May Updates: Rising World Output Projects Higher Grain Stocks Than Expected

Market Analysis

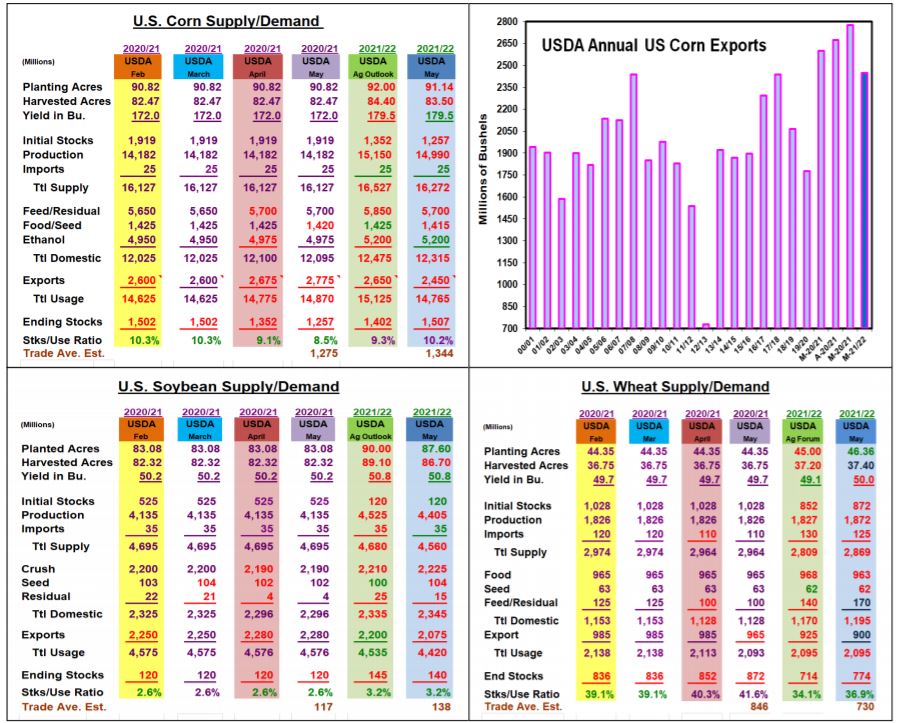

The USDA’s old-crop US supply/demand updates were generally as expected. However, the World Board’s optimism for larger US & World 2021/22 crops produced some modest new-crop US export forecasts. These smaller demands resulted in larger 2022 US corn & wheat stocks than expected. The USDA did utilize their Ag Forum yield levels & this spring’s planting intentions to project the general sizes of the 2021/22 US corn and soybean crops.

Corn’s US 20/21 feed & ethanol demands were left unchanged this month. China’s strong purchases & Brazil’s dryness hurting its second crop (102 vs 109 mmt last month) helped boost corn’s exports by 100 million bu. This dropped May’s stocks to 1.257 billion bu. This smaller carryover reduced corn’s 2021/22 supplies. But the USDA’s outlook for a strong world output led by China, S America & Ukraine trimmed their US 21/22 exports by 200 million bu. vs their Ag Outlook forecast. With Brazil’s forecast remaining dry for another 2-4 weeks, its output & exports could drop another 5-7 mmt boosting US exports by 200 million bu later this year.

May’s old-crop US soybean stocks were left unchanged at 120 million bu as expected. After April’s 30 million export increase & 200 million bu of beans still to be shipped, no export change was made. However, this year’s lower-than expected planting intentions tighten the USDA’s new-crop supplies. The USDA reduced bean’s US exports to 2.075 billion bu. (a 205 million lower level than this year) to keep US stocks at minimal level.

This month’s 1st US winter wheat crop was 27 million bu larger than trade ideas with higher hard & soft red crop prospects. However, reduced PNW & N Plains spring wheat potential because of current dryness kept the USDA’s overall wheat crop near expectations. The USDA did slice 20 million bu of old-crop export demand. Similar to corn, optimism about larger world wheat crops also surfaced with a lower US export forecast. Even with a 70 million bu higher feeding estimate, 2021/22 US wheat stocks were higher (WEAT).

What’s Ahead

The market’s reactions to this month’s USDA larger 2021/22 world crop outputs weaken values across the major crops from pre-report levels. However, Brazilian weather conditions impacting its safranha corn output & dry subsoils in WCB and the US Plains remain major obstacles to larger crop outputs in both continents.

Hold remaining 5-10% corn & soybean supplies. Keep 2021 sales at 20-25% for now (CORN, SOYB).

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more