March US Soybean Stocks - Record US Crush Vs. Reduced Exports; Trade Eyes Trade Talks

Market Analysis

The USDA increasing the US processing outlook on its monthly update and encouraging signs in the ongoing US/China trade negotiations has provided some general support to the soy complex the past few weeks. The trade will note the USDA’s quarterly soybean stocks level on March 29. However, the US initial planting intentions out the same day will likely be the trade’s main focus, given this year’s likely late plantings because of the current flooding across the western Midwest.

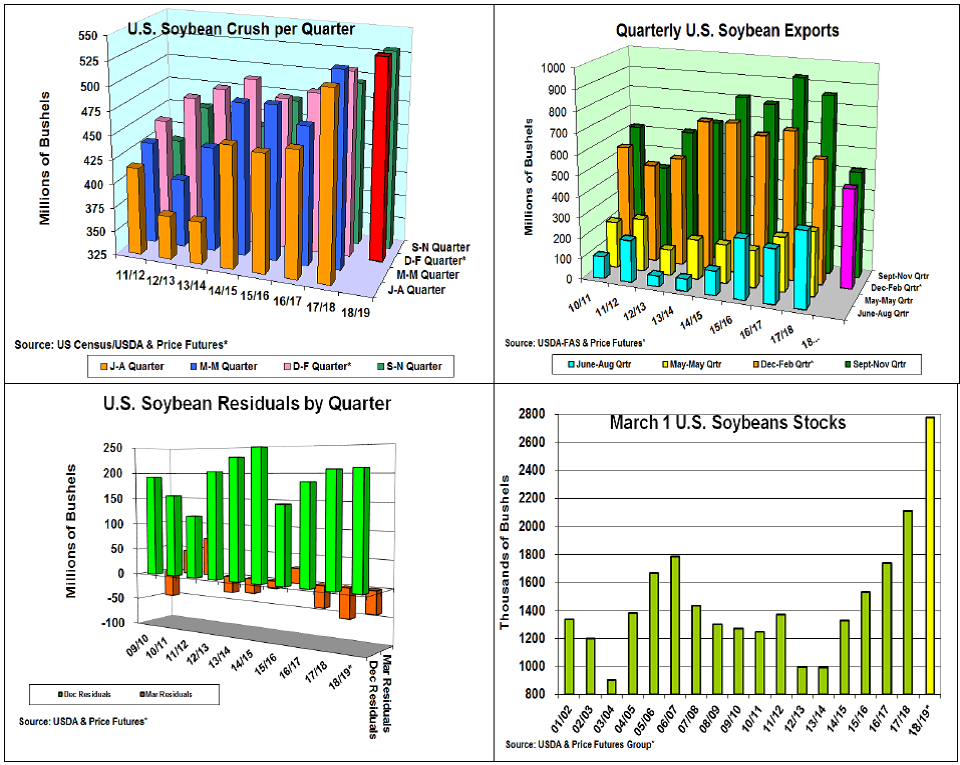

For the 2nd year, strong US processing pace has been talk of the domestic markets. February US National Processor (NOPA) report revealed a 154.5 million bu. pace, up 780,000 bu. for another monthly record for soy processing. For the winter quarter, this year’s total crush will be near 533 million, a 16 million rise from last year. Interesting, this year’s first half processing pace is 53 million bu. higher than last year and a new crushing record for this domestic demand.

As expected, soybean’s overseas demand has been impacted by the US/China trade issues. Until the past 6-8 weeks, US sales were struggling, but a couple of rounds of Chinese purchases have rebounded this year’s sales. To date, bean sales are now only 2.5% to 5% below the last 2 years sales paces. This year’s final third of Brazil’s harvest will determine if the US export outlook will have any potential for increase in the last half of the year.

Despite this year's strong US crush demand, soybeans March 1 stocks will likely be near 2.755 billion bu. This is a record 2nd quarter stock level because of 2018’s record US output and reduced Chinese purchases. Last fall’s 209 million bu. residual, similar to the previous year, suggests this winter’s disappearance will be about the same. This level is a combination of export supplies in transit and soybeans moving to seed firms for processing- suggesting a 42 million bu. adjustment.

(Click on image to enlarge)

What’s Ahead

The USDA’s March 1 soybean stocks will be the first check if 2018’s crop size is on target. This quarter’s residual and June’s quarterly stocks will determine if this is needed. 2019’s planting intentions might be less than expected since this year’s survey was taken before Midwest flooding became a national story. Look to up old-crop sales to 75% in May’s $9.35-$9.50 range & begin 2019 sales at 10% at Nov’s $9.60.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more