Major Asset Classes - Performance Review, Thursday, July 1

After two straight months of across-the-board gains for the major asset classes, red ink returned in June.

Roughly half of asset classes rose and half fell last month. Among the gainers, US real estate investment trusts (REITs) led the way. MSCI US REIT Index rallied 2.7% in June, which marks an impressive run of eight consecutive monthly increases.

Last month’s losers were concentrated in foreign bonds (in unhedged US dollar terms). The deepest shade of red ink: foreign government inflation-indexed bonds. The Non-$ FTSE Russell Inflation-Linked Securities Index retreated a steep 2.6% in June. The decline appears to be a degree of payback after the index’s stellar rise in May, which reflected the strongest monthly performance for the major asset classes.

So far in 2021, US REITs and commodities stand out as performance leaders. MSCI US REIT Index is up nearly 22% year to date closely followed by a 21.2% return for the Bloomberg Commodity Index.

US stocks continued to rally last month. The Russell 3000 Index jumped 2.5% in June, the fifth straight monthly advance. The rebound in US bonds remained alive last month, too, as the Bloomberg US Aggregate Bond Index rose for a third month.

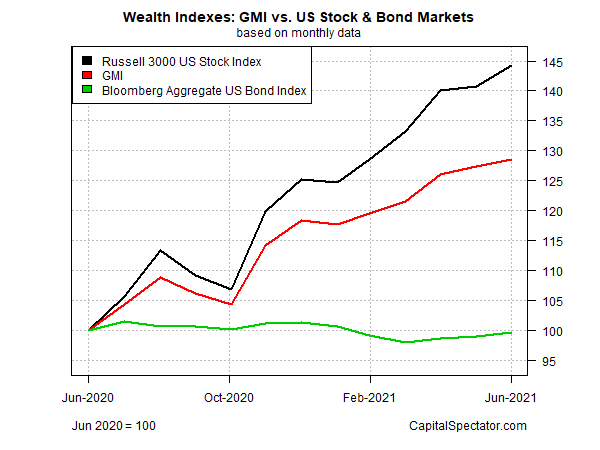

The mostly upside trend for risk assets continued to lift the Global Market Index (GMI). This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rose 0.9% in June, the fifth straight monthly increase for the benchmark. Year to date, GMI is up a strong 8.7%.

Comparing GMI to US stocks and bonds shows that global asset allocation remains competitive this year, generating relatively high returns while offering a degree of risk management through broad diversification. GMI’s 28.6% return for the trailing one-year window is far above the essentially flat performance of US bonds over the span. Meantime, GMI’s trailing one-year gain earned nearly two-thirds of the one-year increase for US equities – an impressive run when you consider that GMI passively owns all the world’s major asset classes.

Disclosures: None.