Market Blast – Monday, February 12

The Fuse

Flatness is the word with equity futures, the SPX are flat while the Nasdaq futures are slightly higher. The industrials are off modestly as the markets continue to grapple with mediocre earnings outlook from companies calling for a subdued 2024. Four Fed speakers out today including Miki Bowman and Neel Kashkari.

Interest Rates are down modestly this morning as bond buyers were coming in to pick up some bargains following the recent selling. Rate strategists at Bank of America are concerned the 10 year range may shift higher following some strong economic data. Today we’ll get the NY Fed’s measure of consumer inflation expectations.

The Chiefs won the Super Bowl for the second consecutive year as they beat the SF 49ers for the second time in the last five years. It was an amazing comeback for the team which was down 10 at one point. Stocks are trying to start the week off right into the CPI print tomorrow. Asian indices are closed for Lunar New Year week. European stocks rose up overnight and are trying to drag the US equity market up with it.

Earnings are still in focus and some big names will be released this week including Cisco, Shopify, Coke, AIG, DraftKings and Biogen.

Markets finished strong this past week, the 14th higher week of the last 15. Some are worried, and for good reason that stocks are way ahead of themselves. Valuations are starting to become rich but when market momentum and liquidity are driving the bus it is difficult to stop it. Frankly, we don’t have an overbought reading of the indicators though sentiment is wildly bullish. Eventually the dip buyers won’t respond, but don’t try and predict when.

Breadth was pretty good on Friday, the best day of the week for advancers over decliners. New 52 week highs continue to rise as that indicator is still on a buy signal. What helps is strength in the Russell 2K, this index carries enormous weight for daily breadth. Oscillators are positive now but not overbought yet.

Strong turnover across the board led the markets to have a nice accumulation day. Small caps were shining brightest with the heaviest turnover vs the prior day. A few more of these would string together some solid volume days and keep this indicator on a buy signal. Remember the importance of the price/volume relationship.

We have 4,900 still as support but with the SPX 500 now over 5K a few more sessions above there will at the very least make 5K a short term support level. If the SPX 500 is above there by the end of the week then the 8 day MA is likely to be above there as well, a good sign of short term momentum staying the course. Resistance is a bit harder to distinguish but we could say 5,120 for now is where it is at. Dow Industrials at 40K would be strong resistance.

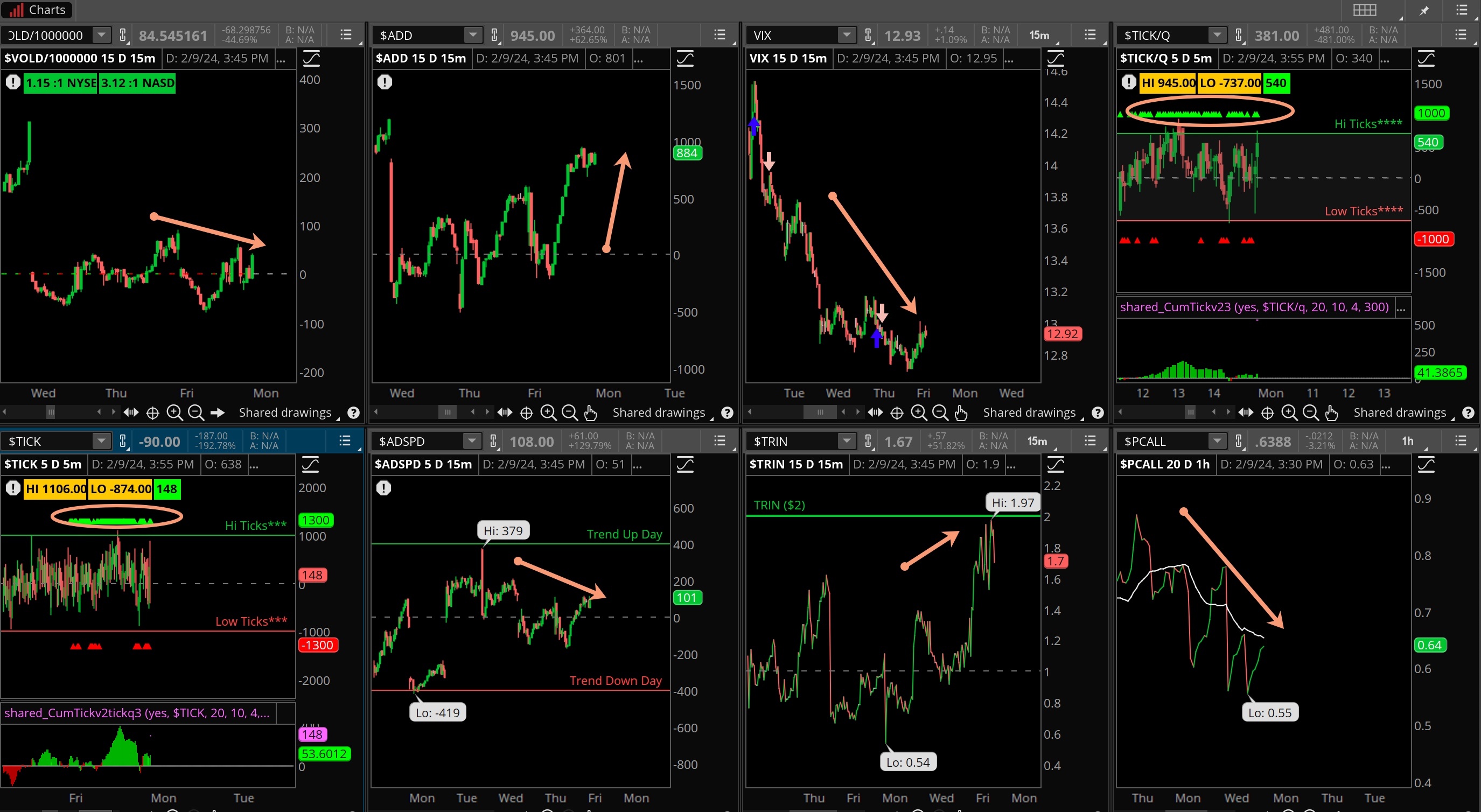

The Internals

What’s it mean?

The internals on Friday were a bit mixed, noticed the strong move up in ADD but only a slight move higher in VOLD. That tells us volume was not supporting the moves on this day. Does it matter? Sure it does, but we remember to not fight the price trend. Ticks were also very strong, look at the heavy green arrows in the two boxes. TRIN was up high curiously, this is because heavy volume did not support the rising breadth. Again, not a problem yet.

The Dynamite

Economic Data:

- Monday: Treasury Budget

- Tuesday: Small Biz Optimism, CPI for January

- Wednesday: Crude Oil Inventories

- Thursday: Jobless claims, retail sales, IP and cap utilization, import/export prices

- Friday: PPI for January, housing starts/permits, Michigan sentiment preliminary

Earnings this week:

- Monday: ANET, WM

- Tuesday: KO, ABNB, MAR, MGM, WELL

- Wednesday: CEVA, GPN, KHC, MLM, CF, CSCO, FSLY, EQIX, VECO

- Thursday: ARCH, DE, HBI, IDCC, SHAK, WEN, AMN, AMAT, DLR, IR, ROKU, SKT, TTD

- Friday: AXL, THS, VMC

Fed Watch:

We heard from several Fed speakers this past week, most notable of them was Rafael Bostic from Atlanta, a voting member who seems to believe inflation is on the right track heading downward. Further, Lorie Logan from Dallas Fed believes the committee needs to see more data before entering a rate cut mode. Clearly the members (others too) are being a bit more conservative, not a bad idea at this juncture and with the markets being more aggressive about rate cuts.

Stocks to Watch

VIX – Once again, we have a three day weekend coming up and we often (not always) see a big drop in volatility before then. This week’s action may be softer to start the week but the markets are not all that overbought either, so a bit of rallying might occur as well.

Inflation – We have the January readings of CPI and PPI this week along with retail sales. The Cleveland Fed Nowcasting is calling for a 1.5% annualized gain on the top line but core still a bit hot at 3.9%. If the numbers come down we could see a sharp market rally.

Small Caps – The Russell 2K has been the laggard so far this year, but had a nice jump towards the end of the week. If this was simply short covering then the IWM will go back down, especially if rates are on the rise.

More By This Author:

General Electric Co Chart AnalysisHow To Handle Trading Mistakes In A Bull Market

ServiceNow Inc Chart Analysis

Disclaimer: Explosives Options disclaims any responsibility for the accuracy of the content of this article. Visitors assume the all risk of viewing, reading, using, or relying upon this ...

more