Massive Short-Squeeze Sends Small Caps Soaring; Big-Tech Skids, Bitcoin & Black Gold Bid

Image Source: Pixabay

Jobless claims just won't quit and were enough to send Treasury yields higher today after ARM and DIS earnings' blast-offs last night.

Rate-cut expectations drifted lower still (hawkish)...

Source: Bloomberg

But stocks hit a new record high...

Source: Bloomberg

The S&P 500 hit 5000.4 intraday...

Source: Bloomberg

...thanks to a miraculous sudden huge buy program in the last few seconds...

Source: Bloomberg

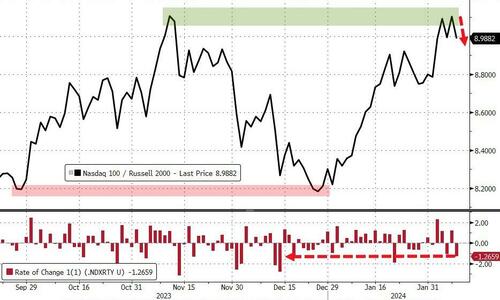

One thing of note, the S&P 500 is at a new all-time high, while the Russell 2000 is still in a bear market...

Source: Bloomberg

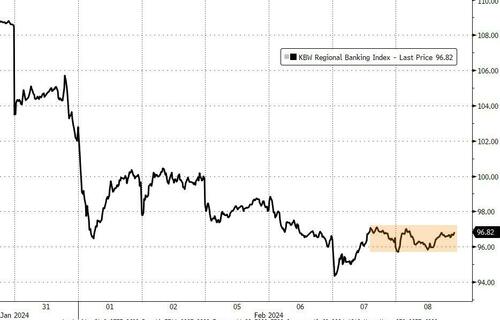

No, 'banking crisis 2.0' is not over. NYCB dumped today...

...and the overall Regional Bank index went sideways...

Source: Bloomberg

Today saw small caps rip higher while the rest of the majors trod water (at a very marginal new high for S&P)...

This was the second-best daily RTY-NDX outperformance in two months, which happened to occur at a critical resistance level...

Source: Bloomberg

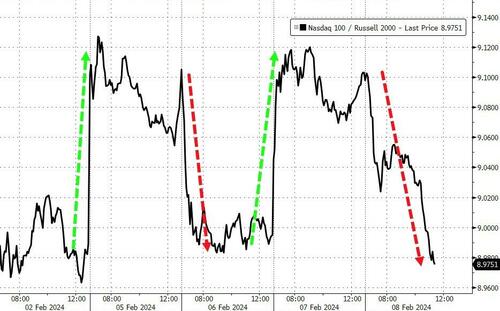

It's been quite a wild ride this week for the RTY-NDX pair - whipsawing from one side to the other... PRESUMABLY, tomorrow brings a big Nasdaq outperformance day...

Source: Bloomberg

ARM was up 50% (yes 5...0)... lol

Source: Bloomberg

DIS rallied over 11% on the day, to one-year highs...

Source: Bloomberg

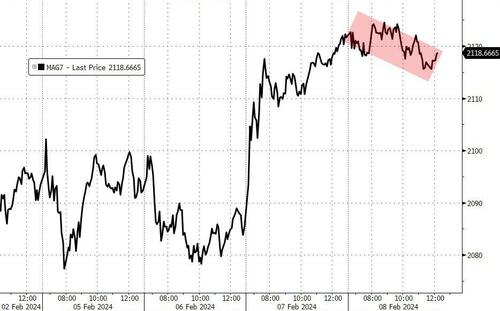

MAG7 stocks drifted very modestly lower on the day...

Source: Bloomberg

Amid a massive short-squeeze...

Source: Bloomberg

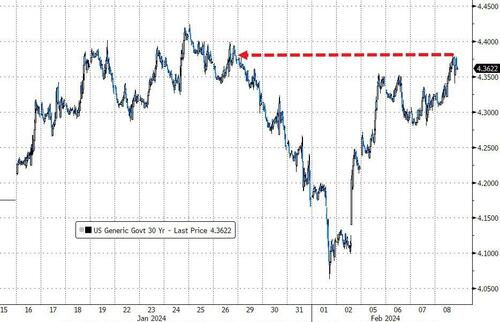

Treasury yields were higher on the day (despite a strong 30Y auction), with the belly (5-10Y) underperforming (2Y +2.5bps, 10Y +6bps, 30Y +4bps).

Source: Bloomberg

Even though the 30Y auction was solid, yields pushed up to two-week highs...

Source: Bloomberg

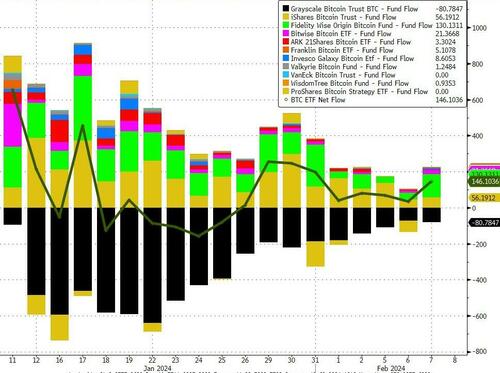

Bitcoin surged back above $45,000 today...

Source: Bloomberg

...after yet another strong day of net inflows to spot bitcoin ETFs...

Source: Bloomberg

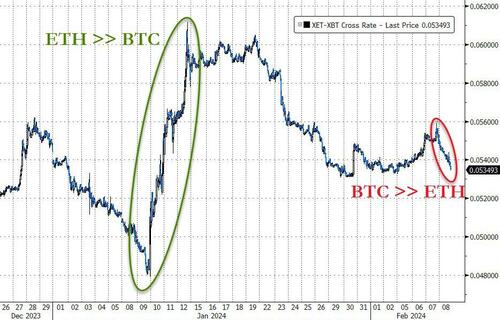

...and bitcoin notably outperformed ethereum today...

Source: Bloomberg

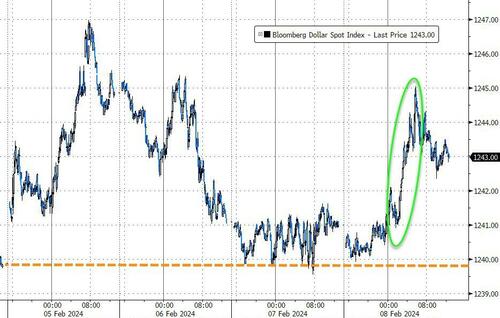

The dollar jumped higher on the strong claims data...

Source: Bloomberg

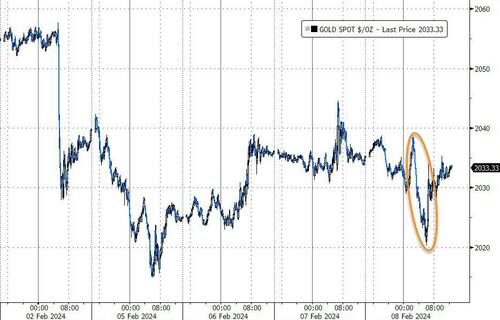

Gold ended the day practically unchanged (despite the dollar strength), after diving to $2020 and finding support...

Source: Bloomberg

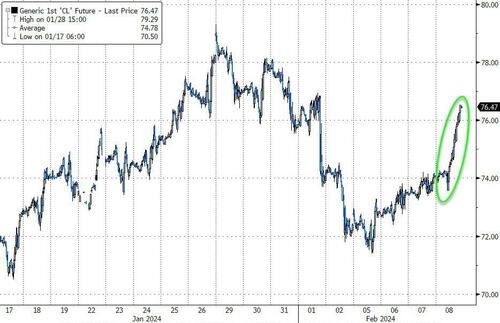

Oil prices surged today with WTI back above $76, erasing the drop at the end of last week...

Source: Bloomberg

Finally, all eyes remain on tomorrow's CPI revisions and next Tuesday's January CPI print. With S&P vol skews at near-record lows...

Source: Bloomberg

...what could go wrong?

More By This Author:

Money-Market Fund Assets Hit New Record High As Fed's Bank-Bailout Facility Holds At $165BNStellar 30Y Auction Sees Surge In Foreign Demand, Biggest Stop Through In 13 Months

Despite Mass Layoffs, US Jobless Claims Declined Last Week

spx iwm nycb ndx arm dis ief bitcomp eth-x uup gld uso oil uco bno

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for ...

more