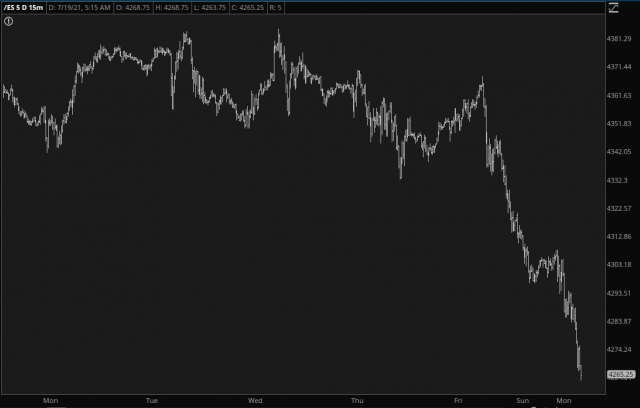

Markets: How About This Time?

It actually makes all the sense in the world. A week ago, when the ES was at the most absurdly, laughably overpriced point in human history, even ZeroHedge was posting statements from the vermin at Goldman Sachs about how the market would simply keep going up because of the Fed. In other words, why wouldn't it keep going up? And, in all seriousness, it’s tough to argue with that.

And yet……….

Of course, I trust this market about as much as I trust David Michael Solomon, the head of the aforementioned vermin zoo. That is to say, not at all. Ever since Greenspan sent this nation on an irreversible course to epic disaster, any weakness has been met by the shameless intervention of our betters at the federal government. So it pays to be insanely paranoid.

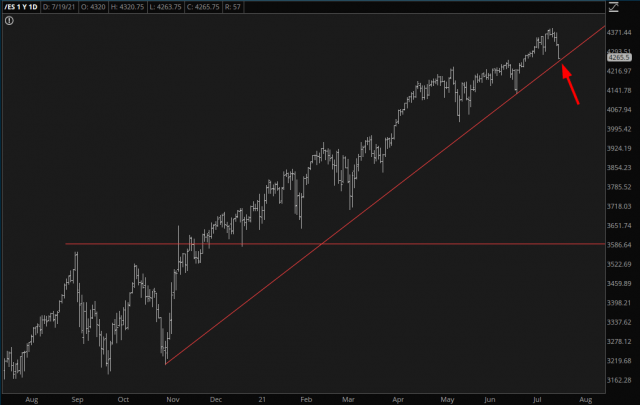

As a chartist and loveable permabear, my hesitation this morning is centered on this trendline on the ES. We are pretty much at support as I am typing this.

Support, however, is not a permanent phenomenon. Crude oil has, thanks to OPEC finally agreeing to crank up its output, has broken its own uptrend (and I hasten to remind everyone here that I have been annoyingly bearish on energy for quite a while). I would add, as an aside, my astonishment at the comments section over at ZH when the Opec deal was announced: to a man, they were all scurrying around trying to anticipate just how HIGH this would make crude go. I felt really stupid because I thought it would go down on such an announcement. Well, guess they were wrong.

Just to wring my hands a bit more, here is the futures chart of the small cap /RTY. This has been range-bound for months, and it is approaching the bottom of its range as well as a major supporting trendline. So if bulls – – curse them – – want to have some hope, then these major supporting lines should provide them. I’m excited and nervous, for obvious reasons, given the confluence of weakness we have seen for the past few days juxtaposed with the prospect of that traitorous touch-hole named Jerome Powell leaping to the rescue of his billionaire buddies yet again.

Before the opening bell, I have all the puts I can afford. Hopefully, I will navigate these treacherous waters with grace and aplomb.

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more