Markets Panic While Economics, Insiders And Valuation Indicate Buying Opportunity

“Davidson” submits:

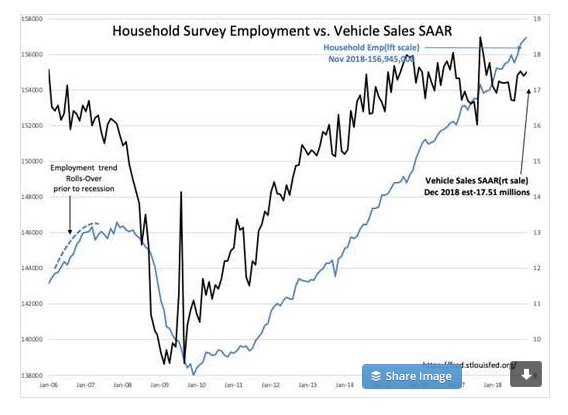

Global markets are in panic, but economics, insiders, valuation measures indicate buying opportunity. To underscore the strong current economic trends, employment continues to rise and vehicle sales remain at decent levels. The recent pessimism is global and in my opinion, is connected to price trends reinforced by the belief that it is simply ‘time for a market top’. The economic indicators do not agree with the Household Survey Employment series which remains in a strong uptrend. This employment indicator has a history of rolling-over after vehicle sales have declined prior to prior market tops and recessions. There are no signs of such weakness in this data. Markets do not have specific timeframes over which they cycle. Markets are dependent on economic trends and respond after the fact. Market prices are driven by investors as they digest the information at hand. Most investors use price trends believing that someone else has better information than they do. Investors mostly act like a group of lemmings, nose-to-tail. A trend begins, they follow and continue to do so till economic data is sufficient to change the direction.

(Click on image to enlarge)

With the rise in global wealth, US markets are increasingly influenced by perceptions of foreign investors. These investors, for the most part, are price-trend followers. Recently, with Russian, Chinese, Iranian missile threats and an accelerated detention of US citizens as bargaining chips, those seeking capital protection have shifted more towards the US$ (US Dollar) assets. This has been a global panic-shift and the US 10yr Treasury rate has fallen precipitously causing the US Treasury yield curve to flatten. The T-Bill/10yr Treasury rate spread has fallen to 0.20%. This is not the negative signal it has been historically because it comes from global panic and not from euphoric investing. This, in turn, has triggered Momentum Investor algorithms to sell oil prices and industrial issues lower. The recent disappointing news in Apple iPhone shares have been interpreted as global slowing and impacted all equities. Few are the analysts who recognize that iPhones over $1,000 without much innovation are simply over-priced for Asian markets. Apparently, Samsung now leads the smartphone market technologically with Apple well behind. The daily T-Bill/10yr Treasury rate spread series reflects the global panic.

(Click on image to enlarge)

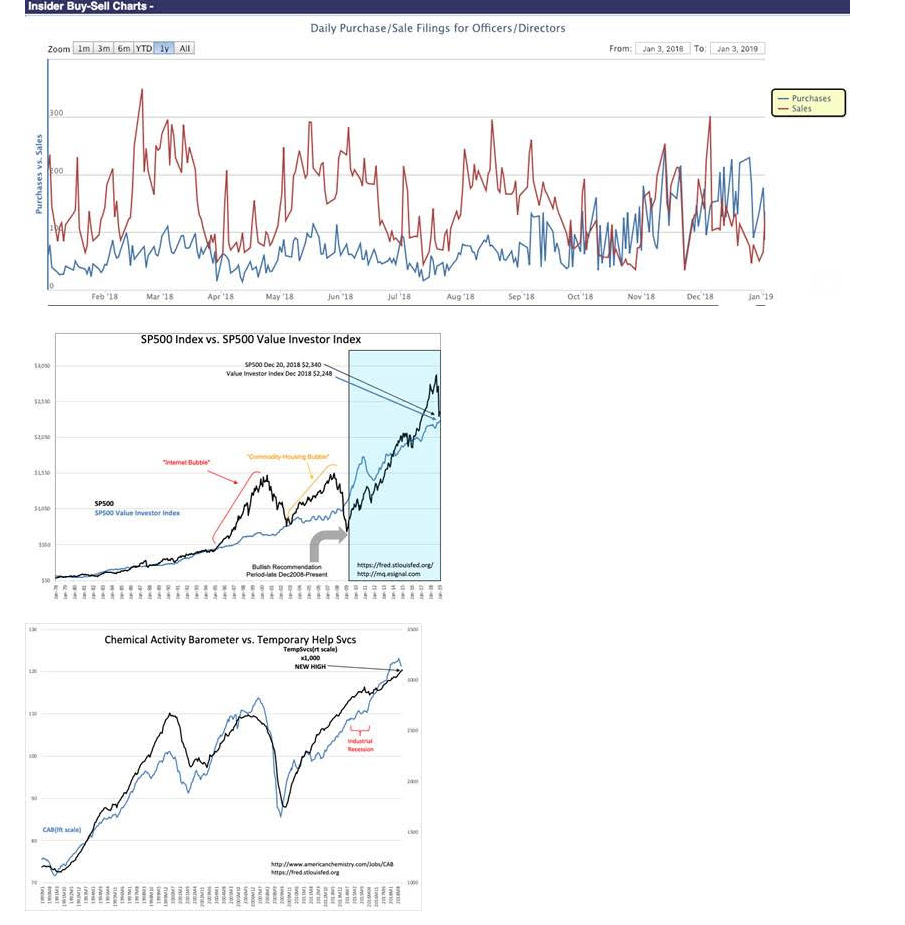

That markets are undervalued continues to be signaled by insider activity which has been highly reliable at identifying equity buying opportunities. As markets began to decline, insider buying(BLUE LINE) began to rise above insider selling(RED LINE) and has built a period of persistent accumulation from late Oct 2018 through Present. The level of insider buying is not the spike usually observed but been more extended throughout the period. A very positive signal in my experience. Buying has occurred is in many sectors but not in the F.A.N.G. issues which have been the Momentum Investor favorites. The SP500 Value Investor Index another reliable measure of valuation is very positive.

That the future direction of employment is likely to continue higher comes from the Temporary Help data which reached a new high with today’s employment reports.

(Click on image to enlarge)

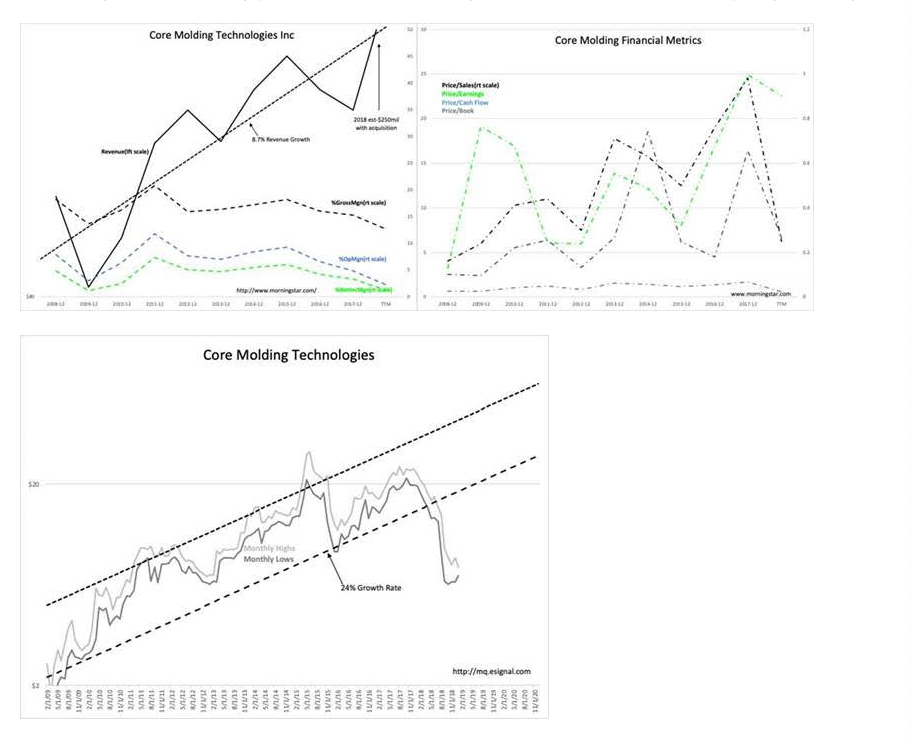

Core Molding as an example of an investment signal

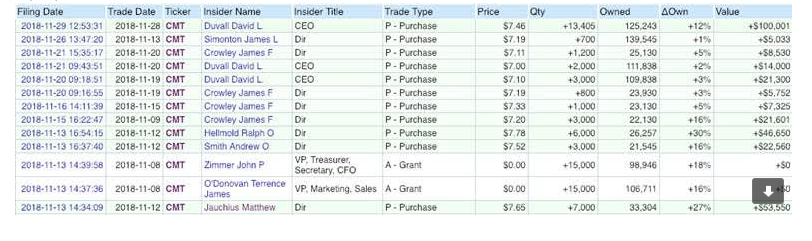

Core Molding Technologies( CMT) as one of many individual examples of increases in insider buying by managements with excellent long-term financial performance histories. Many issues have declined well below reasonable levels. That is the effect of no ‘Uptick Rule’ and Momentum price-trend activity. I consider the market pricing of CMT a good example of discounted pricing with strong insider accumulation. CMT supplies large truck manufacturers with body panels a business which is in a strong uptrend. The demand for truck transport and new vehicles is a fundamental measure of general economic conditions.

The Morningstar financial history, price metrics, and share history indicate how far the current market pricing has diverged.

(Click on image to enlarge)

(Click on image to enlarge)

Summary:

The key employment data and market valuation signals all point to this being a strong equity buying opportunity. The DJ rising more than 500pts today demonstrates how markets follow short-term economic reports without much long-term analysis. The next few years look particularly attractive for equity investors in my opinion.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more