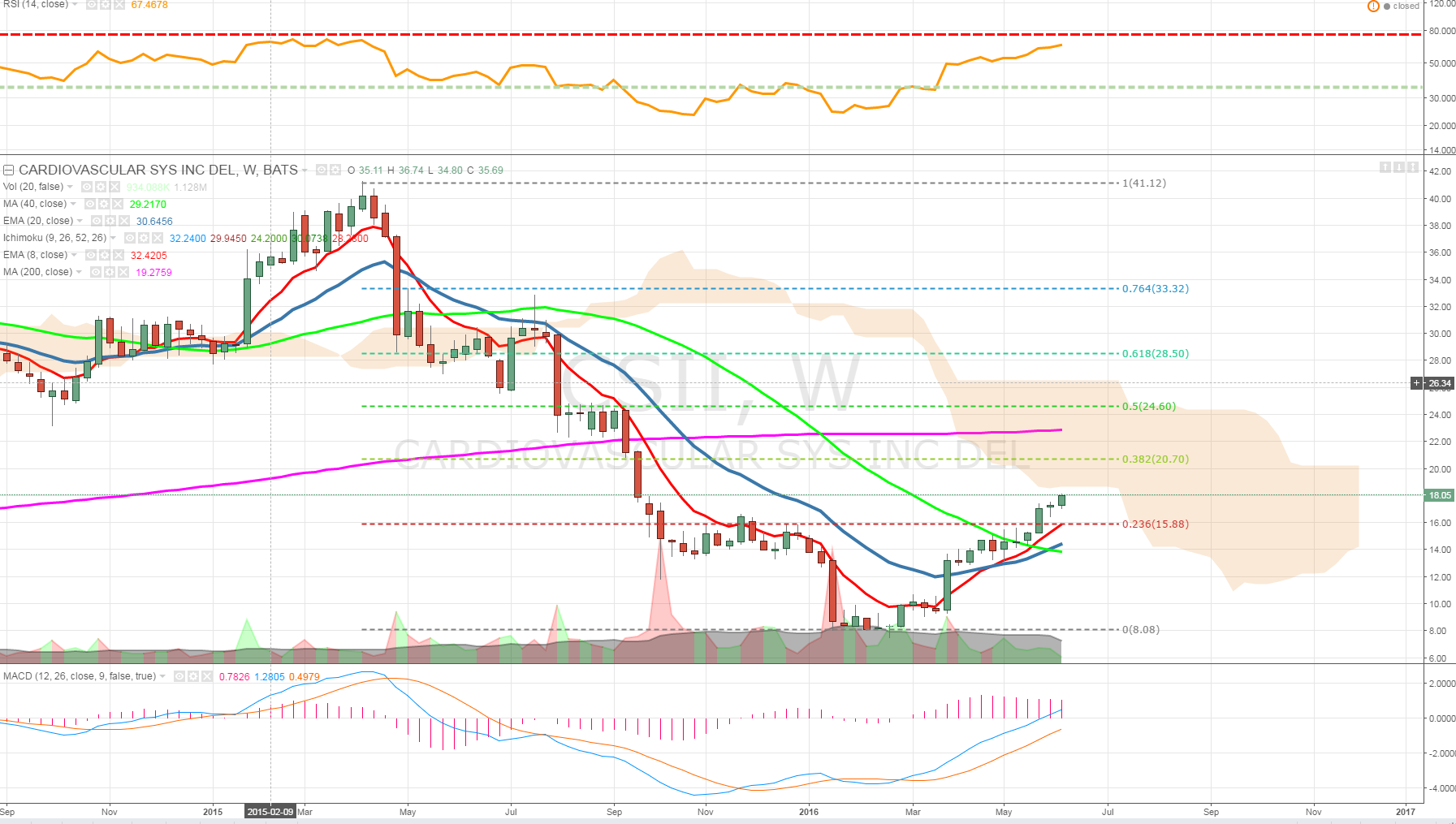

Cardiovascular Systems (CSII) is the main name of interest, at 2.9X FY17 Sales it trades inline with the mean of this group, but offers industry-leading 80% gross margins and has no debt with $60M in cash. CSII shares traded above $40 in early 2015 before coming under pressure and trading recently as low as $8, but now regianing some relative strength and moving out of the downtrend. In May the COmpany posted Q3 results that were above Street expectations and guidance also beat estimates, and the Company expects to return to a growth phase in FY17. CSII fell on tough times after a DOJ investigation was announced in May of 2014, but that is now behind the Company. Another interesting CSII development is that the CEO stepped down in late February after being diagnosed with cancer, so the Company may be ripe for the picking.

(Click on image to enlarge)

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more