Marion Hubbert And Boone Pickens On Oil's Mess

The price of oil is as difficult to predict as it is important to investors' economic outlook. Books have been written on a correlation between climbs in oil and subsequent recessions so that all you had to do is look for a swift enough climb in oil to know that a recession was soon to follow. But for every such analyst, there is one who points to weak oil as a sure sign of recession at hand. Whatever your views, we all know oil is the 800 pound gorilla in the economic china shop. So when accomplished oil price experts like Daniel Yergin and Boone Pickens speak, investors lean, hand cupped to ear, to listen.

Hubbert's Curve

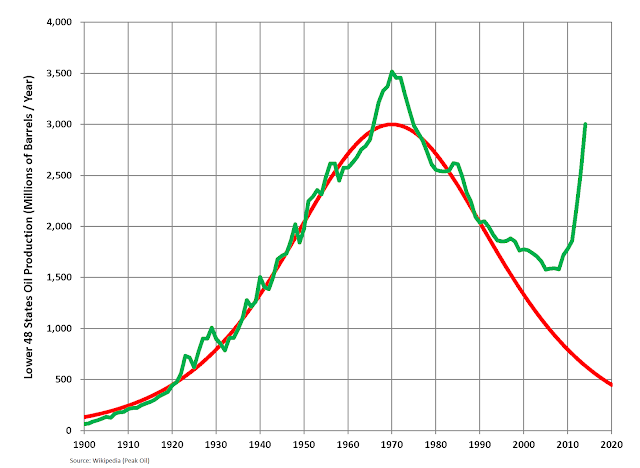

In the early days of oil in 1956, a Shell geophysicist named Marion Hubbert, a much more obscure expert, developed a math model of oil production. He was reviled as crazy, almost unpatriotic in the robust American oil business of the 1950s. But his projection method called for a peak in US production in 1970, after which would be a permanent decline. And that actually happened:

The red line is Hubbert's math projection made in 1956, and the green line is how it actually turned out. The above Wikipedia chart is for the lower 48 and doesn't show the large contribution of Alaska in the '80s. But Alaska wasn't even a state in Hubbert's 1956 model. His math was for conventional oil from naturally pressurized reservoirs (the only kind of oil they knew back then) and it has essentially proven to be correct.

But then, along came shale. This unconventional bonanza has blown the needle far away from Hubbert's curve of physics for conventional reservoirs. Drilling horizontally in oil laden rock and propping open fissures with sand fracking is a totally different recovery with a whole new set of physics and planet of reserves. This departure from Hubbert's world can be seen very graphically in the US production history above. Two things happened to take us far away from the conventional curve, deepwater oil in the Gulf, which started in earnest in the mid '90s as the above chart shows, and the recent shale revolution, the radical explosion starting in 2009.

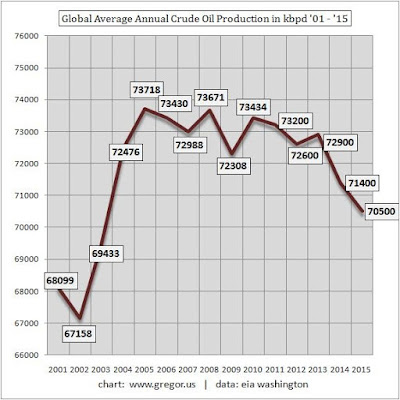

So, as Hubbert's projection for a global peak approached in the early 2000s, slightly fewer considered him a lunatic because his US prediction had been so accurate. His global peak prediction was refined mathematically by Ken Deffeyes, a Shell associate of Hubbert's, as being 2005. So how did Hubbert's global prediction turn out? Well, that crazy man was right again:

The peak was 2005 right on the nose, just as Deffeyes pegged it in his 2005 book Beyond Oil and in his 2001 book Hubbert's Peak: The Impending World Oil Shortage where, according to Amazon's review :

Deffeyes used a slightly more sophisticated version of the Hubbert method to make the global calculations. The numbers pointed to 2003 as the year of peak production, but because estimates of global reserves are inexact, Deffeyes settled on a range from 2004 to 2008

You see varying levels of this "conventional" oil from about 74 mb/d (EIA numbers) to around 84 mb/d depending on how many NGLs (natural gas liquids) and other things are included in "oil". NGL is from gas production, so purists don't like lumping them in with crude production dynamics.

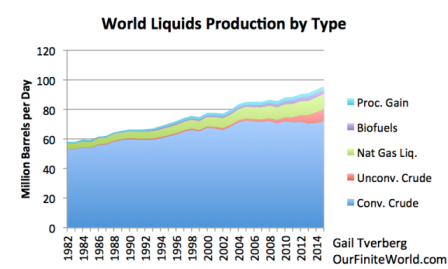

Here we see a rough breakdown of just what is propping us up from the disasters of peak oil. The two big props are the pale green one and the pink one - that is fracked gas liquids and shale oil (unconventional crude). If it weren't for the gas shale fracking revolution that came along, natural gas production, along with the associated liquids, which get put into the "oil" totals, would have plummeted long ago.

This difference in conventional crude and total liquids is behind all the arguing over whether peak oil was right or wrong. "Peak total liquids" has not happened yet, and with shale, may not happen for a long time. Peak conventional crude did happen, and it happened exactly as Hubbert and Deffeyes said. It is also what Boone Pickens has said. Without the pink prop shown above, we would be put back on Hubbert's curve, and Pickens estimates something like $175 oil would result. And without the natural gas shale fracking giving us the green prop, oil would probably be even higher, if the economy could stand it.

Boone Pickens On Peak Oil And The Saudis

The two vastly different types of oil source never gets explained very well, and few understand the difference or its immense implications. This is very evident, for example, in the tempestuous Dec. 23, 2014 CNBC Squawk Box interview with Pickens, right after the sharp collapse in oil, where Joe Kernen calls anyone who still believes in peak oil a nut saying "that was a horrible call". Pickens responded, "You need to go back and look at what happened to oil production without the United States." Kernen then goes on about the Malthusian bet on world catastrophe. Pickens responded, "Yeah, well that's all good bullshit and all [this cracks Kernen up] ...in 2005, you peaked. Go back and look at it ... I'm the expert, not you ...what saved you was the shale." The conversation meanders from there with Kernen complaining that "oil is oil", not understanding much about the oil business. Shale is as if we traveled to a whole new planet and began farming it and adding it to our earth oil that we've been poking a hole in an underground balloon for.

Anyway, all this has abruptly propelled us far away from Hubbert's curve into a world now drowning in oil.

As if all this natural over supply against a weakening global economy wasn't enough of a price killer, we have the price war aspect of oil production as a nasty reality in our world today. Saudi Arabia, thought of as the swing producer, operates mainly conventional fields with high EROI (net energy and ease of extraction) and they frown on significant competition. They not only frown on it, they annihilate it.

Some say this is really what happened with the fall of the Soviet Union in the late 1980s. Reagan's arms race was a real pain for the Soviet economy. But as the forbes.com article "It's Time To Drive Russia Bankrupt - Again" pointed out:

It wasn't Reagan's massive defense build-up, or his Star Wars program, that drove the Soviet Union to the wall; it was the decline in real oil prices caused by the Reagan/Volker/Greenspan strengthening of the US dollar.

The Saudis rubbed salt into those monetary wounds, because Russia was co-leader in the world's oil production at the time with poor quality fields nowhere near the Saudis' EROI and profit price. The Saudis gunned production with their better fields to levels beyond prudent oil field physics and flooded the market with oil just below Russia's break-even price - and Russia suffered an economic collapse. Thus we had the dramatic decline in prices going into the late '90s while Russia's inferior fields were being put out of business.

The Saudis have been aiming that same gunnery at their new enemy, the US shale producers now, as Boones Pickens has often pointed out. In a 4/28/16 article in The Tulsa World titled "T. Boone Pickens calls U.S. oil industry 'dead in the water'." they said of Pickens:

Since 1980, he recalled in an interview, he has watched oil prices plunge five times worldwide. Four of those times, he said, Saudi Arabia stepped in to cut its oil production, balance the market and bring prices up again. The fifth time — this time — the Saudis kept pumping away, prices stayed low and U.S. companies let their drilling grind to a near-stop. Pickens doesn’t expect them to resume anytime soon ...

The Saudis could be waiting for the destruction of the shale industry before they bring prices back up again. Are they really that cut-throat? Pickens certainly thinks so. On the pending public offering of Saudi Aramco stock :

“It’s a joke,” he said, because stockholders would own stakes in a company still very much subject to Saudi politics. “Who the hell would want to own Saudi Aramco?”

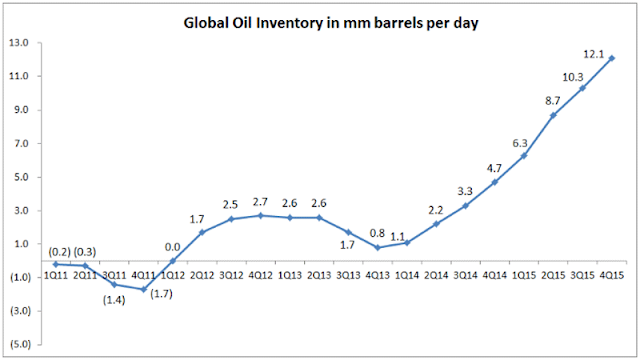

You could, however, make the case that it's mainly the shale explosion that is acting as the swing producer nowadays, not the Saudis. Take a look at this chart:

Here we see that total shale has added 5 mb/d to the world's production whereas the Saudis have been flat since mid 2011, and their market moving excess capacity is thought by Pickens to be only about 1-2 mb/d. In a price war, are they fighting with a pea-shooter compared to the shale guns?

Well, fighting they are. And they're putting up a pretty good scrap.

Pea-shooter or not, OPEC is the only one shooting any ammo in this war. Their lifting costs are only about $15 a barrel, lower than anywhere. The higher cost US and Russian producers are not trying to keep any lid on prices and aren't trying to drive anyone out of business. But Aramco is a state run company, meaning that they run the government with their oil profit. And they need about $80 oil or they must cut services, impose taxes, or dip into their cash reserves of $750 billion built from $100 oil. In the current price melt, they are burning that reserve at $6 billion a month, a rate that will leave their peashooters empty soon. So it's a rope-a-dope strategy by everyone against them, hoping they exhaust their arsenal soon and have to live with oil climbing over $60, limited only by real supply and demand in the US/Russia production onslaught.

The Saudis may soon become a more a victim of low oil than a victor. As was pointed out in an article "Saudis Will Not Destroy The US Shale Industry" at The Telegraph, their temporary ploy can only force the shale properties and technology to change hands, not ever be destroyed. For all the damage they inflicted on Russian oil in the '90s, Russia is now the world leader in production, outdoing the Saudis.

I have said all that to say this: the price of oil is not controlled by supply and demand equations you can tote up and say price must do this. It is controlled by aberrant malinvestment cycles gone crazy, geopolitical price war machinations, surprise innovations, and about everything under the sun that any sane investor avoids. For about 5 brief years from 2003 to 2007, oil pricing was between price wars, economic collapses, and surprise innovations; and Hubbert's curve took firm control as the peaking of conventional ran us way short of oil. I was fascinated with Hubbert's theory and went long energy in those years. But ever since it was de-Hubbertized in 2008, I have avoided the whole sector.

Oil simply has way too many layers of unpredictability in it now, many I haven't even mentioned - like Iraq's future flood of the only significant light, sweet fields left unexploited, and the very dangerous net energy problem with shale. Boone Pickens has a history of making some very good calls on oil, but over the last couple years, he has been way wrong, calling for $80 in early 2015 by the end of that year, and missing big on the high side since then. I'm not knocking Pickens. I am a great fan of US natural gas as a bridge fuel in trucking and the whole Pickens Energy Plan for America. I was writing on this bridge fuel thing years before he went to Congress with his proposal. He is on my short list of people I'd like to see as Secretary of Energy, president, or whatever position could enact The Plan.

But I think oil has gotten to be almost uninvestable, and even the best predictors are stumped. We are in a transition zone. On the other side will be a stable shale industry, in different hands, and it will be a good investing area again. We aren't there yet.

Adding to all the mess oil has gotten into is the whole banking aspect of it. As we all know, the shale drillers have borrowed heavily in the NIRP free money years with oil above $55, putting their fortunes in the same boat with a great many banks. Now with the oil oversupply keeping the price in the range where conventional oil profits but shale doesn't, the Saudis are again showing little mercy on their competition, and are thus at great odds with banking as well this time. But this isn't 1988, and in this derivative crazed banking world we live in today, if they do to shale what they did to the USSR, we all could be in a heap of trouble. The Saudis are probably aware that the shale debt craze has put $2 into the ground for every $1 of revenue, and they just have to keep oil below $60 until the shale companies fold up.

We are going to have banking troubles while bankruptcy courts redistribute the valuable shale properties, until the US shale is "restarted" after oil stays high for awhile. In the above mentioned The Tulsa World article, Pickens was speaking at a gathering of supply-siders, including Art Laffer, Steve Forbes, Larry Kudlow, and some fund managers:

It’ll be hard to start the United States back up,” he said ... They pressed Pickens on how high prices would need to rise to bring U.S. oil rigs back online en masse; he said higher than $40 or $50 a barrel — probably closer to $60.

If we stay in a stable price war, with excess conventional capacity from the likes of the Saudis keeping the shale industry throttled, we will eventually be put back on Hubbert's curve where no excess capacity exists anymore from shale or anybody; and, as Pickens is predicting, prices will then ascend and slowly bring shale back. This would likely be a gentle process of perhaps many years. We should be so lucky. If the Saudis' price war and the banking problem induce shock into the financial system, a badly hurt global economy could have a not so gentle effect on oil.

All the aforementioned changing-of-hands of the valuable shale assets may provide some adventurous plays for the brave with some of the assumed prime beneficiaries of such a shuffle of the cards. That would be the cash rich big oil companies looking to rebalance between conventional and shale assets. The abrupt shale explosion has them way behind the curve on this. Some companies to consider there are Exxon Mobil (XOM) Royal Dutch Shell (RDS-A) and ConocoPhillips (COP). Conoco in particular is making a "massive wager" on US shale according to a Bloomberg release from a little over a year ago "ConocoPhillips Bets On Shale In Major US Spending Shift". They are "pledging" to spend 50% more over the next three years, and much of that may be pennies on the dollar if the shale bust continues.

But I think such investment plays would have to be considered as much higher risk than what we normally think of with such names. We have an unprecedented confluence of unstable, opposing mega forces acting on oil right now. So my best investment advice with oil is - don't even go there.

I am long gold and silver coins and an assortment of gold miners