Major Indexes Sell Off As Microsoft Earnings Weigh

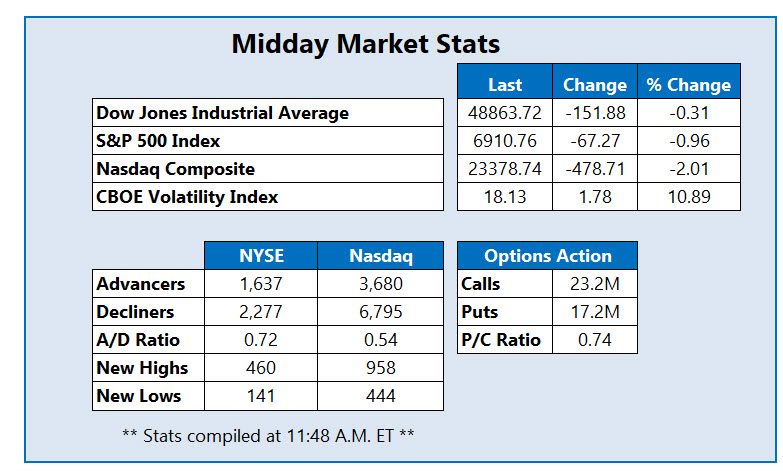

The Dow Jones Industrial Average (DJI), Nasdaq Composite (IXIC), and S&P 500 Index (SPX) are plunging into the red, as a post-earning Big Tech selloff gets underway, triggered by lackluster earnings out of megacap Microsoft (MSFT). Investors are also digesting several bouts of economic data, and yesterday's decision by the Fed to keep rates stable.

Jobless claims slid by just 1,000 last week to 209,000, higher than the anticipated 205,000 and indicative of a stabilizing jobs economy. Meanwhile, trade deficit data nearly doubled for November, rising to $56.8 billion, or 94.6% month-on-month, as President Donald Trump's tariffs made its impact. Oil prices are surging as well, now trading at their highest level since August 2024, as tensions heighten between the U.S. and Iran

Celestica Inc (NYSE: CLS) is popular in the options pits today, as investors flock to the security following its fourth quarter report, which included a 43% jump in revenue. However, the equity is selling off alongside the broader tech sector, now off 16.1% at $293.03. So far, 25,000 puts have been exchanged, seven times the intraday average, and nearly double the amount of calls. Most popular is the March 190 put, where 7,645 contracts have been sold to open. Long-term, CLS has outperformed, up 171% over the past 12 months.

Southwest Airlines Co. (NYSE: LUV) is pacing the outperformers on the New York Stock Exchange (NYSE) today, after the company reported a fourth-quarter earnings beat and forecasted its full-year profit outlook above estimates. LUV was last seen up 15.6% at $47.22, breaking a more than three-year high of $46.14. Over the past 12 months, LUV has added 48%.

Aerospace defense stock Joby Aviation Inc (NYSE: JOBY) is the worst stock on the NYSE today, last seen off 18.4% at $10.92, after the company priced its capital raise at $1.2 billion. This includes $600 million in convertible bonds. JOBY is heading for its worst daily performance on record and was last seen at a six-month low, pulling back to the site of its 320-day moving average.

More By This Author:

S&P 500 Cools From Record Highs After Fed DecisionBig Tech Excitement Pushes S&P 500 Past 7k

S&P 500 Nabs Record Close; Dow Sheds 408 Points