Markets Mixed After Inflation Data, Tariff Updates

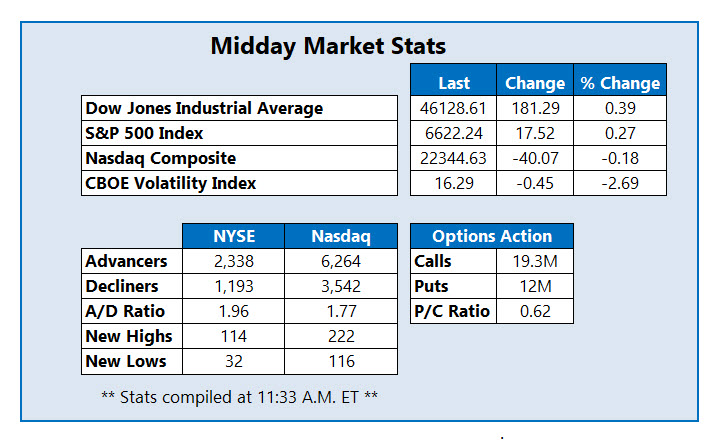

Markets are trading mixed this afternoon following an August personal consumption expenditures (PCE) price index reading showed core inflation at 2.9%, in line with expectations. The University of Michigan's consumer sentiment reading also came within expectations at 55.1 for last month. The tech-heavy Nasdaq Composite (IXIC) is the only loser today, last seen off 40 points, while the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) sport decent midday gains. Updated tariff measures from the Trump administration remain in focus as well. For the week, all three indexes are eyeing losses.

Investment name Galaxy Digital Inc (Nasdaq: GLXY) was last seen down 4.9% to trade at $30.53, a popular pick among bearish traders in the options pits today. So far 14,000 calls and 168,000 puts have been exchanged, 5 times the average daily options volume. Most popular is the weekly 9/26 35-strike put, set to expire at the close today. GLXY remains up nearly 40% for the quarter and earlier this week hit a record peak of $35.74.

The best stock on the New York Stock Exchange (NYSE) today is Eastman Kodak Co (NYSE: KODK), last seen up 7.9% to trade at $6.67, rebounding after two days of losses. Today's surge is pushing the shares back in the black year-to-date and to a close above the 200-day moving average for the first time since mid August.

Financial software stock Klarna Group PLC (NYSE: KLAR) is dragging on the NYSE today, with the shares last seen off 6.2% at $38.92, headed below their initial public offering (IPO) price for the first time. Today will mark a fourth-consecutive drop for the newly public security, which began trading Sept. 10.

More By This Author:

Stocks Land In The Red For 3rd-Straight SessionStocks Sink As AI Darling Drags Broader Sentiment

Dow Suffers First Back-To-Back Loss In 3 Weeks