Market Panic: Buying The Dip And Making Plans For Portfolio Protection

As I write these lines futures for the S&P 500 are down by over 4.5%. This is clearly related to the collapse in oil prices, which is adding more uncertainties to the widely uncertain market environment being produced by the COVID-19 pandemic.

In this highly uncertain context, my plan of action remains in place. I am planning to buy the dips in high-quality stocks during the correction, while also having plans for portfolio protection in case the bottom falls off and we enter into a much deeper and prolonged bear market.

How We Make Investment Decisions

The future can never be known or predicted, so investing is always a matter of probabilities as opposed to certainties. The smart thing to do is to increase your market exposure when there is a good probability of strong market returns and to decrease your exposure when the probabilities are unfavorable.

Nobody knows how the COVID-19 crisis will evolve and what kind of impact it will have on the market. The economic effect of the virus is hard to quantify at this stage, but it will most probably be material.

However, the most important thing is understanding how emotions affect the market returns and how you can profit from the biases and overreactions of other investors. The data is quite clear, most of the time you make attractive returns in the market if you buy when everyone else is selling.

This happened time and again during periods such as the financial crisis in 2008, the European debt crisis in 2011, the Ebola fears in 2014, the declining oil prices in 2016, and the trade war with China in 2019, to name a few relevant examples among many.

Make no mistake, those periods of market pessimism were also very challenging, and there were plenty of reasons to be concerned about the economy during those market phases.

However, even during tough economic times, buying when everyone else is selling tends to produce attractive returns over the middle and long term.

Pessimism At Extreme Levels

Last week was another tough week for the markets. The S&P 500 ended the week not too far away from where it started, but volatility was at historical records, with the market making huge moves every day. Based on the price action in the futures market, on Sunday night, there is no end at sight for the volatility.

Source: Advisor Perspectives

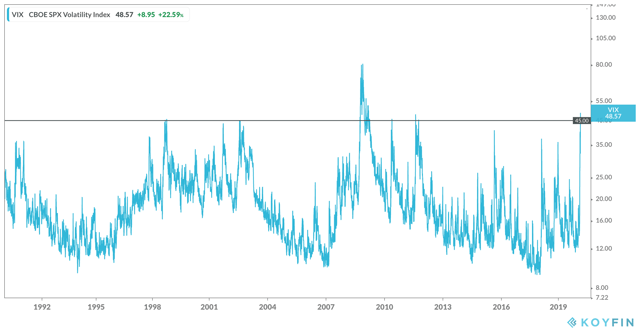

There are all kinds of indicators showing that sentiment is approaching panic levels in the market. The VIX index traded as high as 54.39 on Friday and it closed the day at 41.94. Only during the financial crisis in 2008, the VIX reached substantially higher levels.

Source: Koyfin

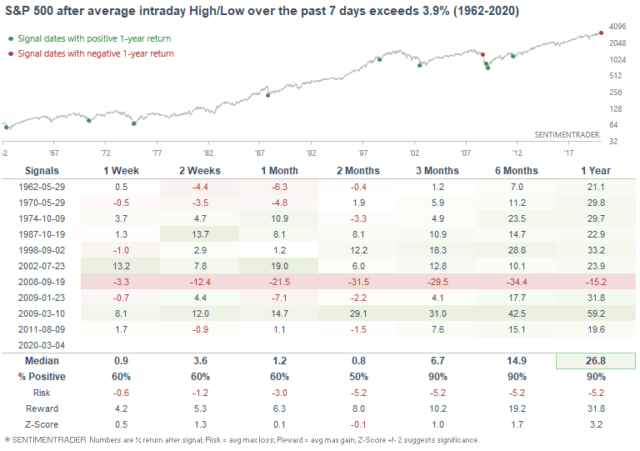

The table from Sentiment Trader shows what kinds of returns the market has produced in the past after volatility reached unusually high levels. As we can see, returns over 6 and 12 months were broadly positive on all of the occasions except for September of 2008, during the financial crisis.

Interestingly, during the financial crisis and the subsequent recession, we still got two signals in January and March of 2009, and those two signals produced big gains for investors over the middle term.

Source: Sentiment Trader

Granted, looking at these cumulative returns in a spreadsheet can be misleading because many times investors had to endure tremendous volatility and considerable drawdowns to achieve those returns.

However, it is what it is, and the evidence is quite clear. Unless we are facing a "financial armageddon" scenario such as 2008, this kind of market action generally creates good buying opportunities for investors over 6 and 12 months.

Looking For A Bottom

The main problem with the market right now is that the news flow will probably remain quite negative. Chances are that we are going to keep hearing about new coronavirus cases in the U.S. and all over the world in the days ahead, and this will generate all kinds of disruptions for the economy.

Adding to the uncertainty, collapsing oil prices could cause some serious trouble in the debt markets. I would not be surprised at all if we learn about hedge funds and other leveraged sophisticated investors getting in deep trouble due to the volatility over the past few weeks.

As Buffett said:

"It's only when the tide goes out that you learn who has been swimming naked"

Some news related to rapid advances in treatments or vaccines for COVID-19 could be a game-changer in terms of the market sentiment. Intervention from the Fed and other Central Banks could also help in the short term.

However, how the market reacts to that news can be even more relevant than the news itself. If we see the market holding on well in spite of bad news about the spread of COVID-19, this could be indicating that this factor is already incorporated into expectations and that we are finding a bottom in prices.

I would also like to see the market retesting the lows from February 28 with a more stable breadth, which could be indicating that the selling pressure is getting exhausted.

To be clear, this is just a key development to watch when looking for a bottom. We don't have any signs indicating that a bottom is in place based on the evidence currently available.

The Recovery Could Be Vigorous

Nobody knows for how long the COVID-19 pandemic will last and how deeply it will affect the markets and the economy. But chances are that the world will overcome this crisis in the next several months, and the recovery could be quite strong.

The economy was doing well when the coronavirus appeared on the scenario. The US economy added 273,000 jobs in February, comfortably beating market expectations for 175,000 jobs. The virus will be a considerable headwind in the short term, but over time the U.S. will overcome the crisis and the economy will start growing again.

When the recovery comes we are going to have massive monetary stimuli from the Fed, and low oil prices are good for consumers. For these reasons, I wouldn't be surprised to see both the economy and the markets doing quite well in the second half of 2020.

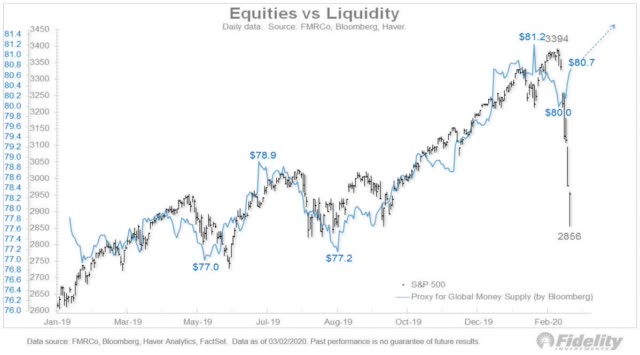

In fact, even if economic growth remains subdued after the COVID-19 crisis, liquidity is a key driver for the market, and we are going to see enormous liquidity injections from the Fed and other central banks over the coming months.

If there is one lesson that has to be learned based on the market behavior in the past decade, that is that you want to be positioned on the same side of liquidity trends.

Source: Fidelity

The Plan Remains On Course

Volatility has been nothing short of spectacular in the past two weeks, and making decisions in this market environment is exceptionally risky and uncertain. However, things have been going on according to plan, and I see no reason to change the course at this stage.

Due to excessive optimism in the market, we were expecting a correction in January, so we raised cash levels to 50% of the portfolio. Now the correction is taking place, although it is admittedly much faster and more violent than I was expecting.

The smart thing to do is slowly adding to positions during a correction, especially when sentiment is getting intensely fearful. We have increased stock holdings in the portfolio from 50% to 67.2% in the past two weeks. The plan is to continue buying high-quality stocks at attractive prices, particularly if we see some signs of stabilization in the market.

Nobody buys at the exact bottom, you will always be early or late to some degree. Being early is generally more painful because you need to tolerate the drawdowns that happen until the market bottoms.

However, things can change very rapidly in this market environment, so it makes sense to start buying when prices are declining in case you get a sharp reversal up for whatever reason.

In addition to buying on dips, it makes sense to have a contingency plan in case the market does not find a bottom in the near term. The market has been acting in an unusual way lately, and you never know how far this kind of behavior can go. If the bottom falls down from the market, protecting the portfolio with hedges via short selling or inverse ETFs can make a lot of sense in order to reduce volatility and keep drawdowns under control.

This plan is not perfect or infallible by any means, but it is consistent and it goes well with my overall investing philosophy, my time frames, and my risk tolerance level.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it ...

more