March 2022 Performance Review - Major Asset Classes

Commodities continued to top monthly returns for the major asset classes in March. The leadership marks the third straight month that raw materials outperformed the rest of the field by a wide margin, based on a set of proxy ETFs.

WisdomTree Enhanced Commodity Strategy Fund (GCC), a broad measure of raw materials, rose 7.5% last month. Year to date, GCC is up 21.3%, marking a large upside outlier performance so far this year for the major asset classes.

A strong second-place performance in March: US real estate investment trusts (REITs), which rebounded after a weak start to the year. Vanguard US Real Estate (VNQ) jumped 6.3%, the first monthly gain for the ETF in 2022.

US stocks also posted a solid gain in March via Vanguard Total US Stock Market (VTI), which climbed 3.3% for the month just ended.

Overall, most of the major asset classes lost ground — again — last month. The biggest loser: foreign government bonds in developed markets. SPDR Bloomberg Barclays International Treasury Bond ETF (BWX) tumbled 4.2% in March.

The Global Market Index (GMI) rebounded in March. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rose 1.1% — the first monthly gain this year.

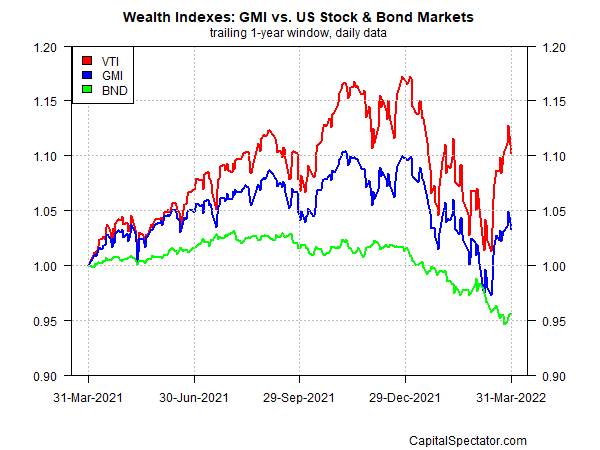

Reviewing GMI’s performance relative to US stocks and bonds over the past year continues to reflect a solid middling performance for this multi-asset-class benchmark (blue line in chart below). US stocks (VTI) earned a bit more than 10% for the trailing one-year window. By contrast, a broad measure of US bonds — Vanguard Total US Bond Market (BND) — fell 4.4%. GMI earned 3.3% for the year ended Mar. 31.

Disclosures: None.