Major Indexes Gap Lower As Earnings, Jobs Data Stays In Focus

The Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are carrying steep losses this afternoon, the former brushing off Alphabet's (GOOGL) pop following news that Berkshire Hathaway (BRK-A) took a stake in the Google parent. The S&P 500 Index (SPX) is also lower, as investors eye Nvidia (NVDA) and Walmart (WMT) earnings. Additionally, Wall Street is looking ahead to this week's release of the nonfarm payrolls reading for September -- the first bout of jobs data since the end of the government shutdown.

Corteva Inc (NYSE: CTVA) stock is seeing unusual bearish activity today, with 21,000 puts traded so far -- 171 times the amount typically seen at this point -- compared to just 1,651 calls. Most active is the November 55 put, with new positions being sold to open at the March 70 call. The equity is down 0.7% to trade at $65.55, after news broke on Friday that Boston Partners sold 15,304 shares. Shares still carry a 15% year-to-date lead, and managed to bounce off a pullback to their lowest level since May.

Albemarle Corp (NYSE: ALB) stock is the best stock on the SPX today, last seen up 7.8% to trade at $124.13, after securing a price-target hike at Argus Research to $140 from $120. The bull note came after Ganfeng Lithium Group predicted a 30-40% surge in demand for lithium in 2026. The shares are now on track for their seventh-straight gain, and earlier secured a fresh more than one-year peak of $125.85. In the past six months, ALB has added 110%.

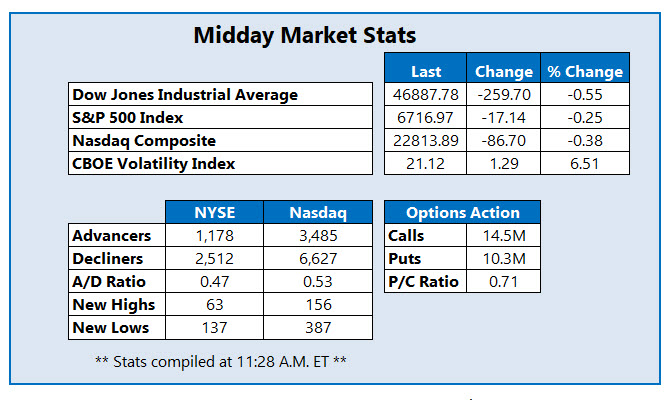

(Click on image to enlarge)

Hewlett Packard Enterprise Co (NYSE: HPE) stock is near the bottom of the SPX today, down 5.8% to trade at $21.49 at last check. Today's losses follow a downgrade at Morgan Stanley to "equal weight" from "overweight," as well as a price-target cut to to $25 from $28. The security is on track for its third-straight daily drop, but still carries a 22.9% lead for the last six months.

More By This Author:

Tech Sends Nasdaq To Biggest Intraday Rally Since AprilStocks Paring Losses Even As Rate Cut Hopes Dwindle

Tech Selloff, Fed Fears Send Stocks Sharply Lower