Market Overview - Thursday, June 29

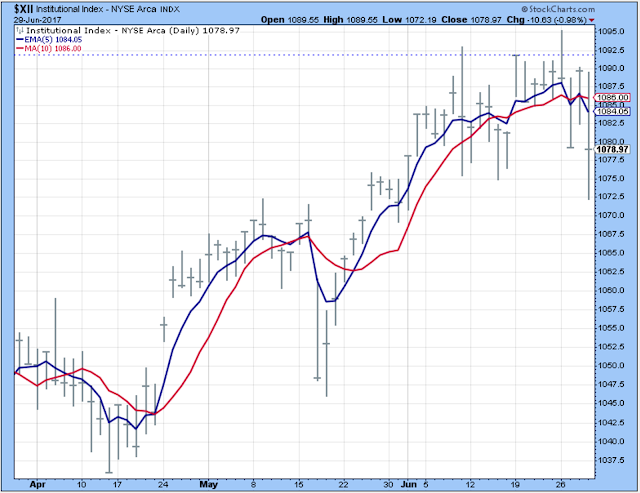

The Institutional Index is showing some short-term weakness. I think this chart confirms a short-term market downturn that probably started on Tuesday.

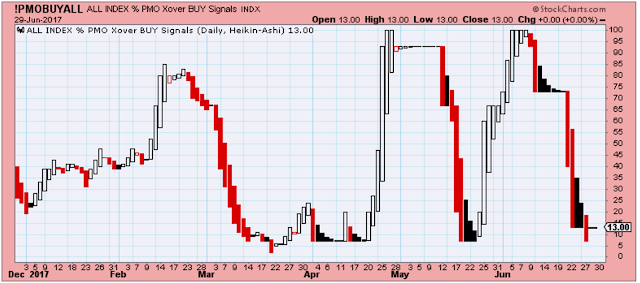

But, the PMO index has been in the oversold range for a few days. Generally, I think of these lows in the PMO index as buying opportunities, but I think this time it is indicating that the general market is ready for a medium-term correction.

This chart shows the SPX breaking the trend line, but holding the support level. When the SPX breaks down in this chart, then we have the possibility of a broader decline. So the bears have a little work to do.

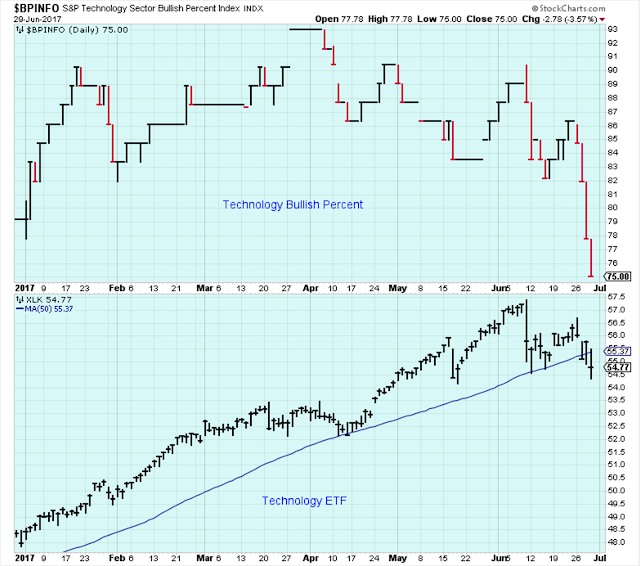

This is a good chart. The Tech index has broken the 50-day, and the bullish percent is confirming the decline. I am sure I am not the only one looking at this as a potential buying opportunity in the weeks ahead.

A problem for the bears... this index hasn't broken down yet. I don't think the market is headed significantly lower unless this chart shows weakness.

Here is another chart that I think needs to break down if we are to get a significant market decline.

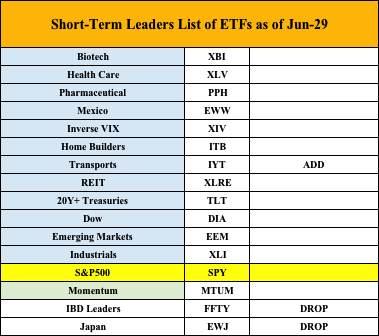

The Leader List

Transports were added to the leader list today, and the IBD Small Cap Leaders and Japan were dropped. The Financials, XLF, is very close to being added as a leader.

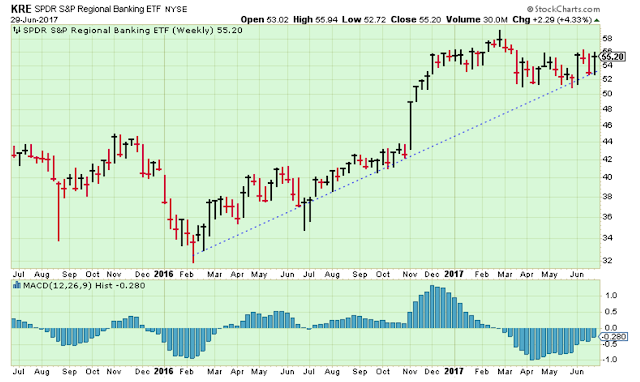

There is a lot of discussion about higher rates, and how that favors banks.

This is a very good looking chart of the regional banks. I like the set up, but do I really want to buy this ETF with the rest of the market selling off? Maybe I will be more inclined to buy if this breaks out higher.

Outlook

The long-term outlook is positive.

The medium-term trend is under pressure and might be topping out.

The short-term trend is down.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more

Thanks