Major Asset Classes: Performance Review, November 2019

The US stock market was the clear performance leader for the major asset classes in November. The strong gain in American shares was all the more striking in a month that was otherwise skewed to the downside.

US companies, however, roared higher last month. The Russell 3000 Index jumped 3.8%, delivering its best gain since June. Year to date, the index is up 27.3%, which is also the leading performance for the major asset classes so far in 2019.

The second-best performer in November: foreign stocks in developed markets. The MSCI EAFE gained 1.1%, marking its third straight monthly increase.

Most of the major asset classes lost ground last month. The biggest loser: broadly defined commodities. The Bloomberg Commodity Index shed 2.6%. Despite the latest loss, commodities are holding on to a mild 2.5% year-to-date gain.

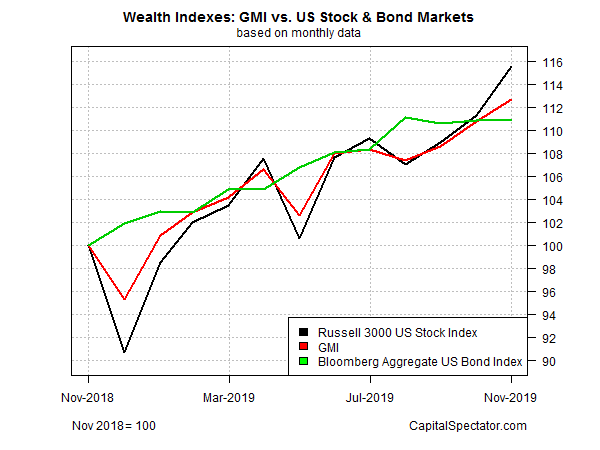

Although most markets backtracked in November, the Global Market Index (GMI) posted a monthly gain. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights rose 1.7% last month, thanks to gains in its US and developed-market equity components.

For the trailing one-year window, GMI is up a strong 12.7% (red line in chart below), modestly behind US equities (Russell 3000) and ahead of US investment-grade fixed income (Bloomberg Aggregate US Bond Index).

Disclosure: None.