Market Losses Worsen After Consumer Sentiment Data

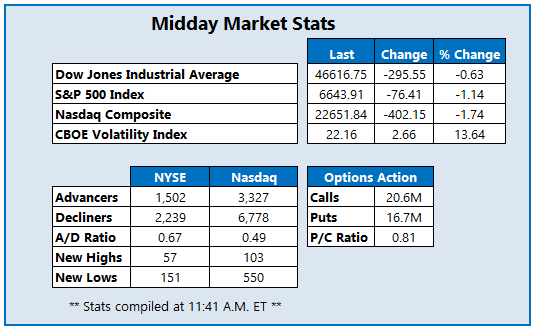

All three major benchmarks are firmly lower at midday, heading for sharp weekly losses, as sliding tech stocks continue to hammer the broader market. The Nasdaq Composite Index (IXIC) and Dow Jones Industrial Average (DJI) are eyeing their second-straight triple-digit drops, while the S&P 500 Index (SPX) sits firmly lower as well. Consumer sentiment data from the University of Michigan is also weighing, falling to 50.3 and nearing its lowest levels ever.

NuScale Power Corp (NYSE: SMR) stock is seeing unusual options activity today, with 129,000 calls and 146,000 puts exchanged so far, which is already double its average daily options volume. The November 29.50 call is the most popular, with new positions being bought to open. At last check, the nuclear energy stock was down 15.6% at $27.40 after the company's third-quarter revenue miss, earlier hitting its lowest levels since May.

Expedia Group Inc (Nasdaq: EXPE) stock is soaring today, up 17.3% to trade at $257.69, after strong third-quarter earnings results. Jumping to fresh record highs after breaking past pressure at the $225 level, the online travel name is now up 38.2% year to date.

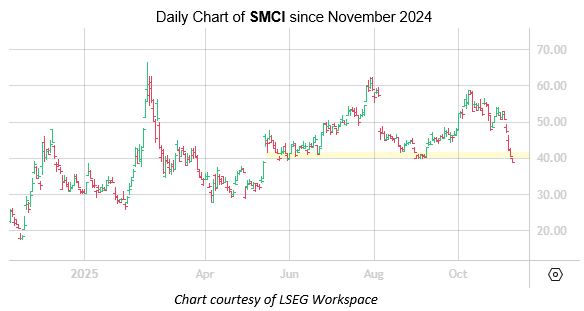

Super Micro Computer Inc (Nasdaq: SMCI) stockis feeling the heat from the chip sector today. The shares were last seen down 3.8% at $38.80 and headed for their fifth-straight daily loss, extending their post-earnings drop from two days ago. Dropping below the $40 level, which has been a floor of support since May, the stock is still up 26.9% since the start of 2025.

More By This Author:

Dow, Nasdaq Fall Over 400 Points As Tech Resumes Losses

Dow, Nasdaq Snap Back With Triple-Digit Wins

Nasdaq, S&P 500 Move Higher As Tech Stocks Rebound