Major Asset Classes Performance Review - June 2019

Nirvana swept over global markets in June as all the major asset classes posted gains. Even more remarkable, last month’s across-the-board increases mark the second time this year that everything rose in a calendar month (January also generated a rally in everything).

Beta, in other words, again gave cover to mediocrity in active management circles. With profits spewing from every nook and cranny of the major asset classes, it was relatively easy to look like a genius in June.

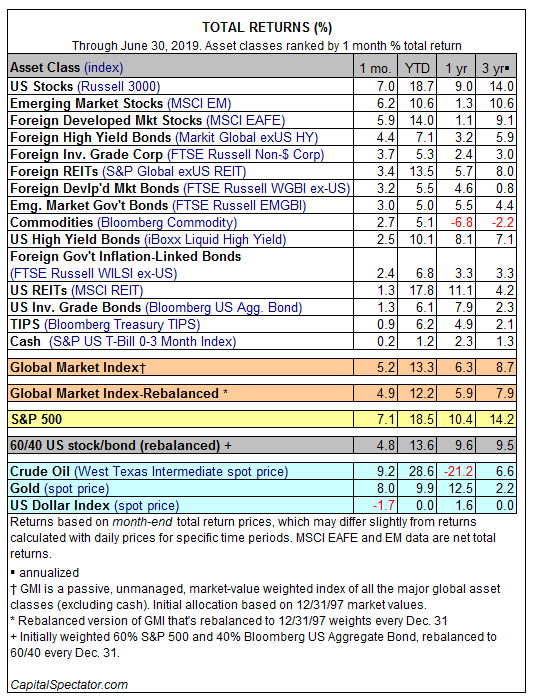

US equities offered the strongest opportunity for appearing brilliant, courtesy of the Russell 3000 Index’s surge last month. This broad measure of American stocks soared 7.0% in June, the benchmark’s best month since January.

Performance wasn’t too shabby in foreign stocks either. Developed-market equities were in second place last month, rising 6.2% via the MSCI EAFE Index. Emerging market stocks also rallied, jumping 5.9% for a third-place finish in June, based on MSCI Emerging Market Index.

As you’d expect with rallies near and far, cash offered the weakest gain: S&P US T-Bill 0-3 Month Index edged up 0.2% in June.

The year-to-date profile is equally impressive for leaving no slice of the global markets in the red. And with the lone exception of a broad-based measure of commodities, rallies in everything also graced the trailing one- and three-year performance windows.

With bull markets raging just about everywhere, it’s no surprise that the Global Market Index has been a winning strategy of late. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights earned a strong 5.2% in June—the index’s best monthly performance since January. Note, too, that GMI’s sizzling 13.3% year-to-date gain beats most of field.

For the one-year trailing window, GMI is up a solid 6.3% on a total-return basis. US stocks (Russell 3000) and bonds (Bloomberg Aggregate Bond) have rallied even more, dispensing one-year gains of 9.0% and 7.9%, respectively.

Disclosure: None.