Markets Sell-Off But Recover Into Close

Trump kicked off the week with some market turmoil, but market participants still seem to consider his presence good rather than bad for the market. The only exception was the Russell 2000, which sold off and stayed sold off. This has created a 'bull trap' next to last week's 'bear trap'; a neutral setup.

For the Russell 2000, a loss of 1,341 opens up for a retracement down to the 200-day MA at 1,233 and the November swig low of 1,156 (which looks a long, long way away). Technicals saw the trend metric +DI/-DI turn negative as the MACD pulled away from a potential trigger 'buy'; shorts should probably be looking at shorting rallies from here.

(Click on image to enlarge)

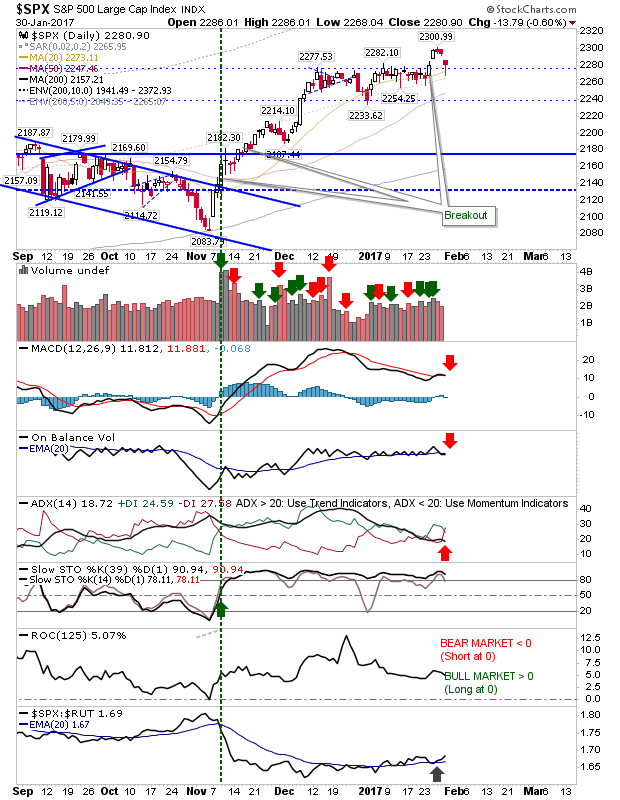

The S&P recovered the threat on its breakout - but it hasn't yet confirmed a 'bull trap'. While the breakout held, there were technical 'sell' triggers for MACD, On-Balance-Volume, and +DI/-DI. Relative performance against Small Caps saw improvement.

(Click on image to enlarge)

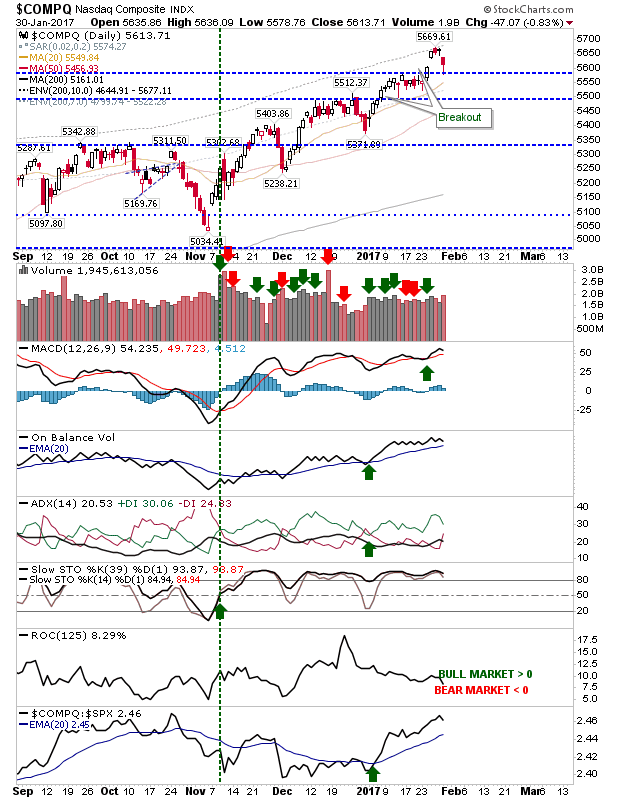

The Nasdaq tagged breakout support, but hasn't yet threatened a 'bull trap'. Technicals are all still in the green.

(Click on image to enlarge)

Tomorrow looks to be all about the Russell 2000. If loses accelerate, then it will likely spread to Large Caps and Tech, but for now, only one index is feeling the heat.

Disclosure: None.

Thanks