Markets Calm Ahead Of Macro Storm, But...

Image Source: Unsplash

After last week's chaotic dumps and pumps across various asset classes amid Powell's comments, a giant 'quad witch' OpEx, and mean-reverting FedSpeak, today saw markets take a pause (of sorts) with stocks, bonds, the dollar, gold, and crypto all relatively flat close-to-close with only crude oil showing any real action - monkeyhammered lower for no apparently good reason...

Source: Bloomberg

Today's apparently calm demeanour perhaps reflects anxious traders gearing up for a pretty busy week of 'hard' and 'soft' data, including the Thursday's durable goods report, Friday's PCE inflation report, plus the Consumer Confidence survey and Richmond Fed survey tomorrow.

The vol market is showing nervousness (and the election is well and truly priced in)...

Source: Bloomberg

All the US majors plunged as European PMIs hit at the European open (ugly across the board). Then futs rallied into the US open, only to be sold again with Small Caps the biggest losers on the day. Of course, we managed a new closing high for both The Dow and S&P 500 though...

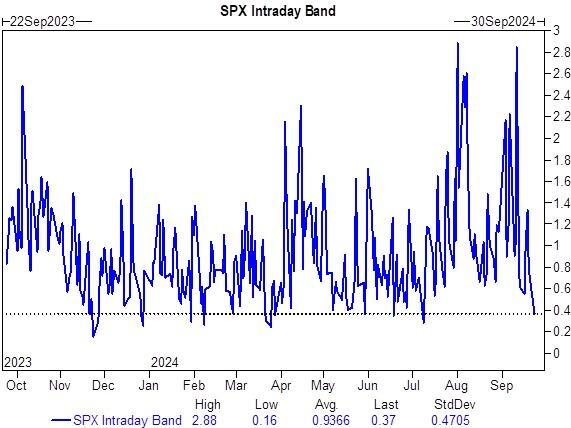

Notably, Goldman points out that the S&P traded within its lowest intraday band (37bps) since early July.

Mag7 stocks continued in their post-Powell surge wedge...

Source: Bloomberg

A somewhat chaotic looking day under the hood in stocks with energy puking at the open, then panic bid, then dumped into the European close. Discretionary outperformed as Real Estate lagged...

Source: Bloomberg

Stocks and bonds remain significantly decoupled since the July FOMC meeting...

Source: Bloomberg

Treasury yields were relatively unchanged close-to-close, despite selling pressure during the EU session and buying during US...

Source: Bloomberg

The yield curve continues to steepen dramatically with 2s10s up yo +16bps today - its steepest since June 2022...

Source: Bloomberg

Not exactly a good sign for those hoping that The Fed will bring down mortgage rates.

The dollar also ended flat on the day after surging on the EU PMIs (EUR weakness) and then fading back into its recent range...

Source: Bloomberg

Gold limped a bit higher - another record high but was basically unchanged...

Source: Bloomberg

Bitcoin ripped higher overnight (topping $64,500) before fading back to almost unchanged...

Source: Bloomberg

Ethereum continues to outperform Bitcoin, surging up to one-month highs on a relative basis...

Source: Bloomberg

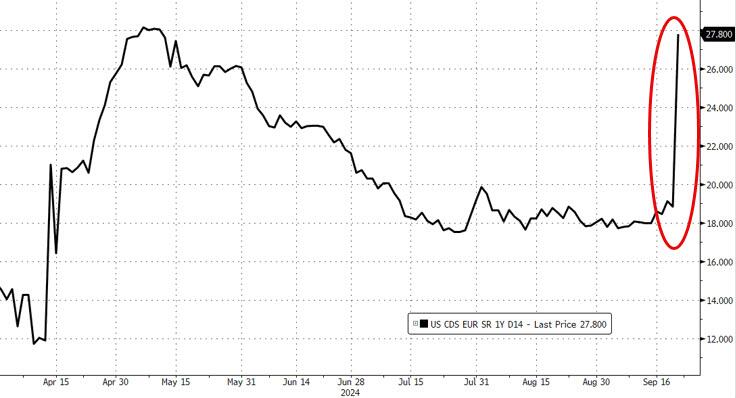

Finally, this just happened...

Source: Bloomberg

That is a sudden surge in the market's perception of USA's short-term sovereign credit risk.

More By This Author:

Key Events This Week: Core PCE, GDP, Durables And Fed Speakers GalloreGold, Oil, & Crypto Soar As Fed Slashes Rates With Stocks At Record Highs

Bank Deposits And Money-Market Funds See Sizable Outflows As Stocks Surge

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more